Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( 9 ) Professional Profits Inc. is analyzing a project with anticipated sales of 1 2 , 5 0 0 units, + - 2 percent.

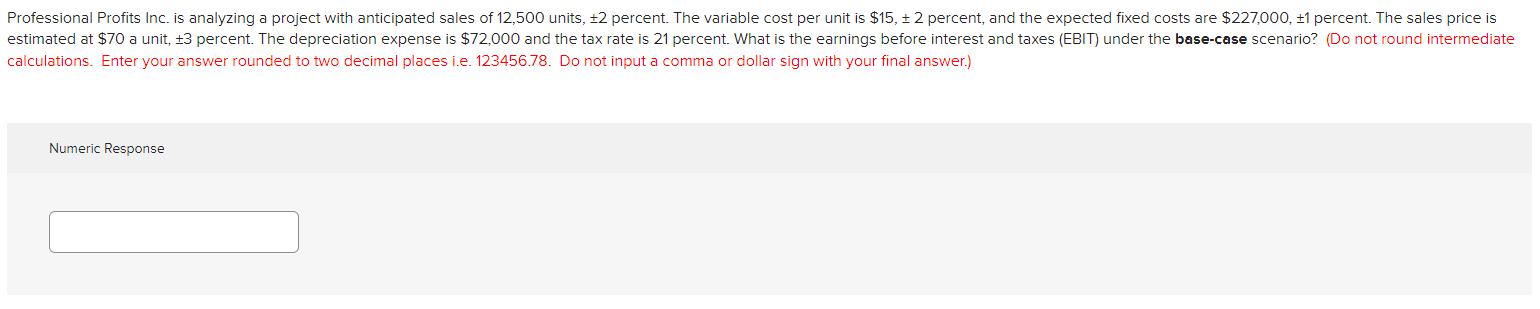

Professional Profits Inc. is analyzing a project with anticipated sales of units, percent. The variable cost per unit is $ percent, and the expected fixed costs are $ percent. The sales price is

estimated at $ a unit, percent. The depreciation expense is $ and the tax rate is percent. What is the earnings before interest and taxes EBIT under the basecase scenario? Do not round intermediate

calculations. Enter your answer rounded to two decimal places ie Do not input a comma or dollar sign with your final answer.

Numeric Response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started