Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. please answer all parts. please read the questionumbers carefully! similar questions may already be posted to Chegg but they have slightly different numbers. i

9. please answer all parts. please read the questionumbers carefully! similar questions may already be posted to Chegg but they have slightly different numbers. i will give upvote/thumbs up for correct answer! thank you for your help!

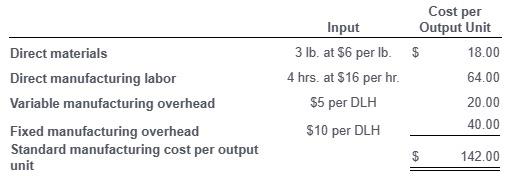

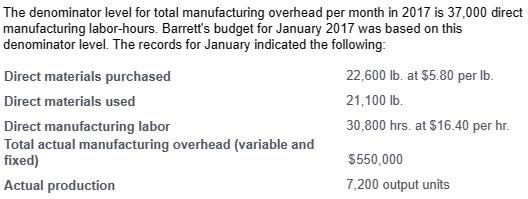

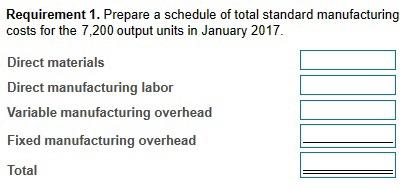

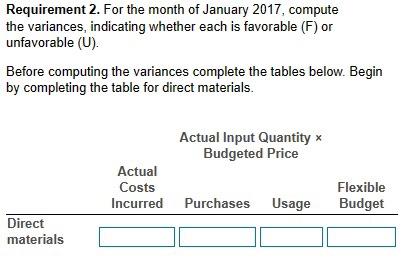

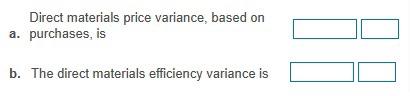

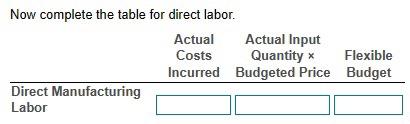

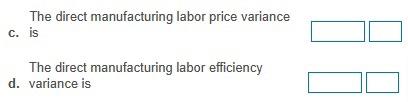

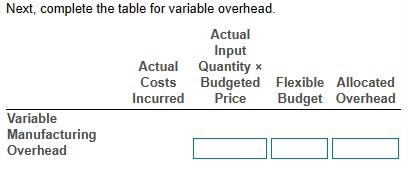

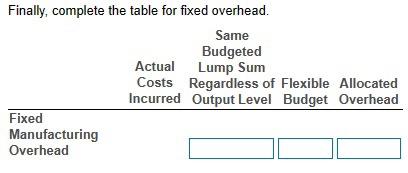

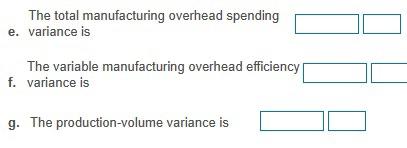

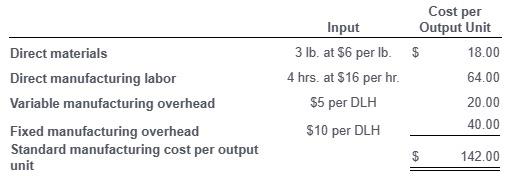

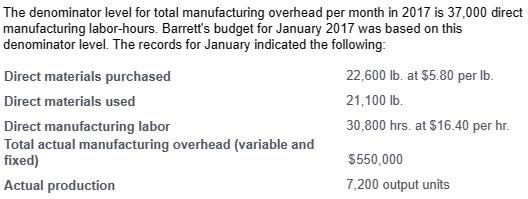

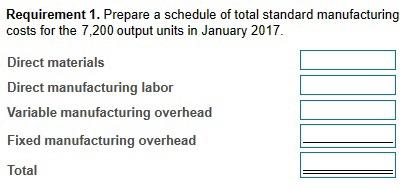

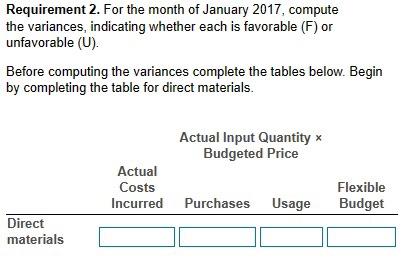

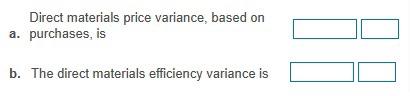

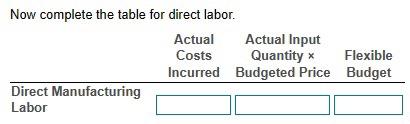

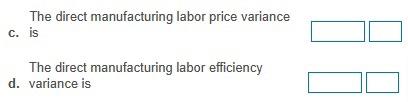

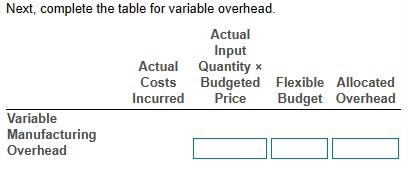

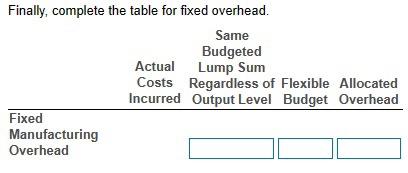

The Barrett Manufacturing Company's costing system has two direct-cost categories: direct materials and direct manufacturing labor. Manufacturing overhead (both variable and fixed) is allocated to products on the basis of standard direct manufacturing labor-hours (DLH). At the beginning of 2017, Barrett adopted the following standards for its manufacturing costs: (Click to view the standards.) additional information.) \begin{tabular}{|c|c|c|c|} \hline \multirow[b]{2}{*}{ Direct materials } & \multirow{2}{*}{3lb.at$6perlb.Input} & \multicolumn{2}{|c|}{\begin{tabular}{l} Cost per \\ Output Unit \\ \end{tabular}} \\ \hline & & $ & 18.00 \\ \hline Direct manufacturing labor & 4 hrs. at $16 per hr. & & 64.00 \\ \hline Variable manufacturing overhead & $5 per DLH & & 20.00 \\ \hline Fixed manufacturing overhead & $10 per DLH & & 40.00 \\ \hline \begin{tabular}{l} Standard manufacturing cost per output \\ unit \end{tabular} & & $ & 142.00 \\ \hline \end{tabular} The denominator level for total manufacturing overhead per month in 2017 is 37,000 direct manufacturing labor-hours. Barrett's budget for January 2017 was based on this denominator level. The records for January indicated the following: Requirement 1. Prepare a schedule of total standard manufacturing costs for the 7,200 output units in January 2017. Direct materials Direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead Total Requirement 2 . For the month of January 2017 , compute the variances, indicating whether each is favorable (F) or unfavorable (U). Before computing the variances complete the tables below. Begin by completing the table for direct materials. Direct materials price variance, based on a. purchases, is b. The direct materials efficiency variance is Now complete the table for direct labor. The direct manufacturing labor price variance c. is The direct manufacturing labor efficiency d. variance is Next, complete the table for variable overhead. Finally, complete the table for fixed overhead. The total manufacturing overhead spending e. variance is The variable manufacturing overhead efficiency f. variance is g. The production-volume variance is

*if you give me an email and ask for money I will report you*

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started