Answered step by step

Verified Expert Solution

Question

1 Approved Answer

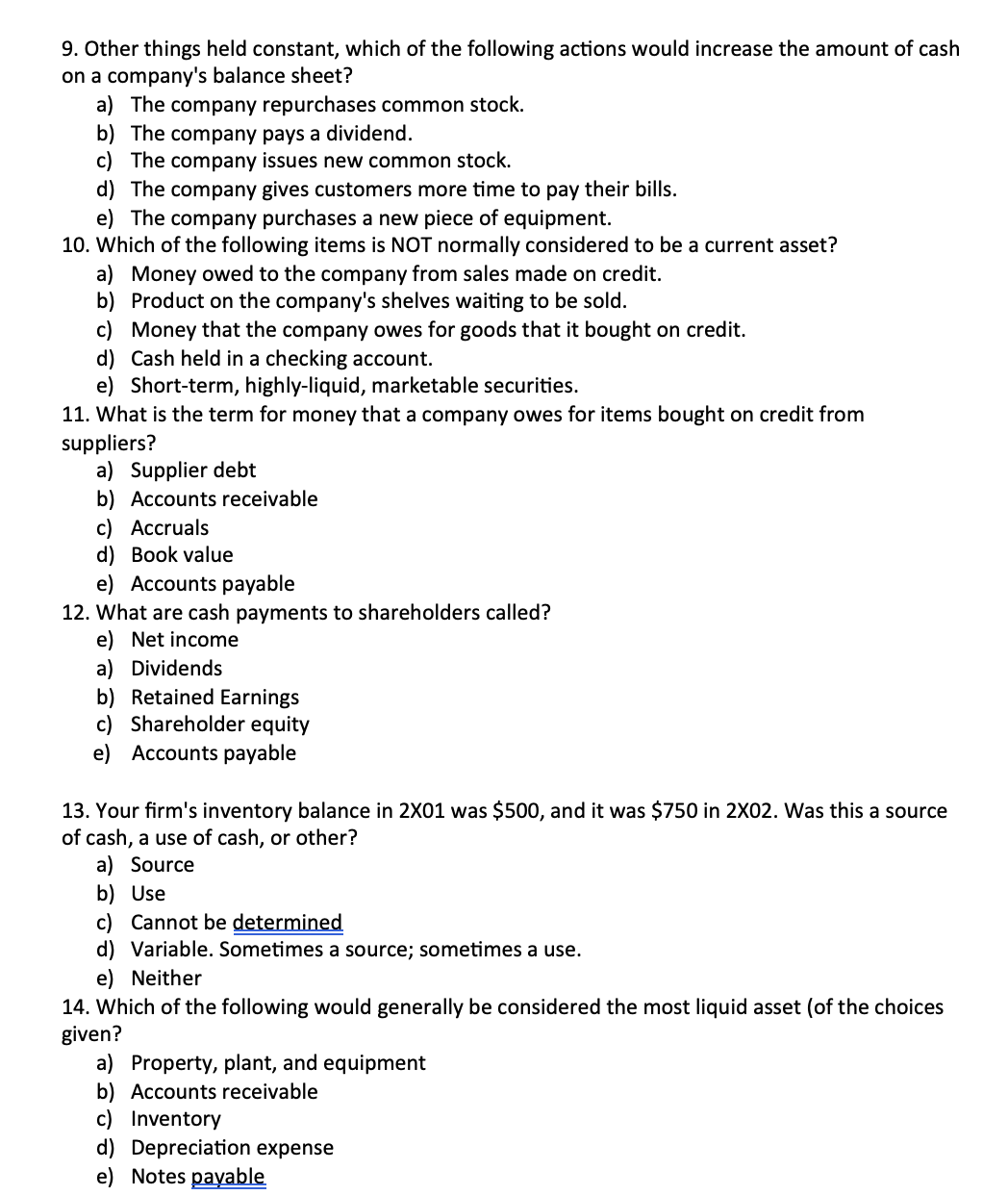

9. Other things held constant, which of the following actions would increase the amount of cash on a company's balance sheet? a) The company repurchases

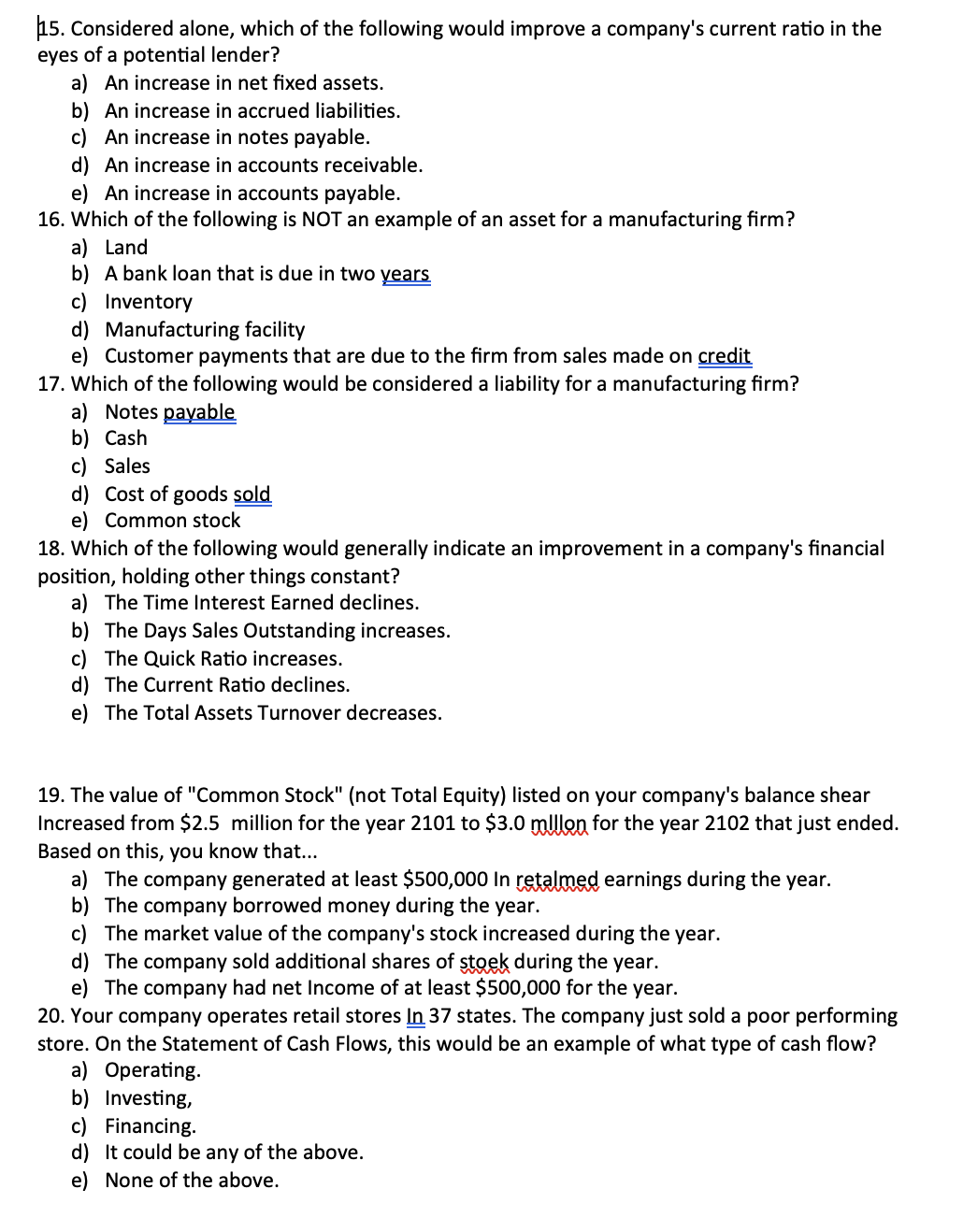

9. Other things held constant, which of the following actions would increase the amount of cash on a company's balance sheet? a) The company repurchases common stock. b) The company pays a dividend. c) The company issues new common stock. d) The company gives customers more time to pay their bills. e) The company purchases a new piece of equipment. 10. Which of the following items is NOT normally considered to be a current asset? a) Money owed to the company from sales made on credit. b) Product on the company's shelves waiting to be sold. c) Money that the company owes for goods that it bought on credit. d) Cash held in a checking account. e) Short-term, highly-liquid, marketable securities. 11. What is the term for money that a company owes for items bought on credit from suppliers? a) Supplier debt b) Accounts receivable c) Accruals d) Book value e) Accounts payable 12. What are cash payments to shareholders called? e) Net income a) Dividends b) Retained Earnings c) Shareholder equity e) Accounts payable 13. Your firm's inventory balance in 2X01 was $500, and it was $750 in 202. Was this a source of cash, a use of cash, or other? a) Source b) Use c) Cannot be determined d) Variable. Sometimes a source; sometimes a use. e) Neither 14. Which of the following would generally be considered the most liquid asset (of the choices given? a) Property, plant, and equipment b) Accounts receivable c) Inventory d) Depreciation expense e) Notes pavable 15. Considered alone, which of the following would improve a company's current ratio in the eyes of a potential lender? a) An increase in net fixed assets. b) An increase in accrued liabilities. c) An increase in notes payable. d) An increase in accounts receivable. e) An increase in accounts payable. 16. Which of the following is NOT an example of an asset for a manufacturing firm? a) Land b) A bank loan that is due in two years c) Inventory d) Manufacturing facility e) Customer payments that are due to the firm from sales made on credit 17. Which of the following would be considered a liability for a manufacturing firm? a) Notes pavable b) Cash c) Sales d) Cost of goods sold e) Common stock 18. Which of the following would generally indicate an improvement in a company's financial position, holding other things constant? a) The Time Interest Earned declines. b) The Days Sales Outstanding increases. c) The Quick Ratio increases. d) The Current Ratio declines. e) The Total Assets Turnover decreases. 19. The value of "Common Stock" (not Total Equity) listed on your company's balance shear Increased from \$2.5 million for the year 2101 to $3.0 millon for the year 2102 that just ended. Based on this, you know that... a) The company generated at least $500,000 In retalmed earnings during the year. b) The company borrowed money during the year. c) The market value of the company's stock increased during the year. d) The company sold additional shares of stoek during the year. e) The company had net Income of at least $500,000 for the year. 20. Your company operates retail stores ln37 states. The company just sold a poor performing store. On the Statement of Cash Flows, this would be an example of what type of cash flow? a) Operating. b) Investing, c) Financing. d) It could be any of the above. e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started