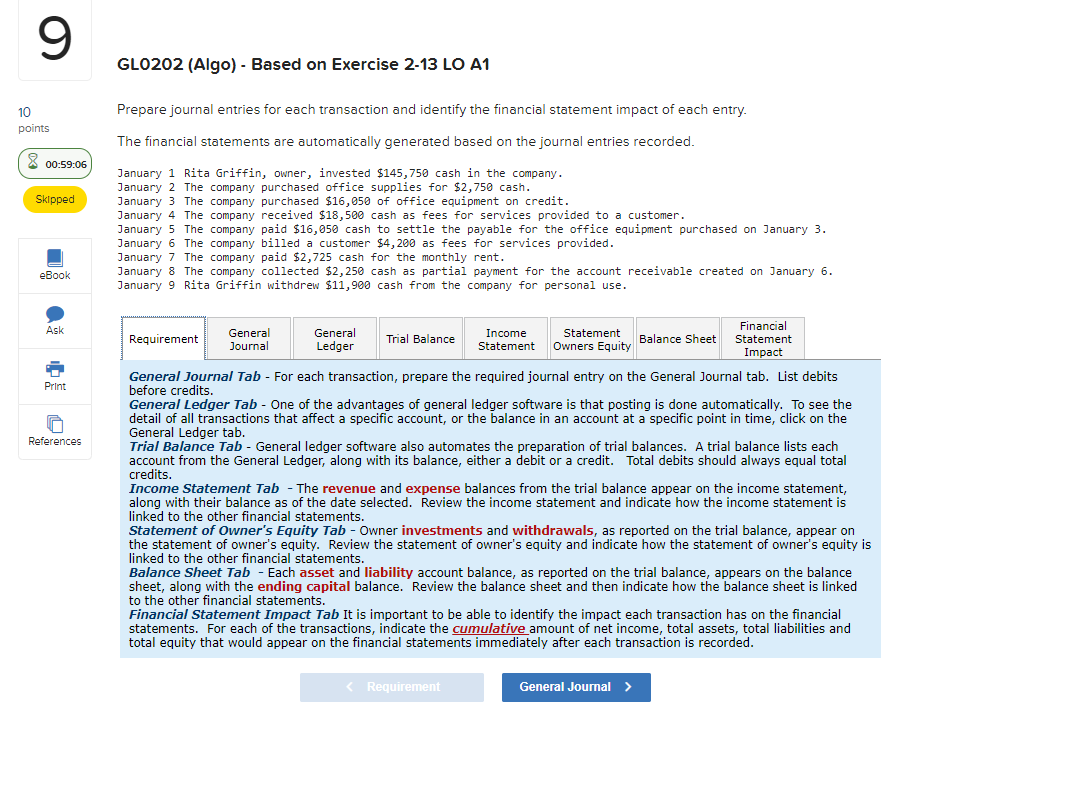

9 GLO202 (Algo) - Based on Exercise 2-13 LO A1 Prepare journal entries for each transaction and identify the financial statement impact of each entry. points The financial statements are automatically generated based on the journal entries recorded. 00:59:06 Skipped January 1 Rita Griffin, owner, invested $145,750 cash in the company. January 2 The company purchased office supplies for $2,750 cash. January 3 The company purchased $16,050 of office equipment on credit. January 4 The company received $18,500 cash as fees for services provided to a customer. January 5 The company paid $16,050 cash to settle the payable for the office equipment purchased on January 3. January 6 The company billed a customer $4,200 as fees for services provided. January 7 The company paid $2,725 cash for the monthly rent. January 8 The company collected $2,250 cash as partial payment for the account receivable created on January 6. January 9 Rita Griffin withdrew $11,900 cash from the company for personal use. eBook Ask Print References Financial Requirement General General Statement Income Trial Balance Journal Balance Sheet Statement Ledger Statement Owners Equity Impact General Journal Tab - For each transaction, prepare the required journal entry on the General Journal tab. List debits before credits. General Ledger Tab - One of the advantages of general ledger software is that posting is done automatically. To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Trial Balance Tab - General ledger software also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits. Income Statement Tab - The revenue and expense balances from the trial balance appear on the income statement, along with their balance as of the date selected. Review the income statement and indicate how the income statement is linked to the other financial statements. Statement of Owner's Equity Tab - Owner investments and withdrawals, as reported on the trial balance, appear on the statement of owner's equity. Review the statement of owner's equity and indicate how the statement of owner's equity is linked to the other financial statements. Balance Sheet Tab Each asset and liability account balance, as reported on the trial balance, appears on the balance sheet, along with the ending capital balance. Review the balance sheet and then indicate how the balance sheet is linked to the other financial statements. Financial Statement Impact Tab It is important to be able to identify the impact each transaction has on the financial statements. For each of the transactions, indicate the cumulative amount of net income, total assets, total liabilities and total equity that would appear on the financial statements immediately after each transaction is recorded.