Answered step by step

Verified Expert Solution

Question

1 Approved Answer

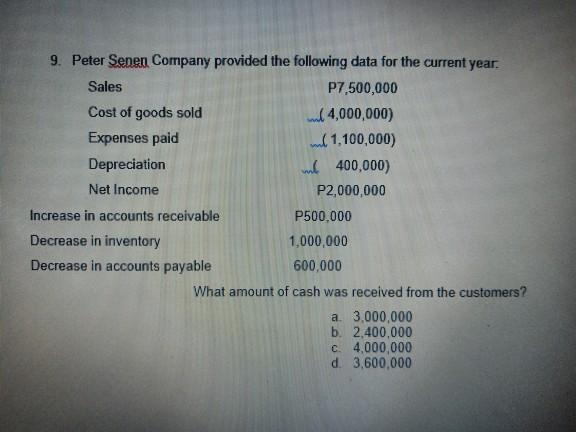

9. Peter Senen Company provided the following data for the current year. P7,500,000 4,000,000) 1,100,000) 400,000) P2,000,000 Sales Cost of goods sold Expenses paid

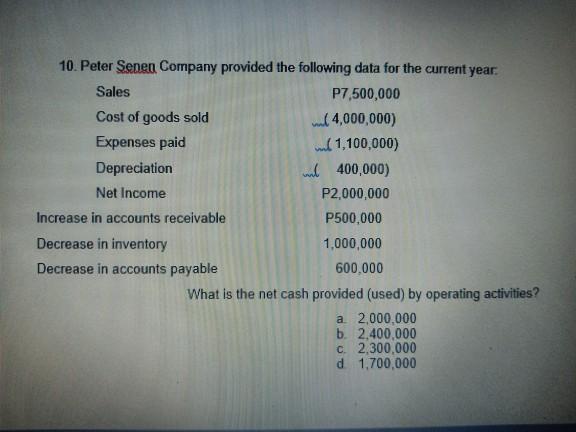

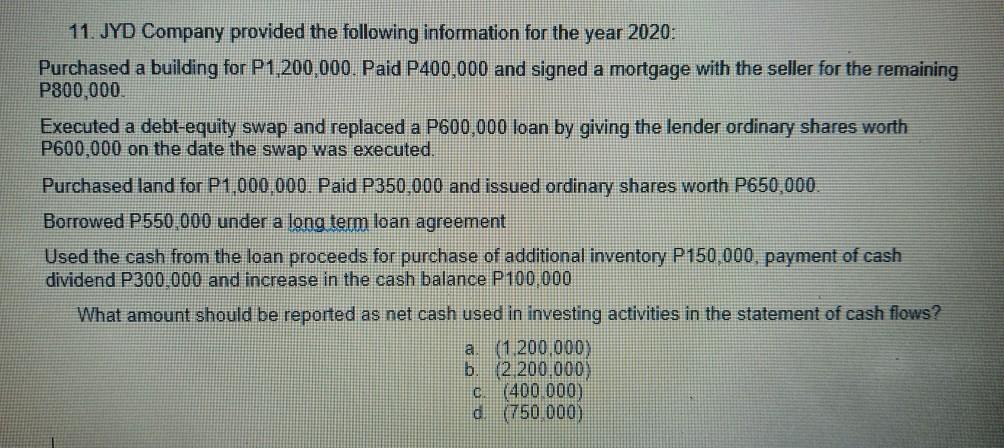

9. Peter Senen Company provided the following data for the current year. P7,500,000 4,000,000) 1,100,000) 400,000) P2,000,000 Sales Cost of goods sold Expenses paid Depreciation Net Income Increase in accounts receivable Decrease in inventory Decrease in accounts payable P500,000 1,000,000 600,000 What amount of cash was received from the customers? a. 3,000,000 b. 2,400,000 c. 4,000,000 d. 3,600,000 10. Peter Senen Company provided the following data for the current year: P7,500,000 Sales Cost of goods sold Expenses paid Depreciation Net Income Increase in accounts receivable Decrease in inventory Decrease in accounts payable (4,000,000) 1,100,000) 400,000) P2,000,000 P500,000 1,000,000 600,000 What is the net cash provided (used) by operating activities? a 2,000,000 b. 2,400,000 c. 2,300,000 d. 1,700,000 11. JYD Company provided the following information for the year 2020: Purchased a building for P1,200,000. Paid P400,000 and signed a mortgage with the seller for the remaining P800,000 Executed a debt-equity swap and replaced a P600,000 loan by giving the lender ordinary shares worth P600,000 on the date the swap was executed. Purchased land for P1,000,000. Paid P350,000 and issued ordinary shares worth P650,000. Borrowed P550,000 under a long term loan agreement Used the cash from the loan proceeds for purchase of additional inventory P150,000, payment of cash dividend P300,000 and increase in the cash balance P100,000 What amount should be reported as net cash used in investing activities in the statement of cash flows? a (1,200,000) b. (2,200,000) c. (400.000) d. (750,000) 12. JYD Company reported net income of P3,000,000 for the current year. Changes occurred in certain accounts as follows: Equipment Accumulated depreciation P250,000 increase 400,000 increase Note payable 300,000 increase During the year, the entity sold equipment costing P250,000 with accumulated depreciation of P120,000 for a gain of P50,000 In December of the current year, the entity purchased equipment costing P500,000 with P200,000 cash and a 12% note payable of P300,000. In the statement of cash flows, what amount should be reported as net cash used in investing activities? a. (20,000) b. (120,000) c. (220,000) d. (350,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 9 Answer P7000000 Calculation Particulars P Sales 7500000 Less Increase in accounts receiva...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started