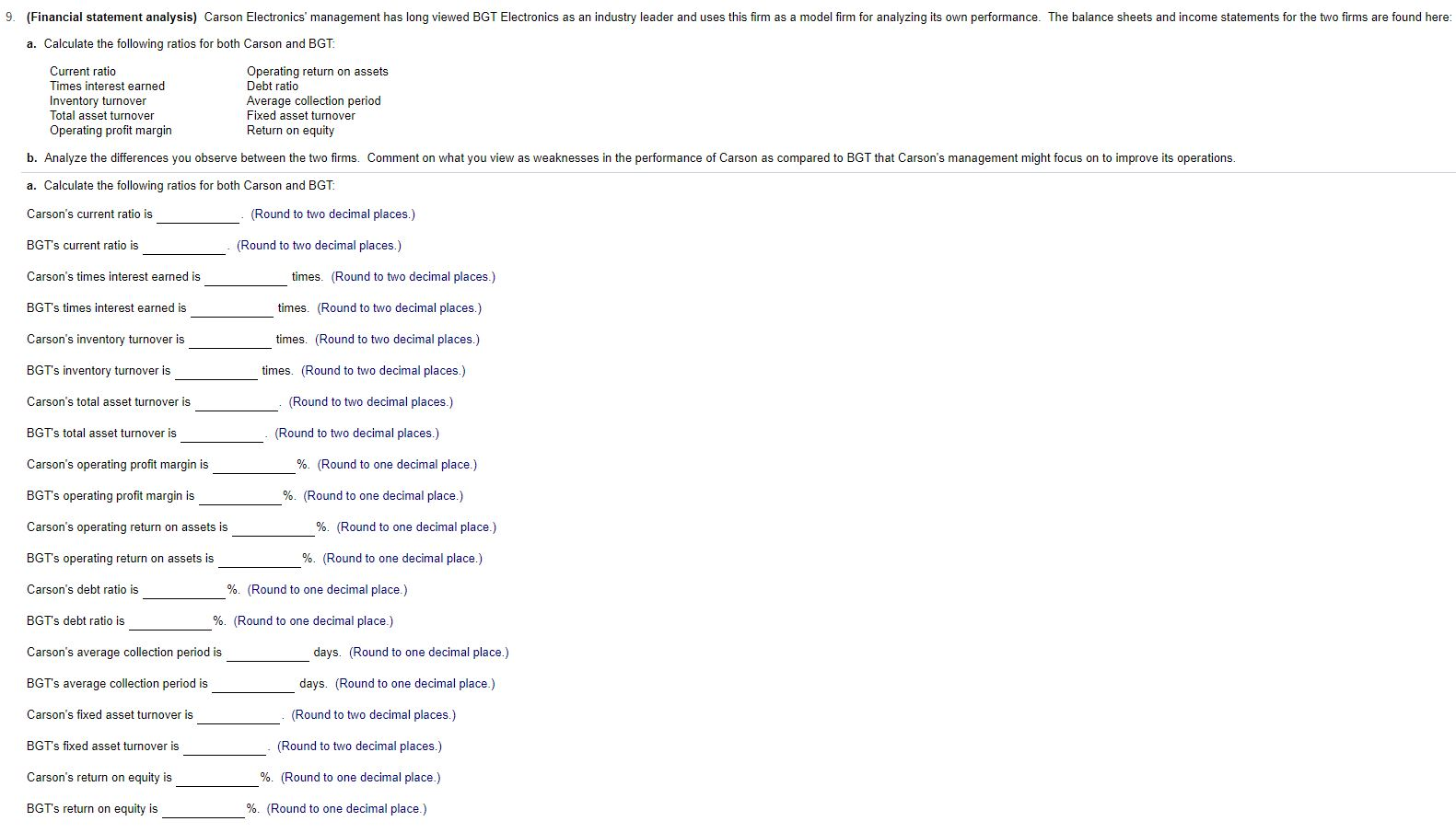

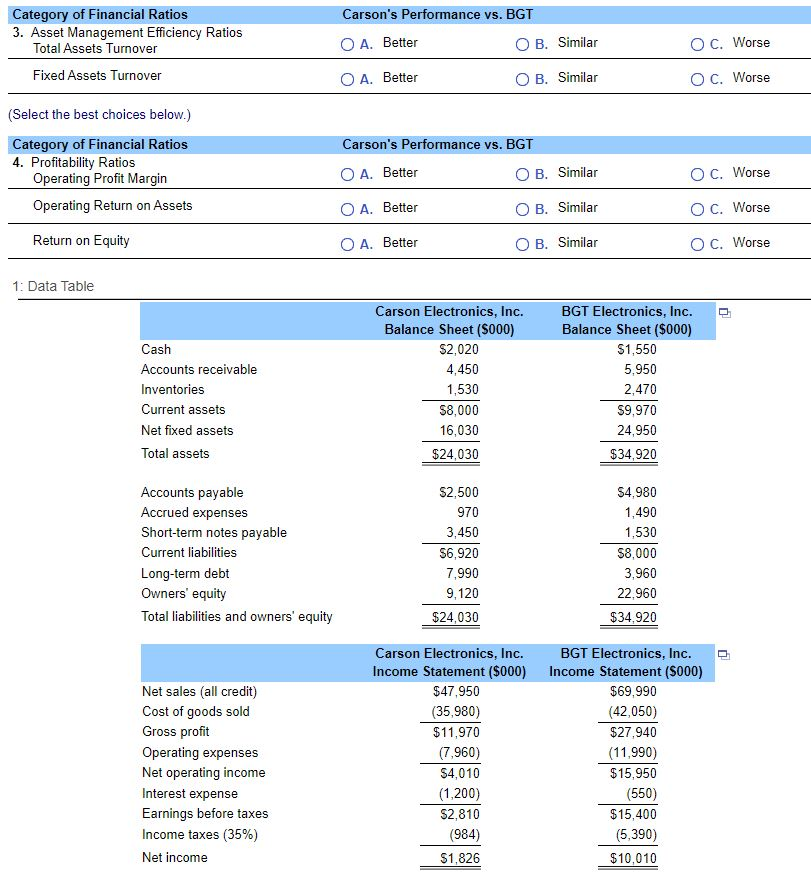

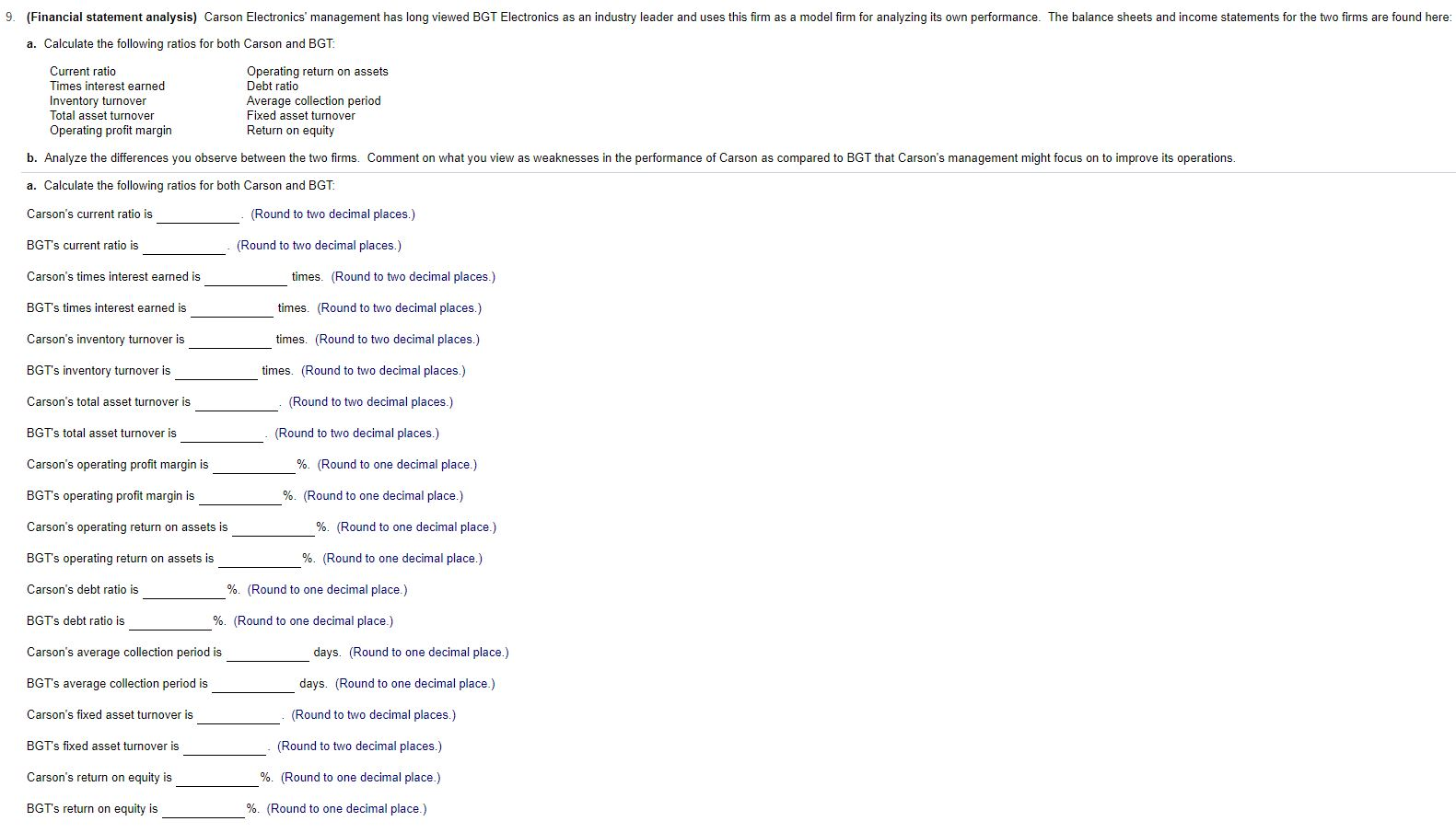

9. (Financial statement analysis) Carson Electronics' management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheets and income statements for the two firms are found here: a. Calculate the following ratios for both Carson and BGT: Current ratio Operating return on assets Times interest earned Debt ratio Inventory turnover Average collection period Total asset turnover Fixed asset turnover Operating profit margin Return on equity b. Analyze the differences you observe between the two firms. Comment on what you view as weaknesses in the performance of Carson as compared to BGT that Carson's management might focus on to improve its operations. a. Calculate the following ratios for both Carson and BGT: Carson's current ratio is (Round to two decimal places.) BGT's current ratio is (Round to two decimal places.) Carson's times interest earned is times. (Round to two decimal places.) BGT's times interest earned is times. (Round to two decimal places.) Carson's inventory turnover is times. (Round to two decimal places.) BGT's inventory turnover is times. (Round to two decimal places.) Carson's total asset turnover is (Round to two decimal places.) BGT's total asset turnover is (Round to two decimal places.) Carson's operating profit margin is %. (Round to one decimal place.) %. (Round to one decimal place.) BGT's operating profit margin is Carson's operating return on assets is %. (Round to one decimal place.) BGT's operating return on assets is %. (Round to one decimal place.) Carson's debt ratio is %. (Round to one decimal place.) BGT's debt ratio is %. (Round to one decimal place.) Carson's average collection period is days. (Round to one decimal place.) BGT's average collection period is days. (Round to one decimal place.) Carson's fixed asset turnover is (Round to two decimal places.) BGT's fixed asset turnover is (Round to two decimal places.) Carson's return on equity is (Round to one decimal place.) BGT's return on equity is %. (Round to one decimal place.) Carson's Performance vs. BGT Category of Financial Ratios 3. Asset Management Efficiency Ratios Total Assets Turnover Fixed Assets Turnover O A. Better OB. Similar OC. Worse O A. Better OB. Similar OC. Worse (Select the best choices below.) Carson's Performance vs. BGT Category of Financial Ratios 4. Profitability Ratios Operating Profit Margin Operating Return on Assets O A. Better OB. Similar O C. Worse O A. Better OB. Similar O C. Worse Return on Equity O A. Better OB. Similar O C. Worse 1: Data Table Cash Accounts receivable Inventories Current assets Net fixed assets Total assets Carson Electronics, Inc. Balance Sheet (5000) $2,020 4,450 1,530 $8,000 16,030 $24,030 BGT Electronics, Inc. Balance Sheet (5000) $1,550 5,950 2,470 $9,970 24,950 $34,920 Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term debt Owners' equity Total liabilities and owners' equity $2,500 970 3,450 $6,920 7,990 9,120 $24,030 54,980 1,490 1,530 $8,000 3,960 22,960 $34,920 Net sales (all credit) Cost of goods sold Gross profit Operating expenses Net operating income Interest expense Earnings before taxes Income taxes (35%) Net income Carson Electronics, Inc. Income Statement ($000) $47.950 (35,980) $11,970 (7,960) $4,010 (1,200) $2,810 (984) $1,826 BGT Electronics, Inc. Income Statement (5000) $69,990 (42,050) $27.940 (11,990) $15,950 (550) $15,400 (5,390) $10,010