Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following cash disbursement transactions were arranged by Ahsan Trading Enterprise during May 2020. 03. Released payment of invoice of Rs. 5,500 of Reliable

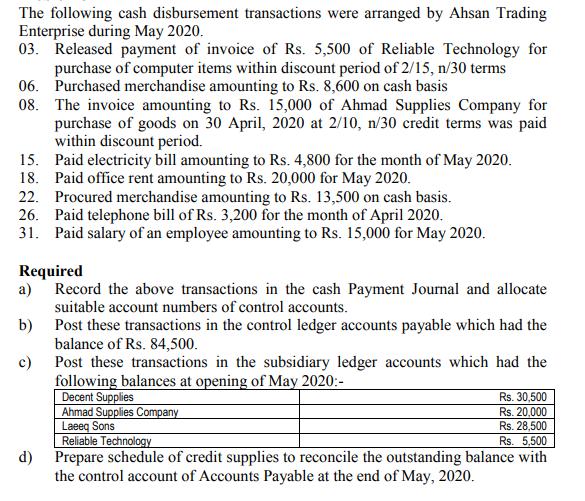

The following cash disbursement transactions were arranged by Ahsan Trading Enterprise during May 2020. 03. Released payment of invoice of Rs. 5,500 of Reliable Technology for purchase of computer items within discount period of 2/15, n/30 terms 06. Purchased merchandise amounting to Rs. 8,600 on cash basis 08. The invoice amounting to Rs. 15,000 of Ahmad Supplies Company for purchase of goods on 30 April, 2020 at 2/10, n/30 credit terms was paid within discount period. 15. Paid electricity bill amounting to Rs. 4,800 for the month of May 2020. 18. Paid office rent amounting to Rs. 20,000 for May 2020. 22. Procured merchandise amounting to Rs. 13,500 on cash basis. 26. Paid telephone bill of Rs. 3,200 for the month of April 2020. 31. Paid salary of an employee amounting to Rs. 15,000 for May 2020. Required a) Record the above transactions in the cash Payment Journal and allocate suitable account numbers of control accounts. b) Post these transactions in the control ledger accounts payable which had the balance of Rs. 84,500. c) Post these transactions in the subsidiary ledger accounts which had the following balances at opening of May 2020:- Decent Supplies Ahmad Supplies Company Laeeq Sons Rs. 30,500 Rs. 20,000 Rs. 28,500 Rs. 5,500 Reliable Technology d) Prepare schedule of credit supplies to reconcile the outstanding balance with the control account of Accounts Payable at the end of May, 2020.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Record the above transactions in the cash Payment Journal and allocate suitable account numbers of control accounts Cash Payment Journal Date Partic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started