Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. O. 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. m Ibekwe, Kem K - 0 problem 2.docx X Mailings

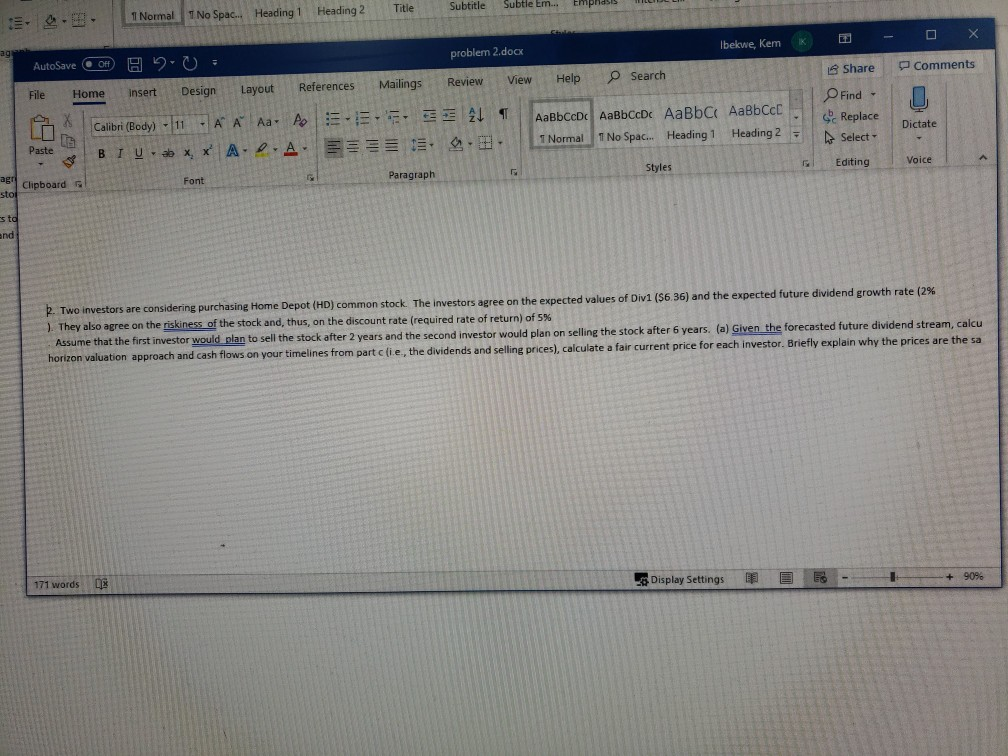

9. O. 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. m Ibekwe, Kem K - 0 problem 2.docx X Mailings Review View Help Search Comments AutoSave of H 2 0 = File Home Insert Design Layout References Calibri (Body) - 11 A A A A BIU , * A.D.A. A 0 Share Find - Sc Replace Select- AaBbCcDc AaBbCcDc AaBC AaBbcc T Normal 1 No Spac. Heading 1 Heading 2 = Dictate Paste ca : Clipboard Font Paragraph Styles Editing Voice sto sta nd B. Two investors are considering purchasing Home Depot (HD) common stock The investors agree on the expected values of Divi (56.36) and the expected future dividend growth rate (2% ). They also agree on the riskiness of the stock and, thus, on the discount rate (required rate of return) of 5% Assume that the first investor would plan to sell the stock after 2 years and the second investor would plan on selling the stock after 6 years. (a) Given the forecasted future dividend stream, calcu horizon valuation approach and cash flows on your timelines from partc(ie, the dividends and selling prices), calculate a fair current price for each investor. Briefly explain why the prices are the sa 171 words 08 Display Settings EEE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started