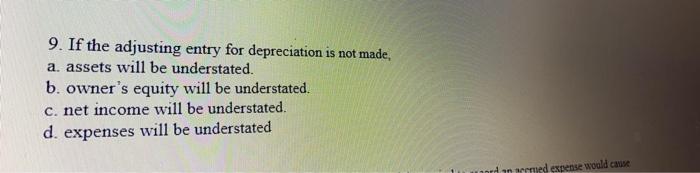

Question: 9. If the adjusting entry for depreciation is not made, a. assets will be understated. b. owner's equity will be understated. c. net income

9. If the adjusting entry for depreciation is not made, a. assets will be understated. b. owner's equity will be understated. c. net income will be understated. d. expenses will be understated ord an armed expense would cause ncome and owner's equity will be understated 's equity will be understated tated and net income and owner's equity will be overstated 8. If the total debits exceed total credits in the balance sheet columns of the work sheet, owner's equity a. will decrease because a net loss has occurred. b. is in error because a mistake has occurred. c. will not be affected. d. will increase because net income has occurred.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Correct answer is dexpenses will be understated Adjusting entry required for depreciation is as foll... View full answer

Get step-by-step solutions from verified subject matter experts