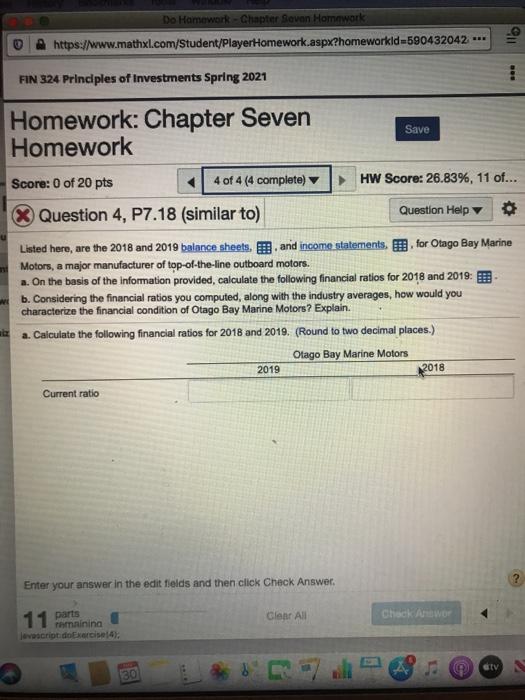

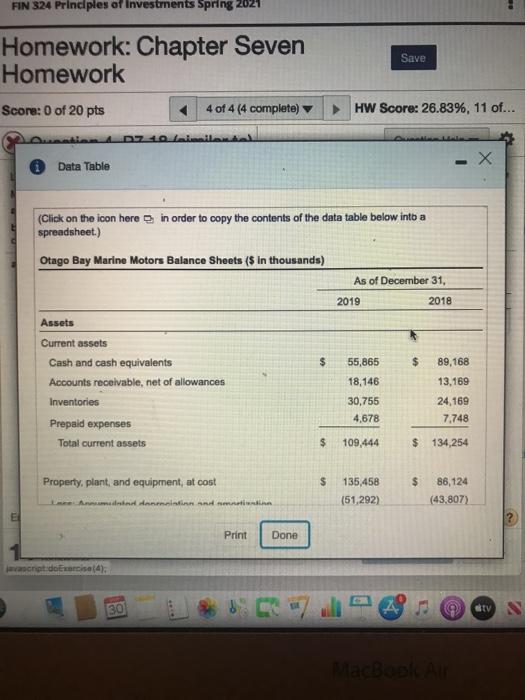

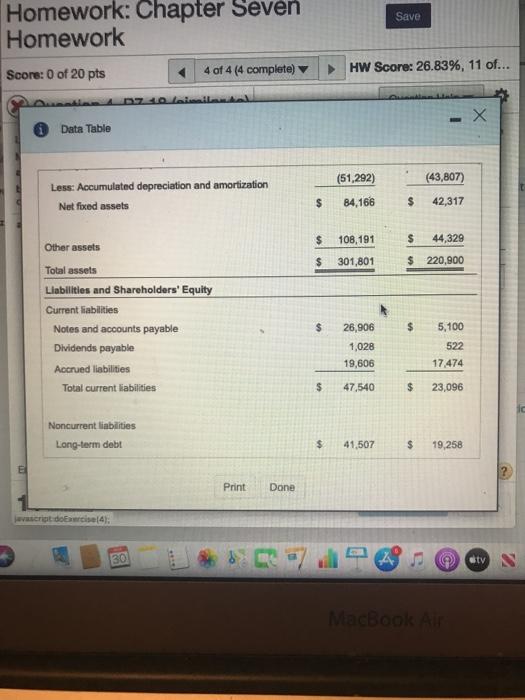

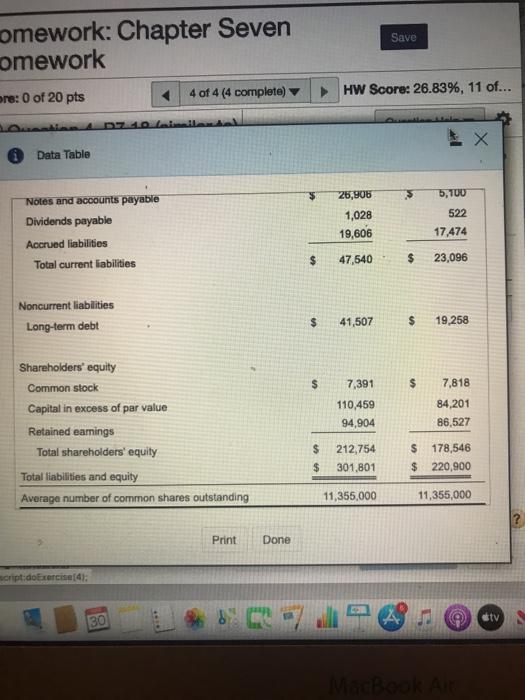

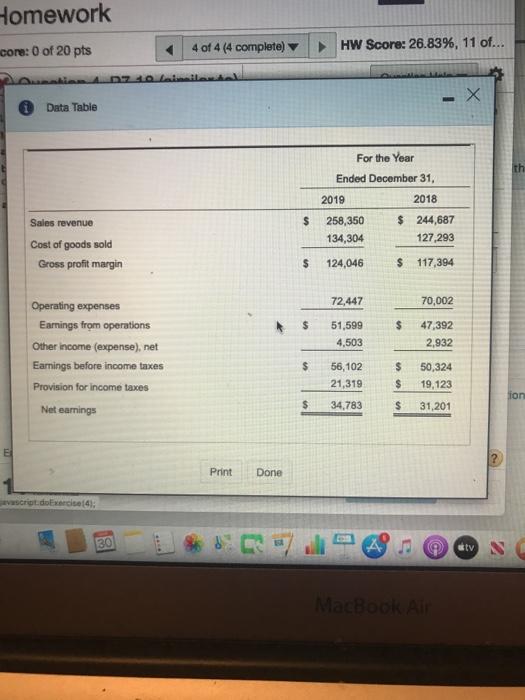

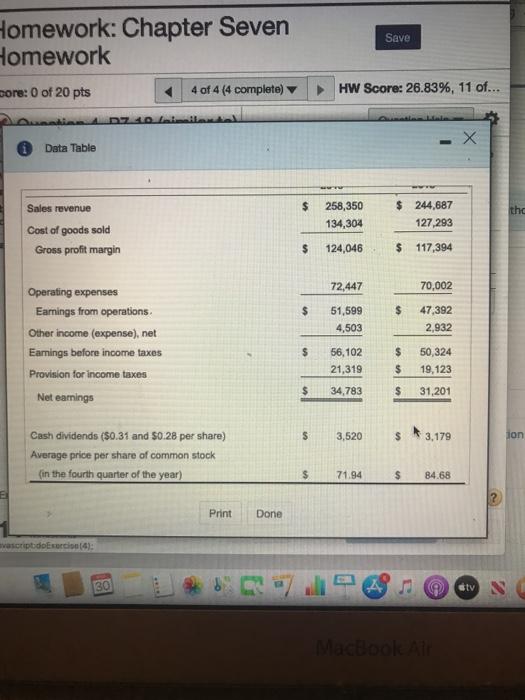

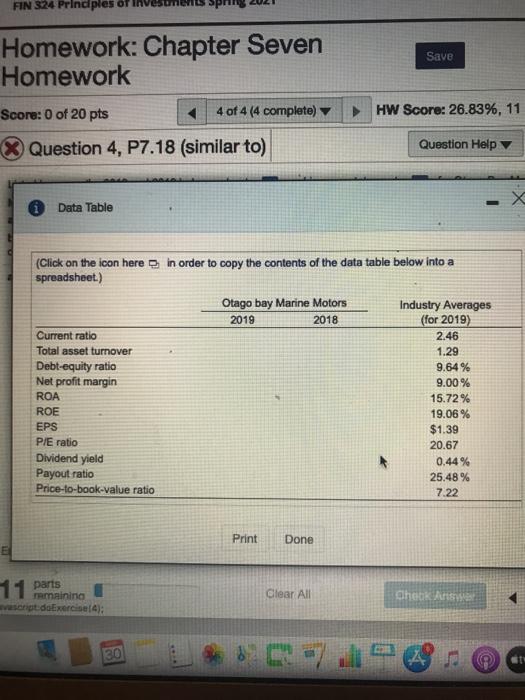

9 Do Hamework - Chapter Seven Homework https://www.mathxl.com/Student/PlayerHomework.aspx?homeworkld-590432042 --- bo FIN 324 Principles of Investments Spring 2021 Homework: Chapter Seven Homework Save HW Score: 26.83%, 11 of... Score: 0 of 20 pts 4 of 4 (4 complete) Question 4, P7.18 (similar to) Question Help Listed here are the 2018 and 2019 balance sheets, and income statements, for Otago Bay Marine Motors, a major manufacturer of top-of-the-line outboard motors. a. On the basis of the information provided, calculate the following financial ratios for 2018 and 2019: b. Considering the financial ratios you computed, along with the industry averages, how would you characterize the financial condition of Otago Bay Marine Motors? Explain. Calculate the following financial ratios for 2018 and 2019. (Round to two decimal places.) Otago Bay Marine Motors 2019 Current ratio 2018 Enter your answer in the edit fields and then click Check Answer, 11 remaining Clear All Check OF Javascript do Exercise 4); @ty 130 FIN 324 Principles of Investments Spring 2021 Homework: Chapter Seven Homework Save Score: 0 of 20 pts 4 of 4 (4 complete) HW Score: 26.83%, 11 of... Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Otago Bay Marine Motors Balance Sheets ($ In thousands) As of December 31, 2019 2018 $ $ 89,168 Assets Current assets Cash and cash equivalents Accounts receivable, net of allowances Inventories Prepaid expenses Total current assets 13,169 55,865 18,146 30,755 4,678 24,169 7.748 $ 109,444 $ 134,254 $ $ Property, plant, and equipment, at cost med dereitinn and minin 135,458 (51,292) 86,124 (43,807) Print Done doExercis(4), 30 BV MacBook Air Save Homework: Chapter Seven Homework Score: 0 of 20 pts 4 of 4 (4 complete) HW Score: 26.83%, 11 of... 40 laimi Data Table (51,292) (43,807) Less: Accumulated depreciation and amortization Net fixed assets $ 84,166 $ 42,317 $ 108,191 $ 44,329 Other assets $ 301,801 $ 220,900 Total assets Liabilities and Shareholders' Equity Current liabilities Notes and accounts payable Dividends payable Accrued liabilities Total current liabilities $ $ 5,100 26,906 1,028 19,606 522 17,474 $ 47.540 $ 23,096 Noncurrent liabilities Long-term debt $ 41,507 $ 19,258 E Print Done Javascript doar 4); 30 4 sty MacBook Air Save omework: Chapter Seven omework re: 0 of 20 pts 4 of 4 (4 complete) HW Score: 26.83%, 11 of... Data Table 26,906 5 5,100 Notes and accounts payable Dividends payable Accrued liabilities Total current liabilities 1,028 19,606 522 17,474 $ 47,540 $ 23,096 Noncurrent liabilities Long-term debt $ 41,507 $ 19,258 $ 7,391 $ 7,818 110,459 94,904 84,201 86,527 Shareholders' equity Common stock Capital in excess of par value Retained earnings Total shareholders' equity Total liabilities and equity Average number of common shares outstanding $ 212,754 301,801 $ 178,546 $ 220,900 $ 11,355,000 11,355,000 Print Done script:doExercise[4): 30 A stv Book Air Homework core: 0 of 20 pts HW Score: 26.83%, 11 of... 4 of 4 (4 complete) 20 til Data Table th For the Year Ended December 31, 2019 2018 258,350 $ 244,687 134,304 127,293 Sales revenue $ Cost of goods sold Gross profit margin $ 124,046 $ 117,394 72,447 70,002 $ $ 51,599 4,503 47,392 2,932 Operating expenses Earnings from operations Other income (expense), net Earnings before income taxes Provision for income taxes Net earnings $ 56,102 21,319 $ $ 50,324 19,123 ion $ 34,783 $ 31,201 Print Done script.doExercise (4): 30 A dv MacBook Air Homework: Chapter Seven Homework Save Dore: 0 of 20 pts 4 of 4 (4 complete) HW Score: 26.83%, 11 of... X Data Table Sales revenue $ 258,350 134,304 $ 244,687 127,293 thc Cost of goods sold Gross profit margin $ 124,046 $ 117,394 72,447 70,002 $ $ 51,599 4,503 47,392 2,932 Operating expenses Earnings from operations Other income (expense), net Eamings before income taxes Provision for income taxes Net earnings $ 56,102 21,319 $ $ 50,324 19,123 $ 34,783 $ 31,201 $ 3,520 $ 3,179 lon Cash dividends ($0.31 and 50:28 per share) Average price per share of common stock in the fourth quarter of the year) $ 71.94 $ 84.68 Print Done vascriptodoExercio (4): 30 av SC Macao FIN 324 Prindples of Homework: Chapter Seven Homework Save HW Score: 26.83%, 11 Score: 0 of 20 pts 4 of 4 (4 complete) * Question 4, P7.18 (similar to) Question Help Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Otago bay Marine Motors Industry Averages 2019 2018 (for 2019) Current ratio 2.46 Total asset turnover 1.29 Debt-equity ratio 9.64% Net profit margin 9.00% ROA 15.72% ROE 19.06% EPS $1.39 P/E ratio 20.67 Dividend yield 0.44% Payout ratio 25.48% Price-to-book-value ratio 7.22 Print Done 11 parts Clear All Check remaining vascript do Exercise (4): 30 ge