Question

9. JJ&T Partnership has three partners, James Small, Josh Platt, and Turner Lyle, who allocate net income according to the services provided and any

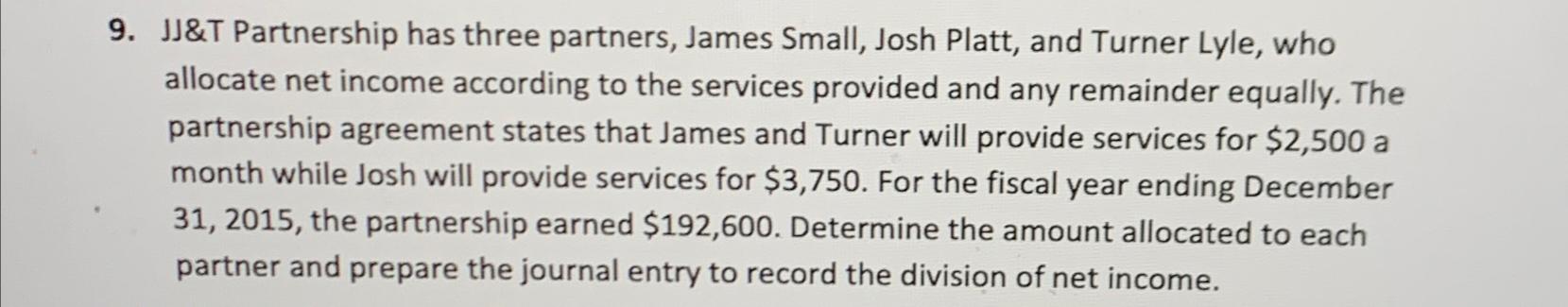

9. JJ&T Partnership has three partners, James Small, Josh Platt, and Turner Lyle, who allocate net income according to the services provided and any remainder equally. The partnership agreement states that James and Turner will provide services for $2,500 a month while Josh will provide services for $3,750. For the fiscal year ending December 31, 2015, the partnership earned $192,600. Determine the amount allocated to each partner and prepare the journal entry to record the division of net income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the amount allocated to each partner we need to follow the allocation method stated in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App