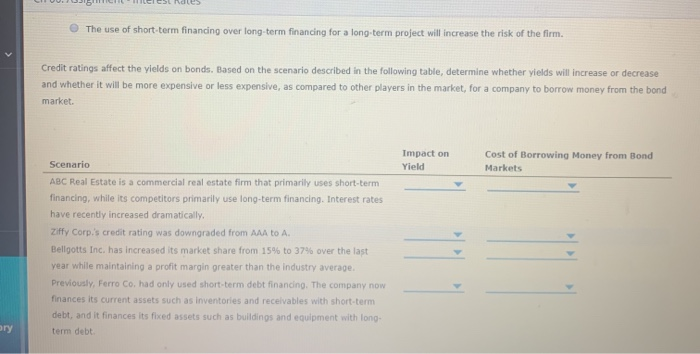

9. Interest rates and decisions Which of the following best explains why a firm that needs to borrow money would borrow at long-term rates when short-terms rates are lower than long-term rates? The firm's interest payments will be the same whether it uses short-term or long-term financing, so it is essentially indifferent to which type of financing it uses. A firm will only borrow at short-term rates when the yield curve is downward-sloping. The use of short-term financing over long-term financing for a long term project will increase the risk of the firm Credit ratings affect the yields on bonds. Based on the scenario described in the following table, determine whether yields will increase or decrease and whether it will be more expensive or less expensive, as compared to other players in the market, for a company to borrow money from the bond market Impact on Yield Cost of Borrowing Money from Bond Markets Scenario ABC Real Estate is a commercial real estate firm that primarily uses short-term The use of short-term financing over long-term financing for a long-term project will increase the risk of the firm. Credit ratings affect the yields on bonds. Based on the scenario described in the following table, determine whether yields will increase or decrease and whether it will be more expensive or less expensive, as compared to other players in the market, for a company to borrow money from the bond market Scenario Impact on Yield Cost of Borrowing Money from Bond Markets ABC Real Estate is a commercial real estate firm that primarily uses short-term financing, while its competitors primarily use long-term financing. Interest rates have recently increased dramatically, Ziffy Corp.'s credit rating was downgraded from AAA to A. Bellgotts Inc. has increased its market share from 15% to 37% over the last year while maintaining a profit margin greater than the industry average Previously, Ferro Co. had only used short-term debt financing. The company now finances its current assets such as inventories and receivables with short-term debt, and it finances its fixed assets such as buildings and equipment with long- term debt