Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(9) On April 4, Alam Company purchased a call option on 10,000 bushels of com with delivery on June 30. The strike price is $2.15

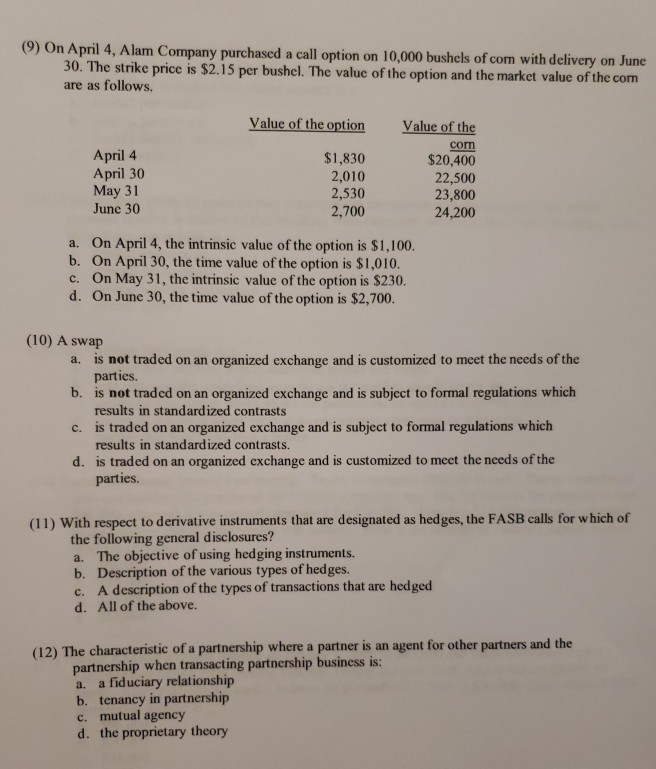

(9) On April 4, Alam Company purchased a call option on 10,000 bushels of com with delivery on June 30. The strike price is $2.15 per bushel. The value of the option and the market value of the com are as follows. Value of the option Value of the com $20,400 22,500 23,800 24,200 April 4 April 30 May 31 June 30 $1,830 2,010 2,530 2,700 a. On April 4, the intrinsic value of the option is $1,100. b. On April 30, the time value of the option is $1,010. c. On May 31, the intrinsic value of the option is $230. d. On June 30, the time value of the option is $2,700. (10) A swap a. is not traded on an organized exchange and is customized to meet the needs of the parties. b. is not traded on an organized exchange and is subject to formal regulations which results in standard ized contrasts c. is traded on an organized exchange and is subject to formal regulations which results in standardized contrasts. d. is traded on an organized exchange and is customized to meet the needs of the parties. (11) With respect to derivative instruments that are designated as hedges, the FASB calls for which of the following general disclosures? a. The objective of using hedging instruments. b. Description of the various types of hedges. c. A description of the types of transactions that are hedged d. All of the above. (12) The characteristic of a partnership where a partner is an agent for other partners and the partnership when transacting partnership business is: a fiduciary relationship b. tenancy in partnership c. mutual agency d. the proprietary theory a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started