Answered step by step

Verified Expert Solution

Question

1 Approved Answer

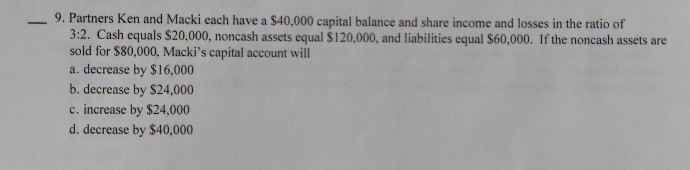

9. Partners Ken and Macki each have a $40,000 capital balance and share income and losses in the ratio of 3:2. Cash equals $20,000, noncash

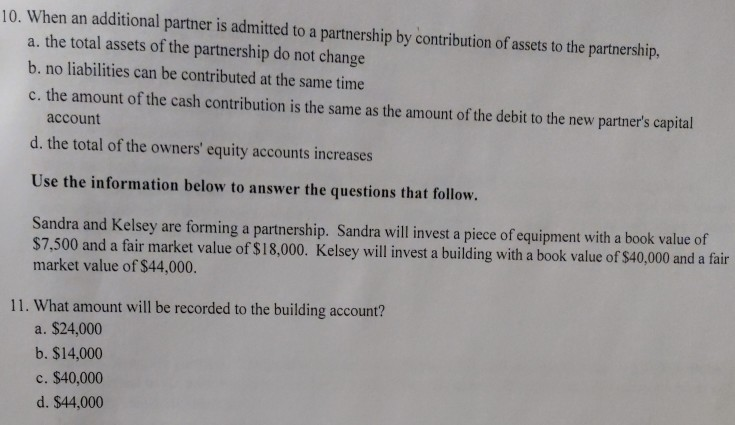

9. Partners Ken and Macki each have a $40,000 capital balance and share income and losses in the ratio of 3:2. Cash equals $20,000, noncash assets equal $120,000, and liabilities equal $60,000. If the noncash assets are sold for $80,000, Macki's capital account will a. decrease by $16,000 b. decrease by $24,000 c. increase by $24,000 d. decrease by $40,000 10. When an additional partner is admitted to a partnership by contribution of assets to the partnership, a. the total assets of the partnership do not change b. no liabilities can be contributed at the same time c. the amount of the cash contribution is the same as the amount of the debit to the new partner's capital account d. the total of the owners' equity accounts increases Use the information below to answer the questions that follow. Sandra and Kelsey are forming a partnership. Sandra will invest a piece of equipment with a book value of $7.500 and a fair market value of S18,000. Kelsey will invest a building with a book value of $40,000and a fair market value of $44,000. 11. What amount will be recorded to the building account? a. $24,000 b. $14,000 c. $40,000 d. $44,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started