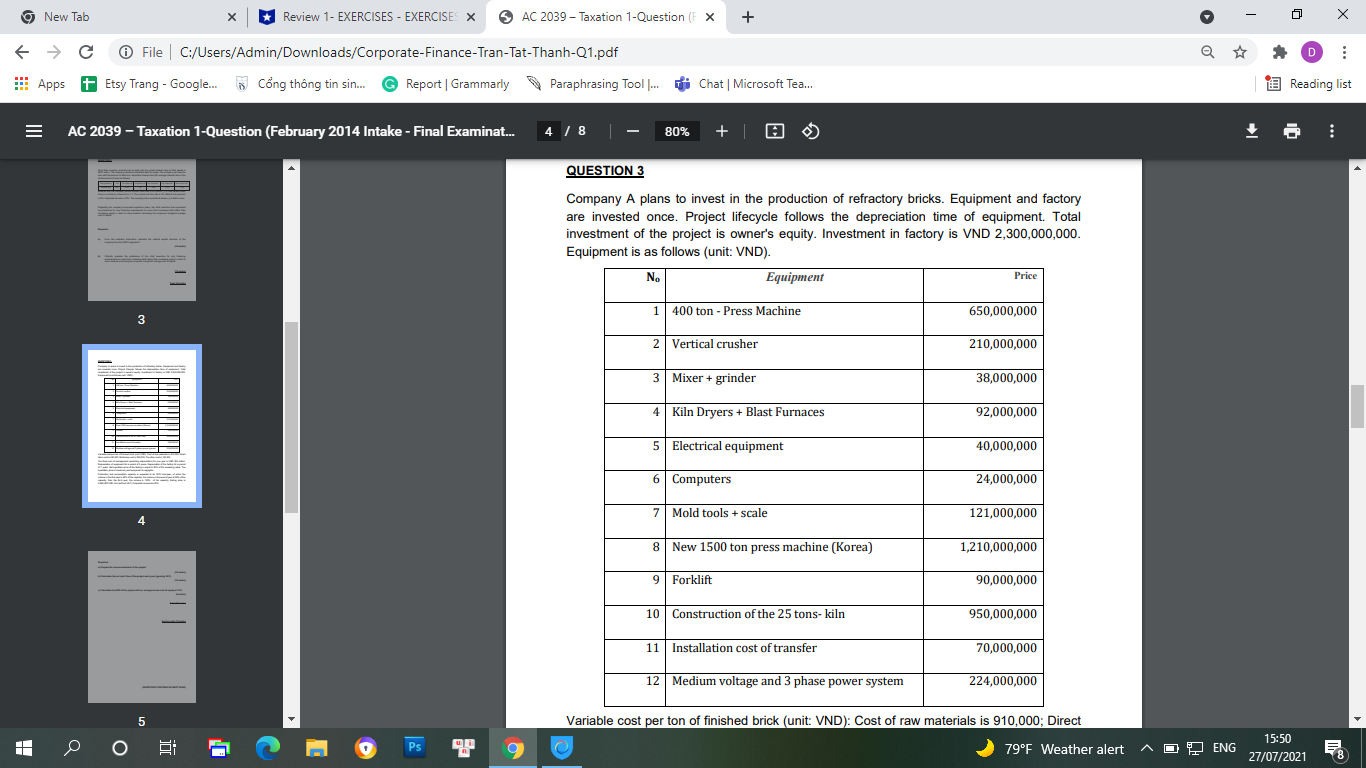

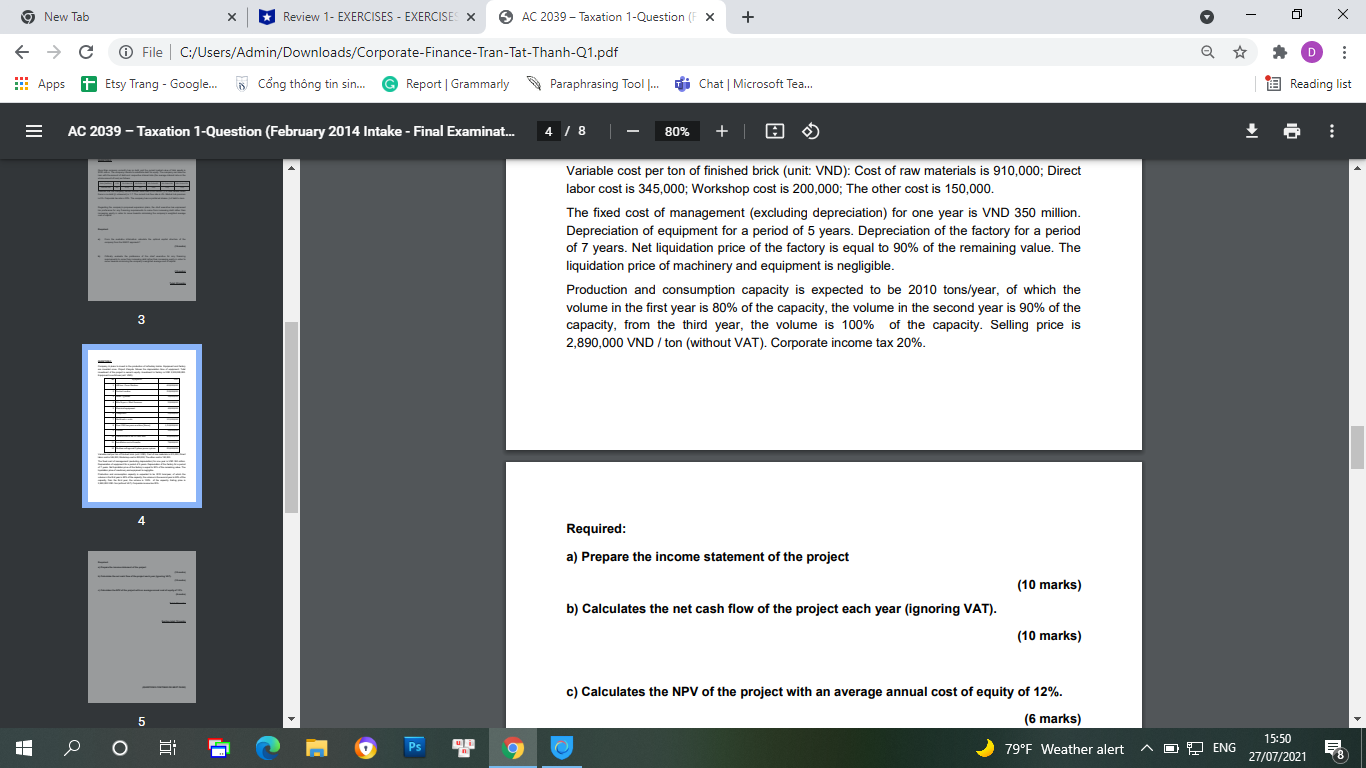

9 New Tab X Review 1- EXERCISES - EXERCISES X 5 AC 2039 - Taxation 1-Question (F X + X -) @ File | C:/Users/Admin/Downloads/Corporate-Finance-Tran-Tat-Thanh-Q1.pdf Q D : Apps + Etsy Trang - Google. Cong thong tin sin. @ Report | Grammarly Paraphrasing Tool |.. i Chat | Microsoft Tea.. Reading list AC 2039 - Taxation 1-Question (February 2014 Intake - Final Examinat.. 4 / 8 80% + QUESTION 3 Company A plans to invest in the production of refractory bricks. Equipment and factory are invested once. Project lifecycle follows the depreciation time of equipment. Total investment of the project is owner's equity. Investment in factory is VND 2,300,000,000. Equipment is as follows (unit: VND). No Equipment Price 1 400 ton - Press Machine 650,000,000 3 2 Vertical crusher 210,000,000 3 Mixer + grinder 38,000,000 4 Kiln Dryers + Blast Furnaces 92,000,000 5 Electrical equipment 40,000,000 Computers 24,000,000 7 Mold tools + scale 121,000,000 4 8 New 1500 ton press machine (Korea) 1,210,000,000 9 Forklift 90,000,000 10 Construction of the 25 tons- kiln 950,000,000 11 Installation cost of transfer 70,000,000 12 Medium voltage and 3 phase power system 224,000,000 5 Variable cost per ton of finished brick (unit: VND): Cost of raw materials is 910,000; Direct 15:50 O O Ps O 79 F Weather alert ^ DENG 27/07/20219 New Tab X Review 1- EXERCISES - EXERCISES X 5 AC 2039 - Taxation 1-Question (F X + X -) @ File | C:/Users/Admin/Downloads/Corporate-Finance-Tran-Tat-Thanh-Q1.pdf D : Apps + Etsy Trang - Google. Cong thong tin sin. @ Report | Grammarly Paraphrasing Tool |.. i Chat | Microsoft Tea.. Reading list AC 2039 - Taxation 1-Question (February 2014 Intake - Final Examinat.. 4 1 8 80% Variable cost per ton of finished brick (unit: VND): Cost of raw materials is 910,000; Direct labor cost is 345,000; Workshop cost is 200,000; The other cost is 150,000. The fixed cost of management (excluding depreciation) for one year is VND 350 million. Depreciation of equipment for a period of 5 years. Depreciation of the factory for a period of 7 years. Net liquidation price of the factory is equal to 90% of the remaining value. The liquidation price of machinery and equipment is negligible. Production and consumption capacity is expected to be 2010 tons/year, of which the volume in the first year is 80% of the capacity, the volume in the second year is 90% of the 3 capacity, from the third year, the volume is 100% of the capacity. Selling price is 2,890,000 VND / ton (without VAT). Corporate income tax 20%. 4 Required: a) Prepare the income statement of the project (10 marks) b) Calculates the net cash flow of the project each year (ignoring VAT). (10 marks) c) Calculates the NPV of the project with an average annual cost of equity of 12%. 5 (6 marks) O O Ps 15:50 O 79F Weather alert ~ DENG 27/07/2021