Answered step by step

Verified Expert Solution

Question

1 Approved Answer

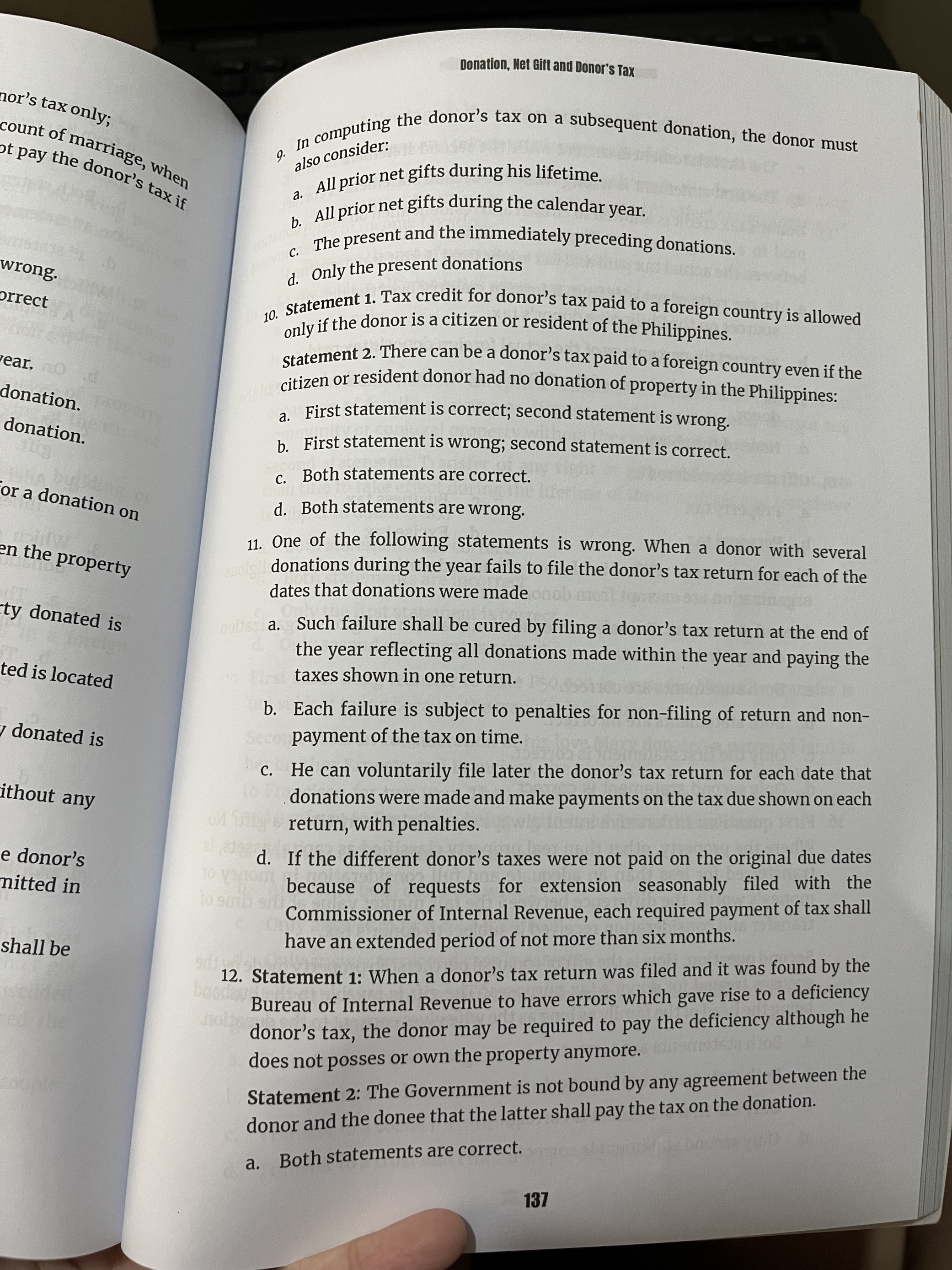

9 . In computing the donor's tax on a subsequent donation, the donor must also consider: a . All prior net gifts during his lifetime.

In computing the donor's tax on a subsequent donation, the donor must also consider:

a All prior net gifts during his lifetime.

b All prior net gifts during the calendar year.

c The present and the immediately preceding donations.

d Only the present donations

Statement Tax credit for donor's tax paid to a foreign country is allowed only if the donor is a citizen or resident of the Philippines.

Statement There can be a donor's tax paid to a foreign country even if the citizen or resident donor had no donation of property in the Philippines:

a First statement is correct; second statement is wrong.

b First statement is wrong; second statement is correct.

c Both statements are correct.

d Both statements are wrong.

One of the following statements is wrong. When a donor with several donations during the year fails to file the donor's tax return for each of the dates that donations were made.

a Such failure shall be cured by filing a donor's tax return at the end of

the year reflecting all donations made within the year and paying the

taxes shown in one return.

b Each failure is subject to penalties for nonfiling of return and non

payment of the tax on time.

c He can voluntarily file later the donor's tax return for each date that

donations were made and make payments on the tax due shown on each

return, with penalties.

d If the different donor's taxes were not paid on the original due dates

because of requests for extension seasonably filed with the

Commissioner of Internal Revenue, each required payment of tax shall

have an extended period of not more than six months.

Just answer number please. Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started