Answered step by step

Verified Expert Solution

Question

1 Approved Answer

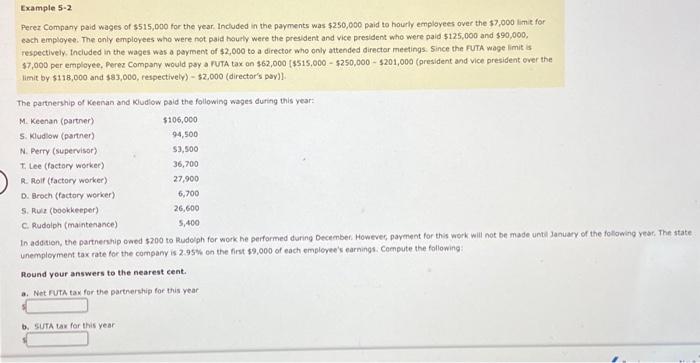

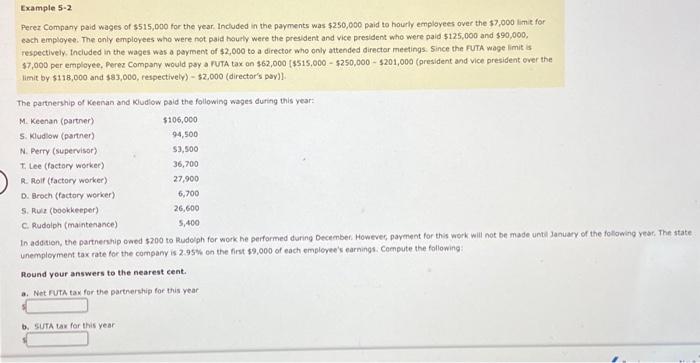

9 Perez Company paid wages of $515,000 for the year. Included in the payments was $250,000 paid to hourly employees over the $7,000 lime for

9

Perez Company paid wages of $515,000 for the year. Included in the payments was $250,000 paid to hourly employees over the $7,000 lime for each employee. The only employees who were not paid hourly were the presidert and vice president who were paid $125,000 and $90,000, respectively. Included in the wages was a payment of $2,000 to a director who only attended director meetings. $ ince the Futa wage limit is $7,000 per employee, Perez Company would pay a RuTA tax on \$62,000 [\$515,000 - \$250,000 - \$201,000 (president and vice president ever the limit by $118,000 and $83,000, respectively) $2,000 (director's pay)l. The partnership of Keenan and Kludiow paid the following wages during this vear: unemployment tax rate for the company is 2.95% on the first $9,000 of each emplovec's earnings. Compute the following: Round your answers to the nearest cent. a. Net rutA tax for the partnership for this year s b. SuTA tax for this year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started