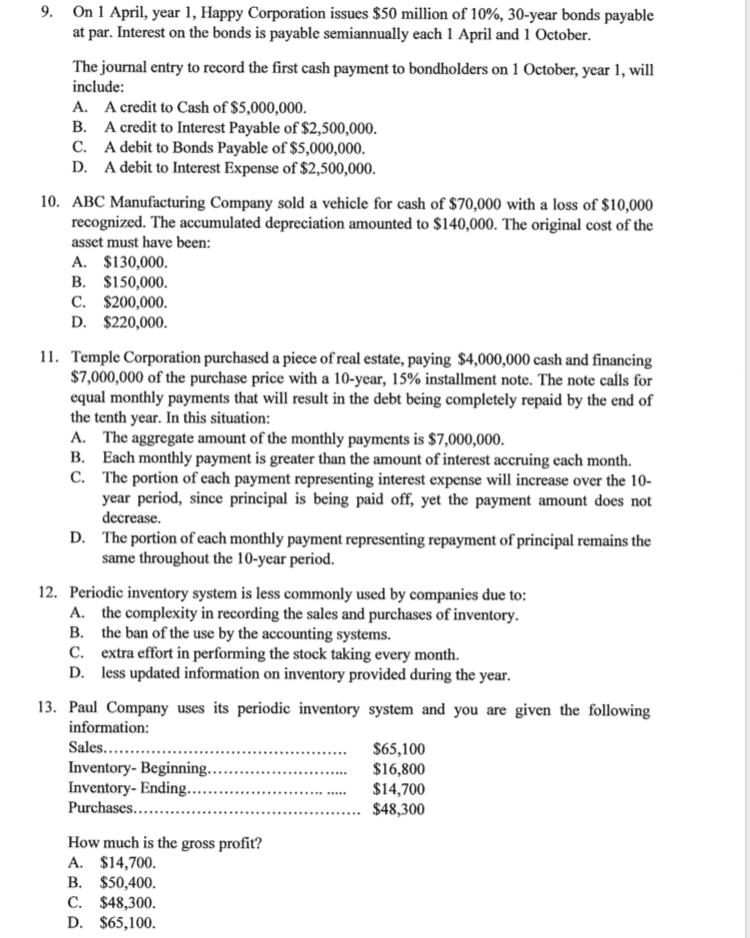

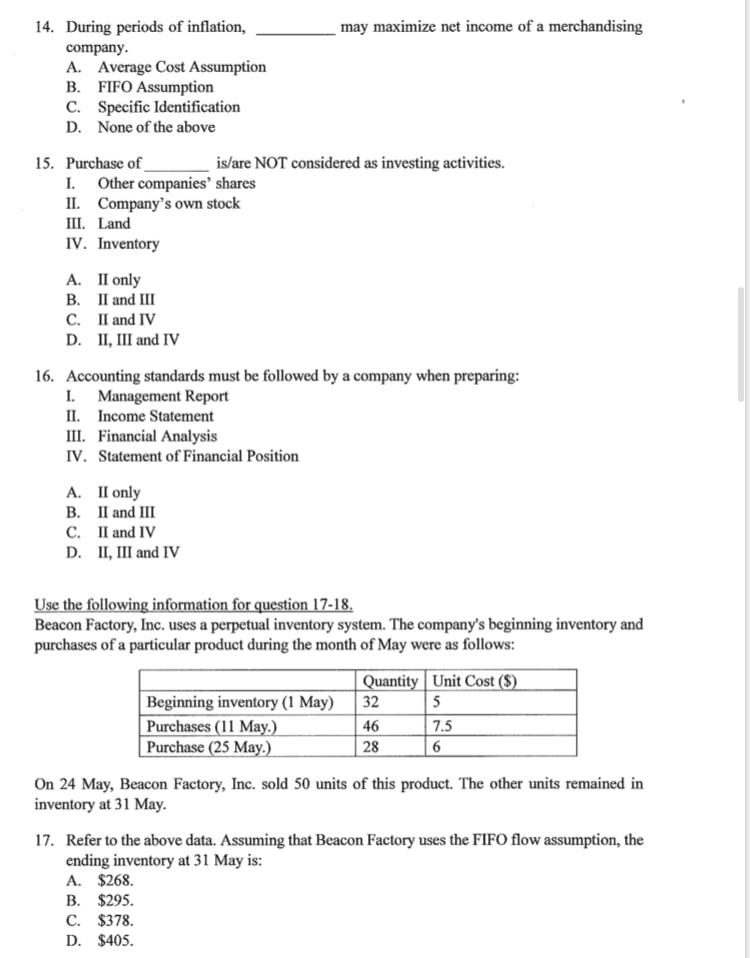

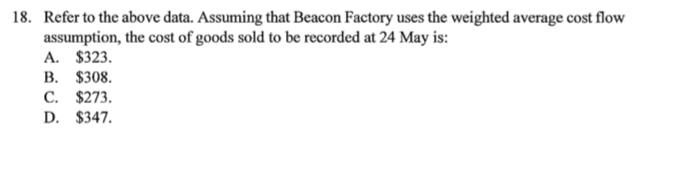

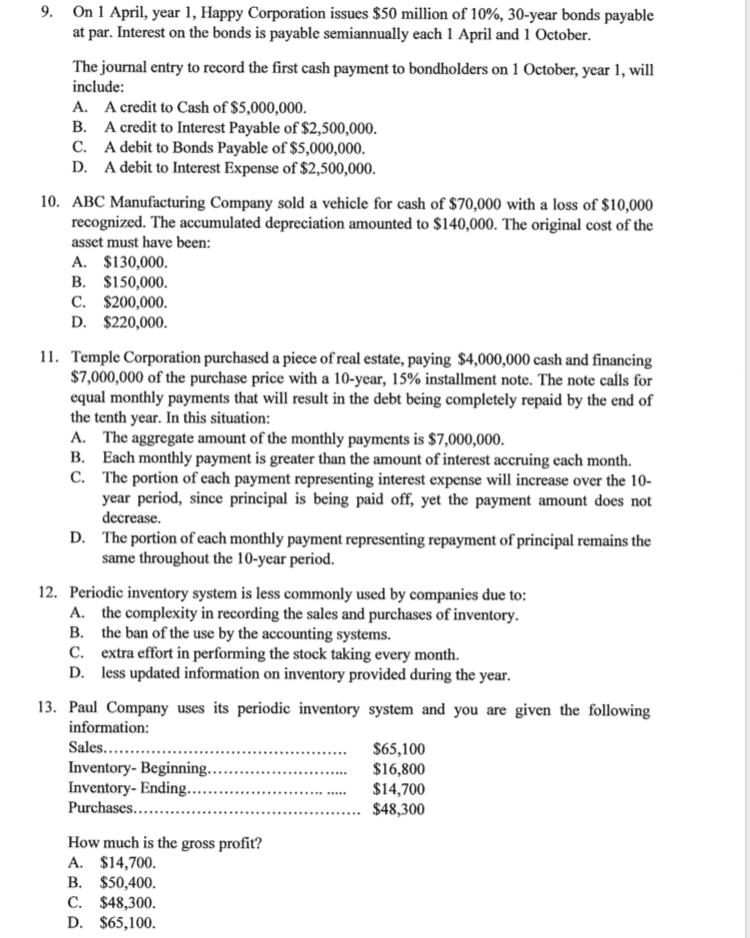

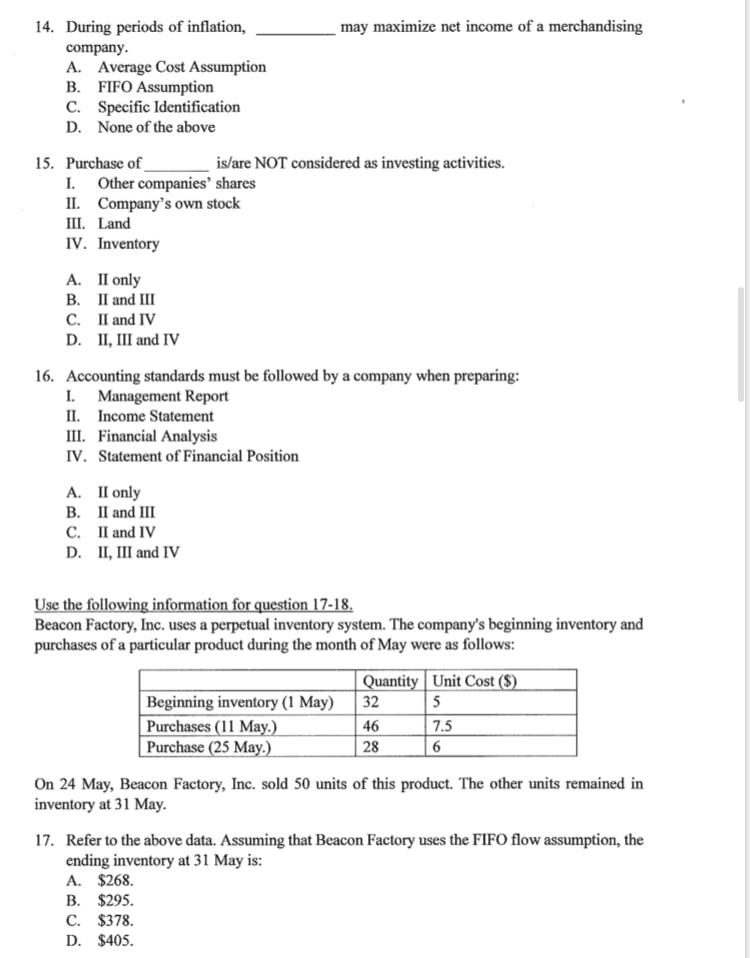

9. On 1 April, year 1, Happy Corporation issues $50 million of 10%, 30-year bonds payable at par. Interest on the bonds is payable semiannually each 1 April and 1 October. The journal entry to record the first cash payment to bondholders on 1 October, year 1, will include: A. A credit to Cash of $5,000,000. B. A credit to Interest Payable of $2,500,000. C. A debit to Bonds Payable of $5,000,000. D. A debit to Interest Expense of $2,500,000. 10. ABC Manufacturing Company sold a vehicle for cash of $70,000 with a loss of $10,000 recognized. The accumulated depreciation amounted to $140,000. The original cost of the asset must have been: A. $130,000. B. $150,000. C. $200,000. D. $220,000. 11. Temple Corporation purchased a piece of real estate, paying $4,000,000 cash and financing $7,000,000 of the purchase price with a 10-year, 15% installment note. The note calls for equal monthly payments that will result in the debt being completely repaid by the end of the tenth year. In this situation: A. The aggregate amount of the monthly payments is $7,000,000. B. Each monthly payment is greater than the amount of interest accruing each month. C. The portion of cach payment representing interest expense will increase over the 10- year period, since principal is being paid off, yet the payment amount does not decrease. D. The portion of cach monthly payment representing repayment of principal remains the same throughout the 10-year period. 12. Periodic inventory system is less commonly used by companies due to: A. the complexity in recording the sales and purchases of inventory. B. the ban of the use by the accounting systems. C. extra effort in performing the stock taking every month. D. less updated information on inventory provided during the year. 13. Paul Company uses its periodic inventory system and you are given the following information: Sales... $65,100 $16,800 $14,700 $48,300 Inventory- Beginning.... Inventory- Ending... Purchases.... How much is the gross profit? A. $14,700. B. $50,400. C. $48,300. D. $65,100. may maximize net income of a merchandising 14. During periods of inflation, company. A. Average Cost Assumption B. FIFO Assumption C. Specific Identification D. None of the above 15. Purchase of I. Other companies' shares II. Company's own stock III. Land IV. Inventory is/are NOT considered as investing activities. A. II only . nd I C. II and IV D. II, III and IV 16. Accounting standards must be followed by a company when preparing: I. Management Report II. Income Statement III. Financial Analysis IV. Statement of Financial Position A. II only . nd I . nd IV D. I, and IV Use the following information for question 17-18. Beacon Factory, Inc. uses a perpetual inventory system. The company's beginning inventory and purchases of a particular product during the month of May were as follows: Quantity Unit Cost ($) |Beginning inventory (1 May) Purchases (11 May.) Purchase (25 May.) 32 46 7.5 28 On 24 May, Beacon Factory, Inc. sold 50 units of this product. The other units remained in inventory at 31 May. 17. Refer to the above data. Assuming that Beacon Factory uses the FIFO flow assumption, the ending inventory at 31 May is: A. $268. B. $295. C. $378. D. $405. 18. Refer to the above data. Assuming that Beacon Factory uses the weighted average cost flow assumption, the cost of goods sold to be recorded at 24 May is: A. $323. B. $308. C. $273. D. $347