9 part question. Using excel which is currently not applicable for me.

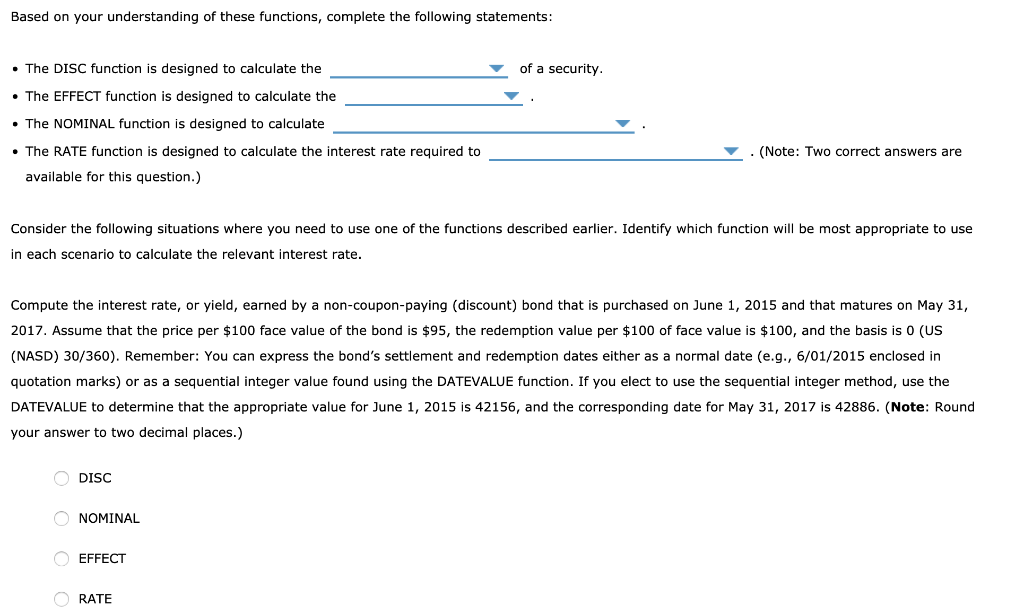

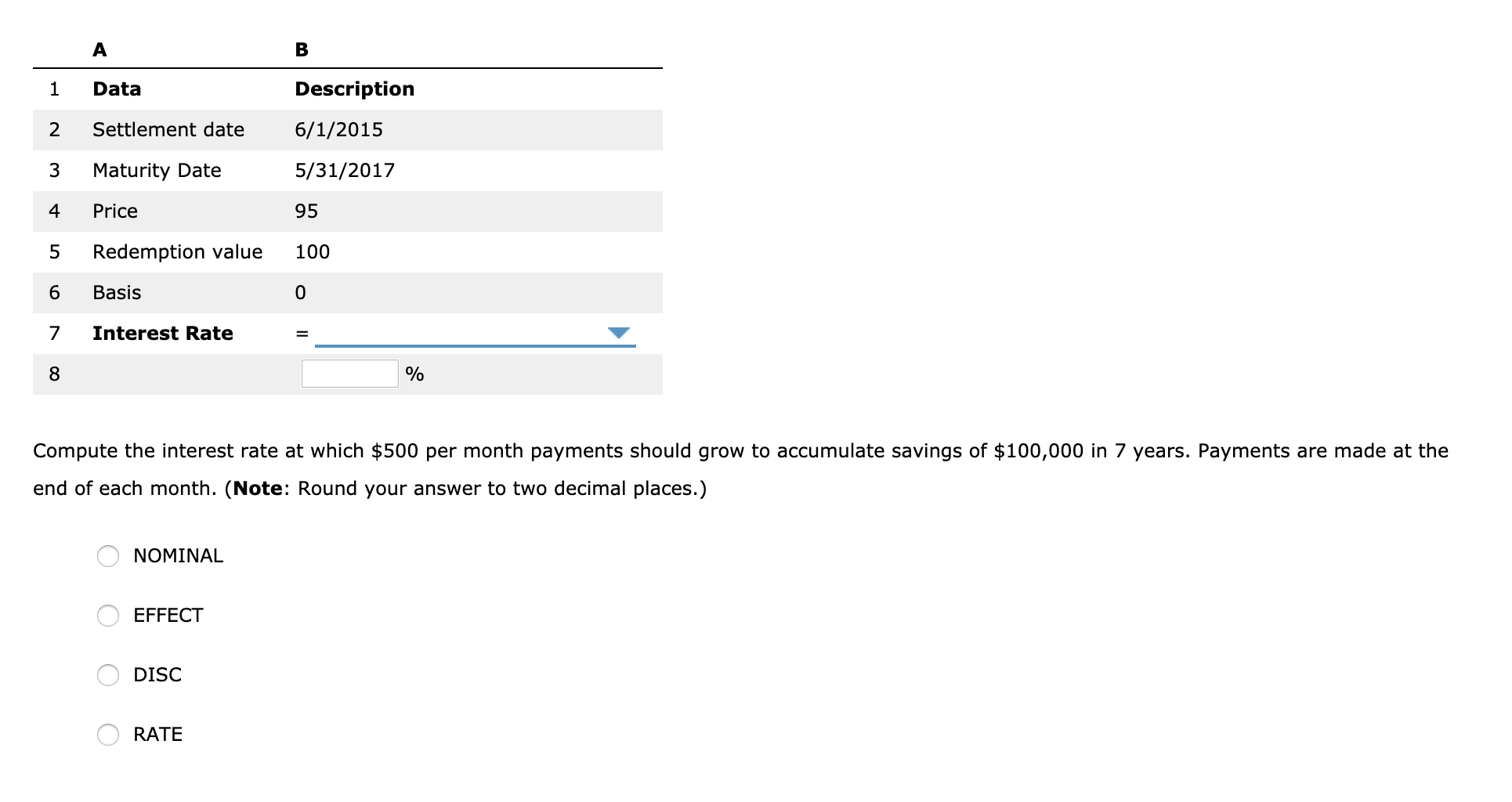

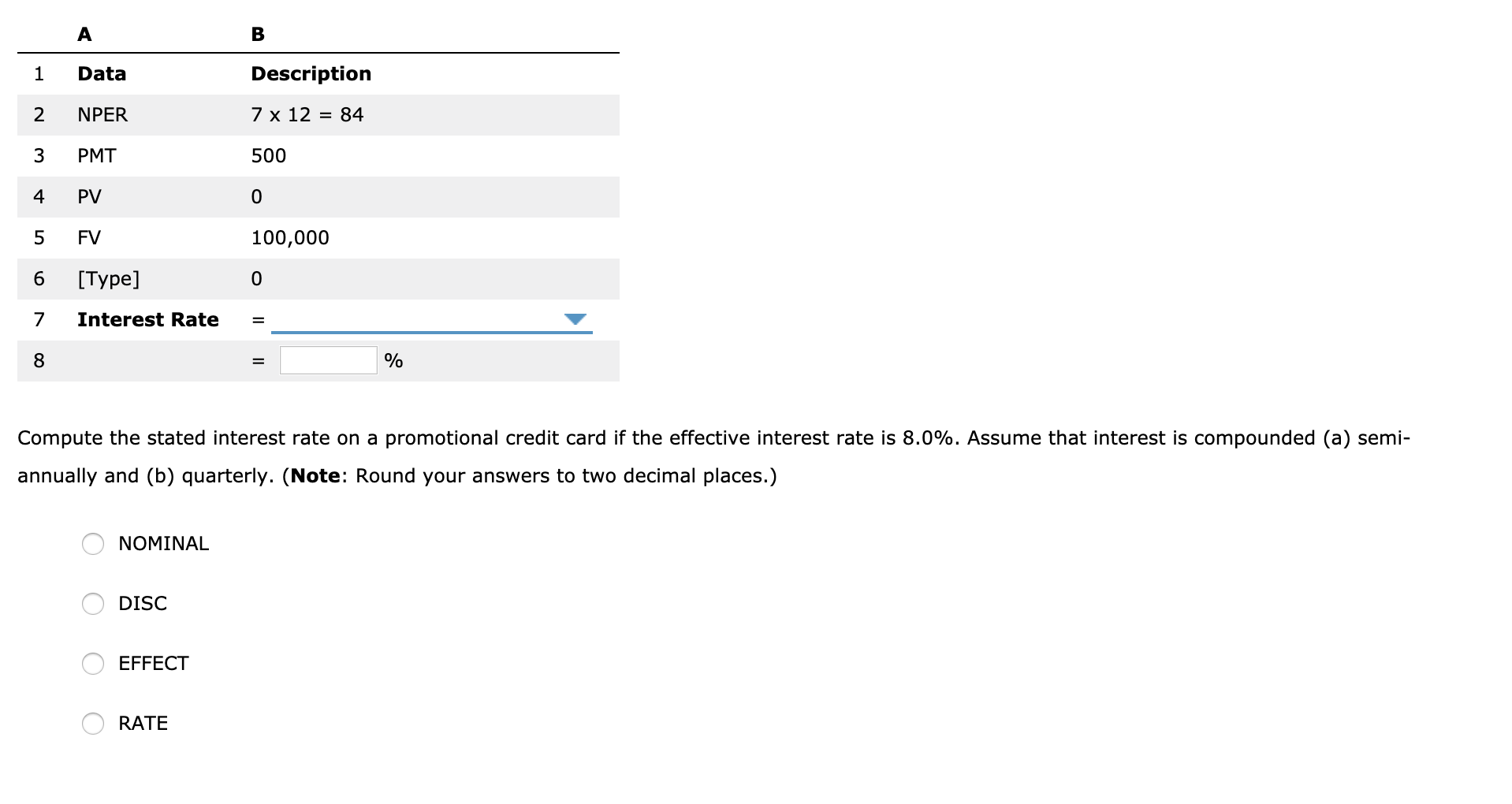

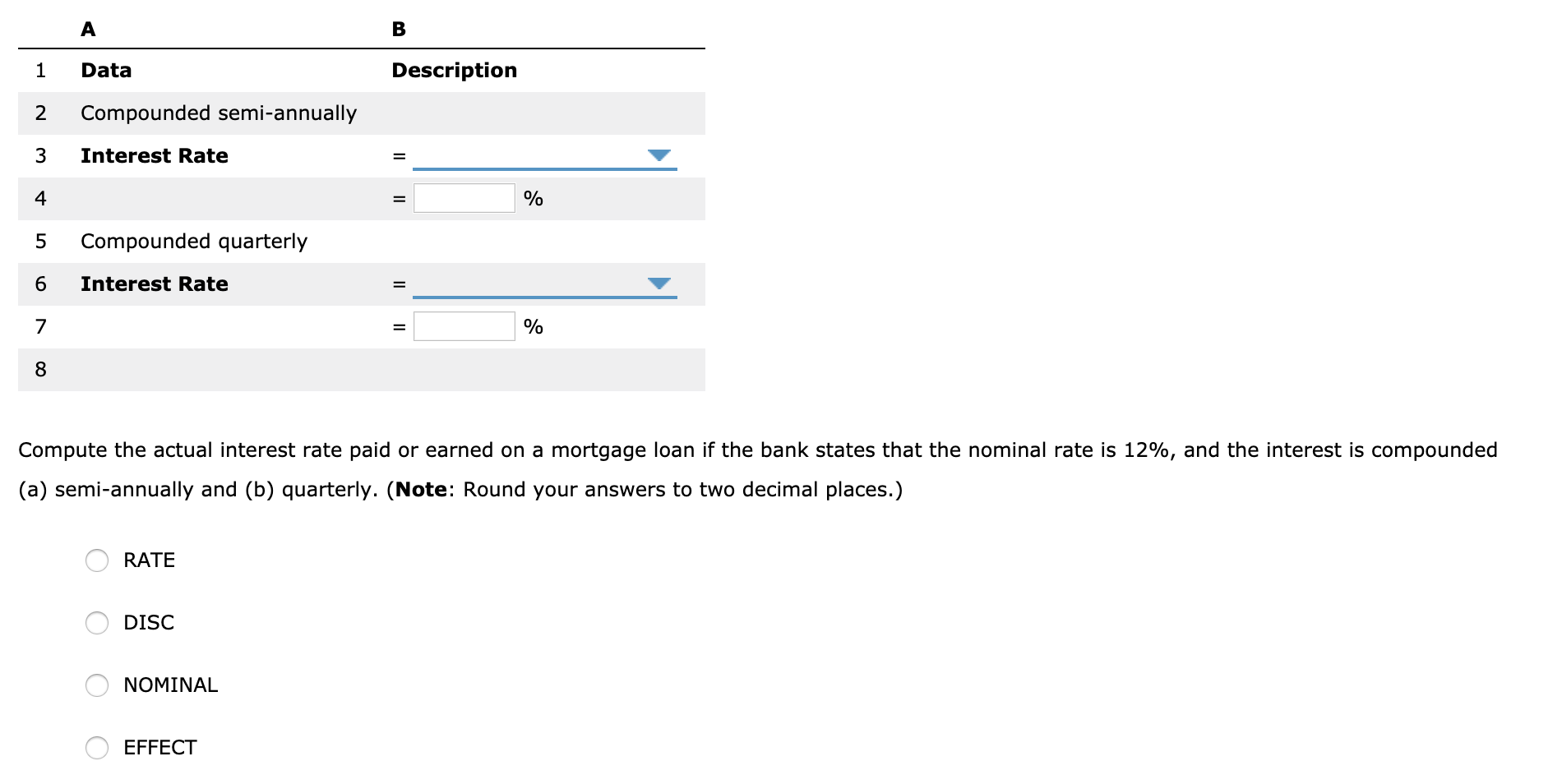

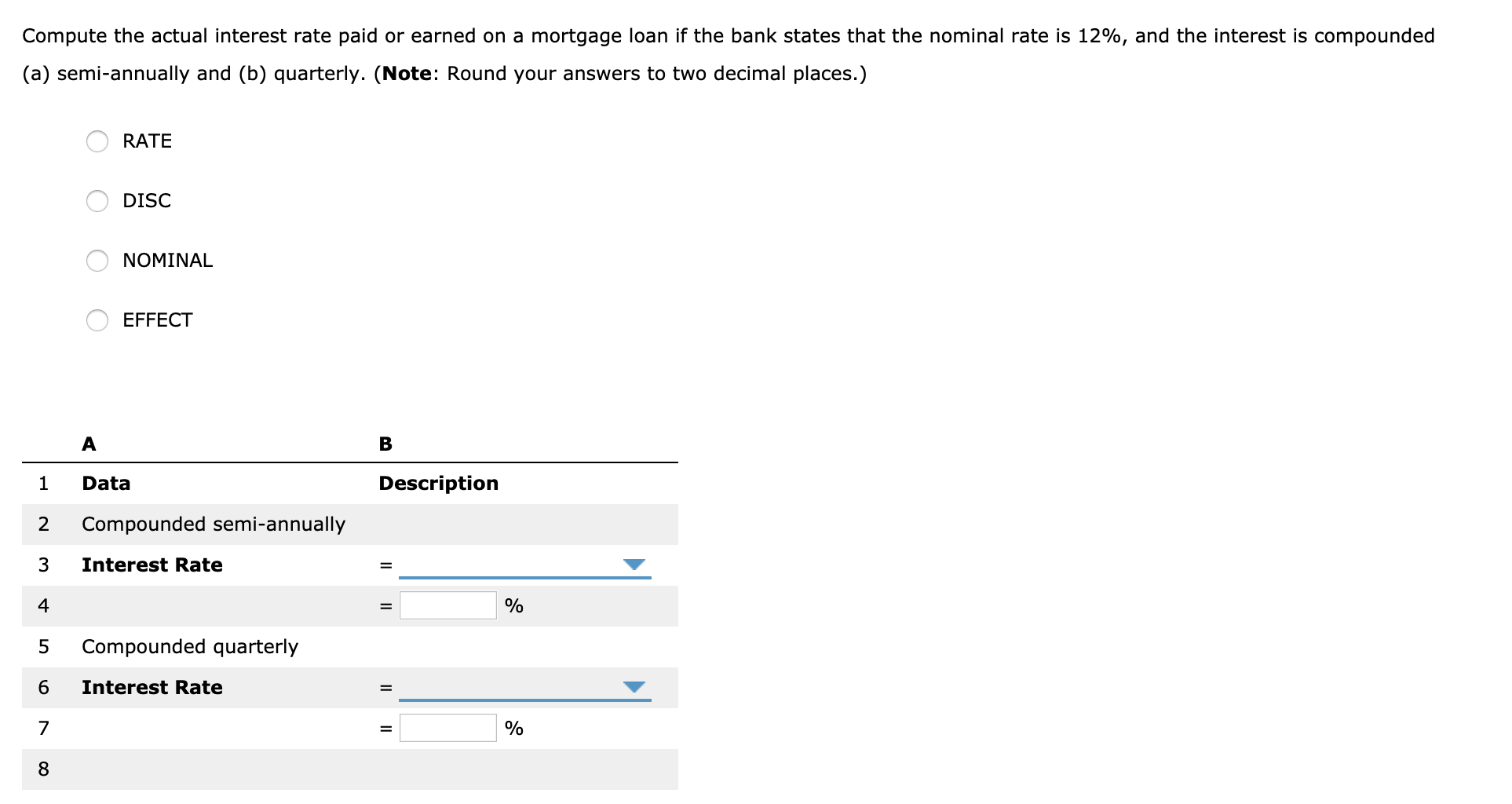

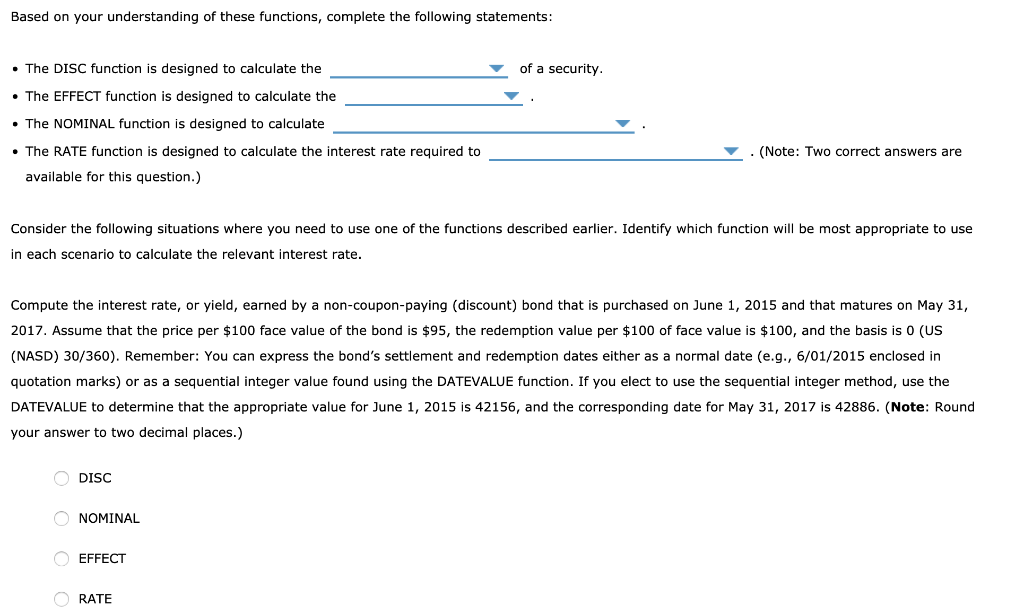

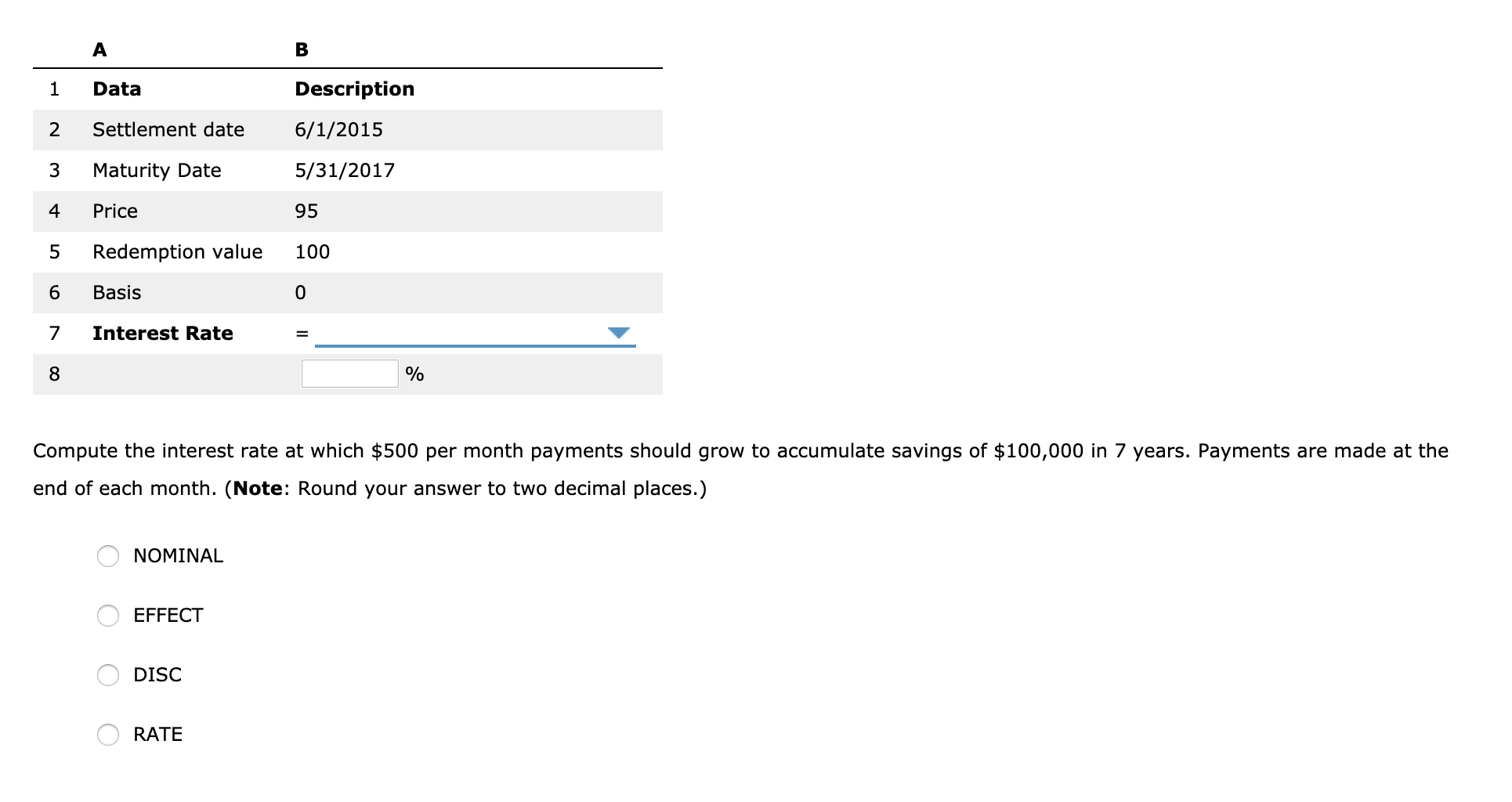

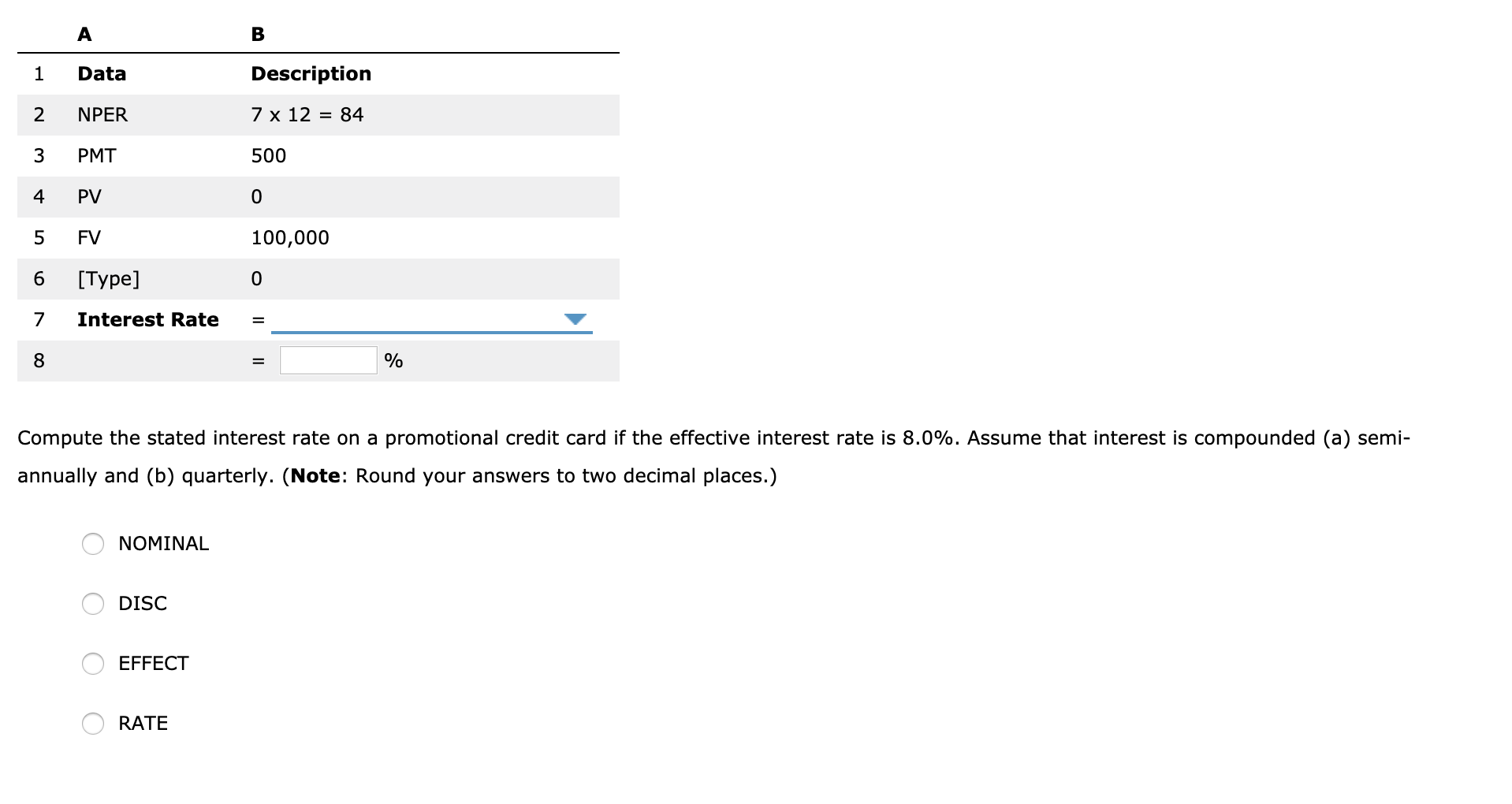

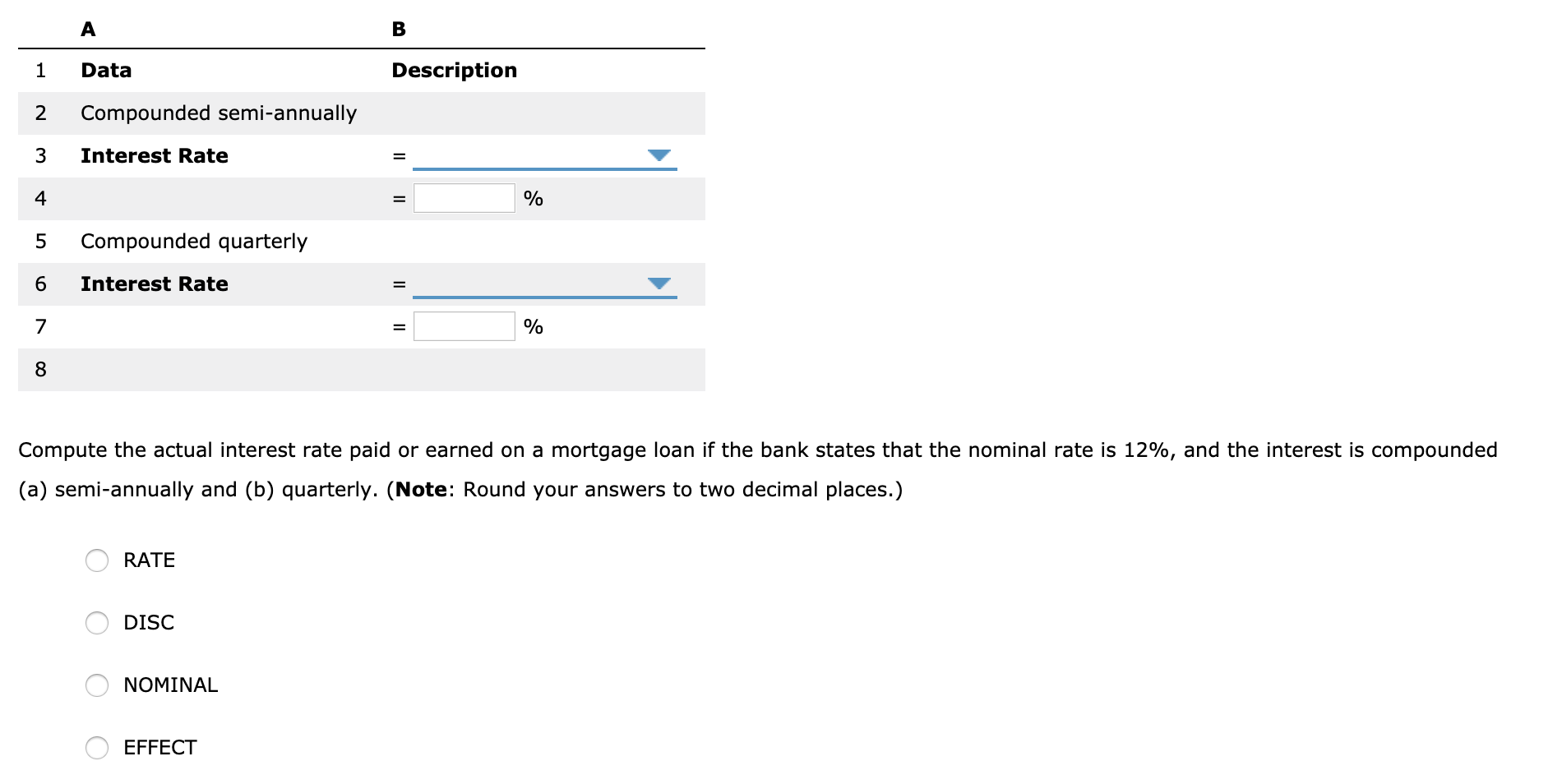

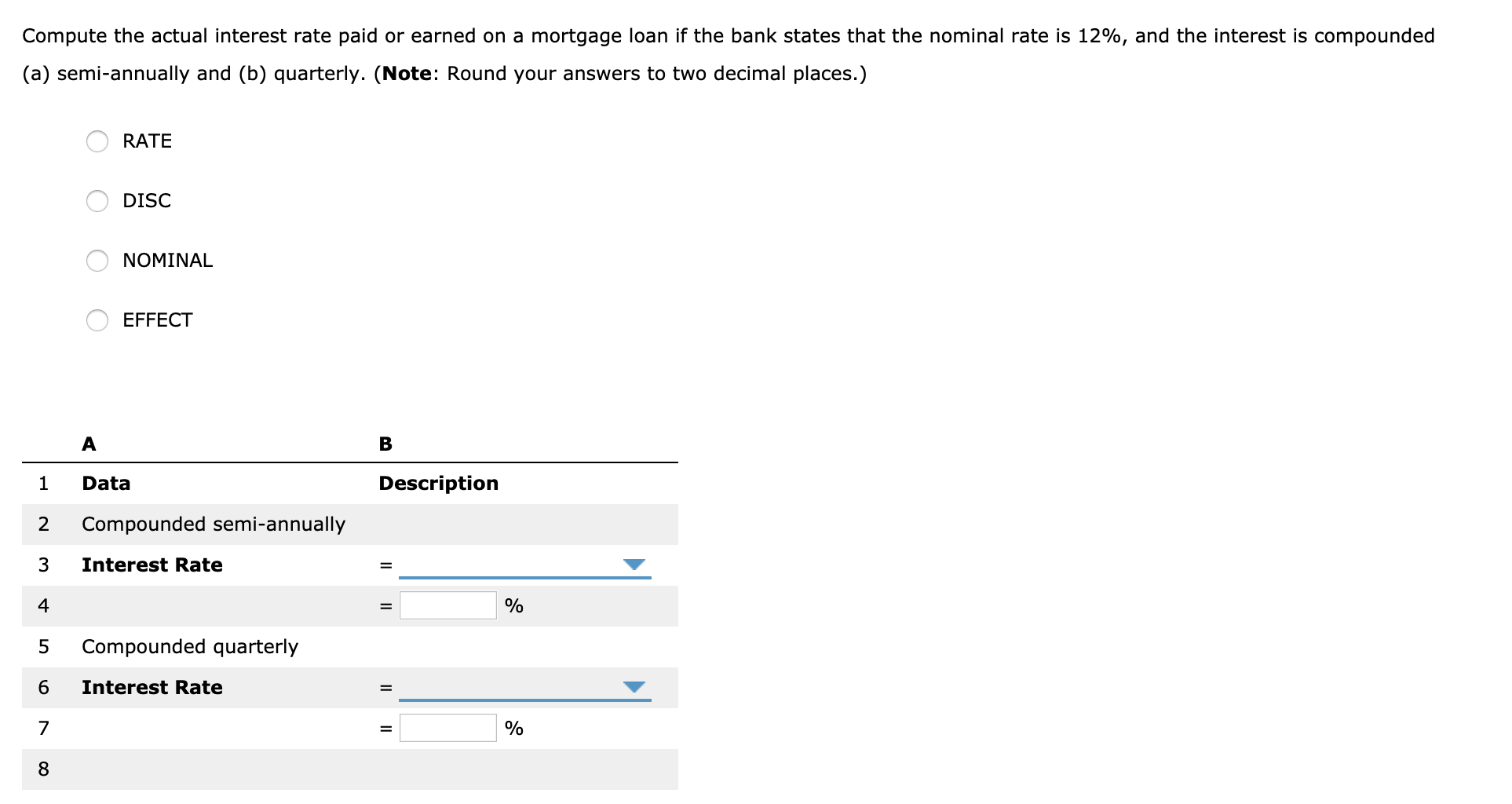

Based on your understanding of these functions, complete the following statements: of a security The DISC function is designed to calculate the The EFFECT function is designed to calculate the The NOMINAL function is designed to calculate The RATE function is designed to calculate the interest rate required to (Note: Two correct answers are available for this question.) Consider the following situations where you need to use one of the functions described earlier. Identify which function will be most appropriate to use in each scenario to calculate the relevant interest rate Compute the interest rate, or yield, earned by a non-coupon-paying (discount) bond that is purchased on June 1, 2015 and that matures on May 31 2017. Assume that the price per $100 face value of the bond is $95, the redemption value per $100 of face value is $100, and the basis is 0 (US (NASD) 30/360). Remember: You can express the bond'ss settlement and redemption dates either as a normal date (e.g., 6/01/2015 enclosed in quotation marks) or as a sequential integer value found using the DATEVALUE function. If you elect to use the sequential integer method, use the DATEVALUE to determine that the appropriate value for June 1, 2015 is 42156, and the corresponding date for May 31, 2017 is 42886. (Note: Round your answer to two decimal places.) DISC NOMINAL EFFECT ORATE A 1 Data Description Settlement date 6/1/2015 2 5/31/2017 3 Maturity Date 4 Price 95 Redemption value 5 100 6 Basis 7 Interest Rate 8 Compute the interest rate at which $500 per month payments should grow to accumulate savings of $100,000 in 7 years. Payments are made at the end of each month. (Note: Round your answer to two decimal places.) NOMINAL EFFECT DISC RATE A Description 1 Data 7 x 12 2 NPER 84 3 PMT 500 4 PV 0 100,000 FV ] 0 7 Interest Rate 8 Compute the stated interest rate on a promotional credit card if the effective interest rate is 8.0%. Assume that interest is compounded (a) semi- annually and (b) quarterly. (Note: Round your answers to two decimal places.) NOMINAL DISC EFFECT RATE LC A Description 1 Data Compounded semi-annually 2 3 Interest Rate 4 Compounded quarterly 5 6 Interest Rate 7 8 Compute the actual interest rate paid or earned on a mortgage loan if the bank states that the nominal rate is 12%, and the interest is compounded (a) semi-annually and (b) quarterly. (Note: Round your answers to two decimal places.) RATE DISC NOMINAL EFFECT LC Compute the actual interest rate paid or earned on a mortgage loan if the bank states that the nominal rate is 12%, and the interest is compounded (a) semi-annually and (b) quarterly. (Note: Round your answers to two decimal places.) RATE DISC NOMINAL EFFECT A Description 1 Data Compounded semi-annually 2 3 Interest Rate 4 5 Compounded quarterly Interest Rate 6 7 8 II LC Based on your understanding of these functions, complete the following statements: of a security The DISC function is designed to calculate the The EFFECT function is designed to calculate the The NOMINAL function is designed to calculate The RATE function is designed to calculate the interest rate required to (Note: Two correct answers are available for this question.) Consider the following situations where you need to use one of the functions described earlier. Identify which function will be most appropriate to use in each scenario to calculate the relevant interest rate Compute the interest rate, or yield, earned by a non-coupon-paying (discount) bond that is purchased on June 1, 2015 and that matures on May 31 2017. Assume that the price per $100 face value of the bond is $95, the redemption value per $100 of face value is $100, and the basis is 0 (US (NASD) 30/360). Remember: You can express the bond'ss settlement and redemption dates either as a normal date (e.g., 6/01/2015 enclosed in quotation marks) or as a sequential integer value found using the DATEVALUE function. If you elect to use the sequential integer method, use the DATEVALUE to determine that the appropriate value for June 1, 2015 is 42156, and the corresponding date for May 31, 2017 is 42886. (Note: Round your answer to two decimal places.) DISC NOMINAL EFFECT ORATE A 1 Data Description Settlement date 6/1/2015 2 5/31/2017 3 Maturity Date 4 Price 95 Redemption value 5 100 6 Basis 7 Interest Rate 8 Compute the interest rate at which $500 per month payments should grow to accumulate savings of $100,000 in 7 years. Payments are made at the end of each month. (Note: Round your answer to two decimal places.) NOMINAL EFFECT DISC RATE A Description 1 Data 7 x 12 2 NPER 84 3 PMT 500 4 PV 0 100,000 FV ] 0 7 Interest Rate 8 Compute the stated interest rate on a promotional credit card if the effective interest rate is 8.0%. Assume that interest is compounded (a) semi- annually and (b) quarterly. (Note: Round your answers to two decimal places.) NOMINAL DISC EFFECT RATE LC A Description 1 Data Compounded semi-annually 2 3 Interest Rate 4 Compounded quarterly 5 6 Interest Rate 7 8 Compute the actual interest rate paid or earned on a mortgage loan if the bank states that the nominal rate is 12%, and the interest is compounded (a) semi-annually and (b) quarterly. (Note: Round your answers to two decimal places.) RATE DISC NOMINAL EFFECT LC Compute the actual interest rate paid or earned on a mortgage loan if the bank states that the nominal rate is 12%, and the interest is compounded (a) semi-annually and (b) quarterly. (Note: Round your answers to two decimal places.) RATE DISC NOMINAL EFFECT A Description 1 Data Compounded semi-annually 2 3 Interest Rate 4 5 Compounded quarterly Interest Rate 6 7 8 II LC