Answered step by step

Verified Expert Solution

Question

1 Approved Answer

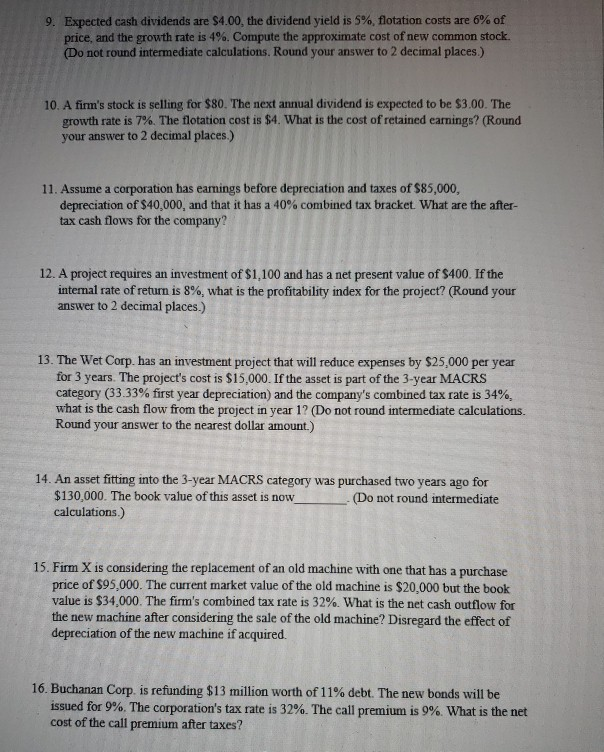

9. Expected cash dividends are $4.00, the dividend yield is 5%, flotation costs are 6% of price, and the growth rate is 4%. Compute the

9. Expected cash dividends are $4.00, the dividend yield is 5%, flotation costs are 6% of price, and the growth rate is 4%. Compute the approximate cost of new common stock. (Do not round intermediate calculations. Round your answer to 2 decimal places.) 10. A firm's stock is selling for $80. The next annual dividend is expected to be $3.00. The growth rate is 7%. The flotation cost is $4. What is the cost of retained earnings? (Round your answer to 2 decimal places.) 11. Assume a corporation has earnings before depreciation and taxes of $85,000, depreciation of $40,000, and that it has a 40% combined tax bracket. What are the after- tax cash flows for the company? 12. A project requires an investment of $1,100 and has a net present value of $400. If the internal rate of return is 8%, what is the profitability index for the project? (Round your answer to 2 decimal places.) 13. The Wet Corp. has an investment project that will reduce expenses by $25,000 per year for 3 years. The project's cost is $15,000. If the asset is part of the 3-year MACRS category (33.33% first year depreciation) and the company's combined tax rate is 34%. what is the cash flow from the project in year 1? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) 14. An asset fitting into the 3-year MACRS category was purchased two years ago for $130,000. The book value of this asset is now (Do not round intermediate calculations.) 15. Firm X is considering the replacement of an old machine with one that has a purchase price of $95,000. The current market value of the old machine is $20,000 but the book value is $34,000. The firm's combined tax rate is 32%. What is the net cash outflow for the new machine after considering the sale of the old machine? Disregard the effect of depreciation of the new machine if acquired. 16. Buchanan Corp. is refunding $13 million worth of 11% debt. The new bonds will be issued for 9%. The corporation's tax rate is 32%. The call premium is 9% What is the net cost of the call premium after taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started