Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. L0. 3, 4, 5 Cisco, a calendar year taxpayer who is age 63 , owns a residence in which he has lived for 21

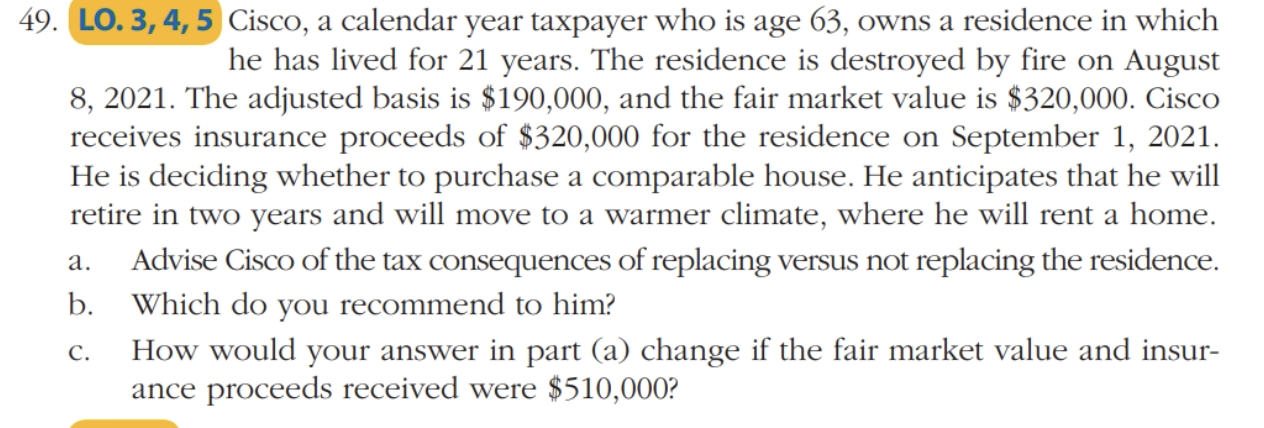

9. L0. 3, 4, 5 Cisco, a calendar year taxpayer who is age 63 , owns a residence in which he has lived for 21 years. The residence is destroyed by fire on August 8,2021 . The adjusted basis is $190,000, and the fair market value is $320,000. Cisco receives insurance proceeds of $320,000 for the residence on September 1,2021 . He is deciding whether to purchase a comparable house. He anticipates that he will retire in two years and will move to a warmer climate, where he will rent a home. a. Advise Cisco of the tax consequences of replacing versus not replacing the residence. b. Which do you recommend to him? c. How would your answer in part (a) change if the fair market value and insurance proceeds received were $510,000

9. L0. 3, 4, 5 Cisco, a calendar year taxpayer who is age 63 , owns a residence in which he has lived for 21 years. The residence is destroyed by fire on August 8,2021 . The adjusted basis is $190,000, and the fair market value is $320,000. Cisco receives insurance proceeds of $320,000 for the residence on September 1,2021 . He is deciding whether to purchase a comparable house. He anticipates that he will retire in two years and will move to a warmer climate, where he will rent a home. a. Advise Cisco of the tax consequences of replacing versus not replacing the residence. b. Which do you recommend to him? c. How would your answer in part (a) change if the fair market value and insurance proceeds received were $510,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started