Question

9. Harrison acquires $65,000 of 5-year property in June 2017 that is required to be depreciated using the mid-quarter convention (because of other purchases

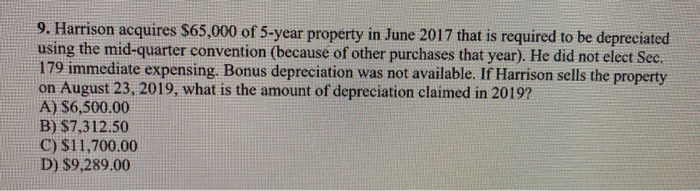

9. Harrison acquires $65,000 of 5-year property in June 2017 that is required to be depreciated using the mid-quarter convention (because of other purchases that year). He did not elect Sec. 179 immediate expensing. Bonus depreciation was not available. If Harrison sells the property on August 23, 2019, what is the amount of depreciation claimed in 2019? A) $6,500.00 B) $7,312.50 C) $11,700.00 D) $9,289.00

Step by Step Solution

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

B 65000 18 254 7312...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav

13th Edition

8120335643, 136126634, 978-0136126638

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App