Question: 9. How do you differentiate company expenses and categorize them either as Cost of Goods Sold (COGS) or General and Administrative (G&A) expenses for a

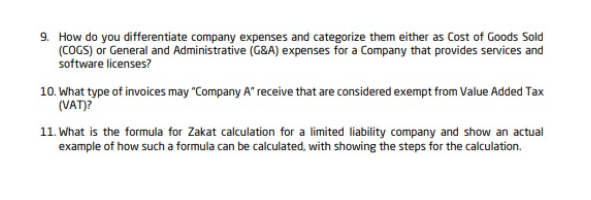

9. How do you differentiate company expenses and categorize them either as Cost of Goods Sold (COGS) or General and Administrative (G&A) expenses for a company that provides services and software licenses? 10. What type of invoices may "Company A" receive that are considered exempt from Value Added Tax (VAT)? 11. What is the formula for Zakat calculation for a limited liability company and show an actual example of how such a formula can be calculated with showing the steps for the calculation. 9. How do you differentiate company expenses and categorize them either as Cost of Goods Sold (COGS) or General and Administrative (G&A) expenses for a company that provides services and software licenses? 10. What type of invoices may "Company A" receive that are considered exempt from Value Added Tax (VAT)? 11. What is the formula for Zakat calculation for a limited liability company and show an actual example of how such a formula can be calculated with showing the steps for the calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts