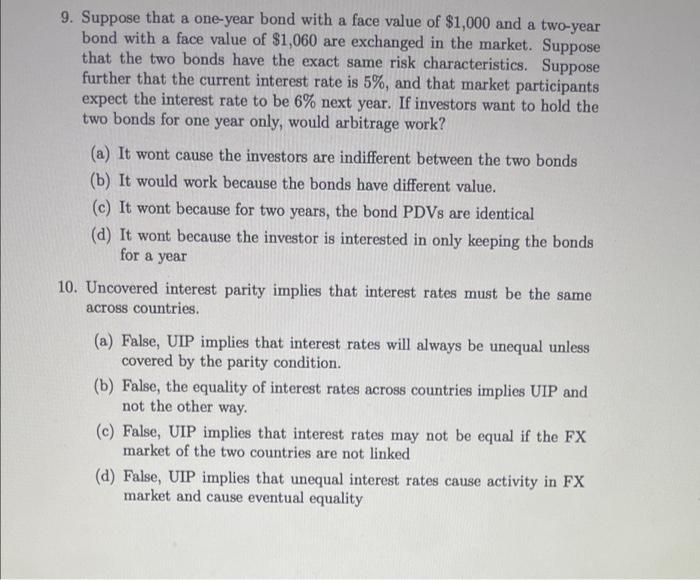

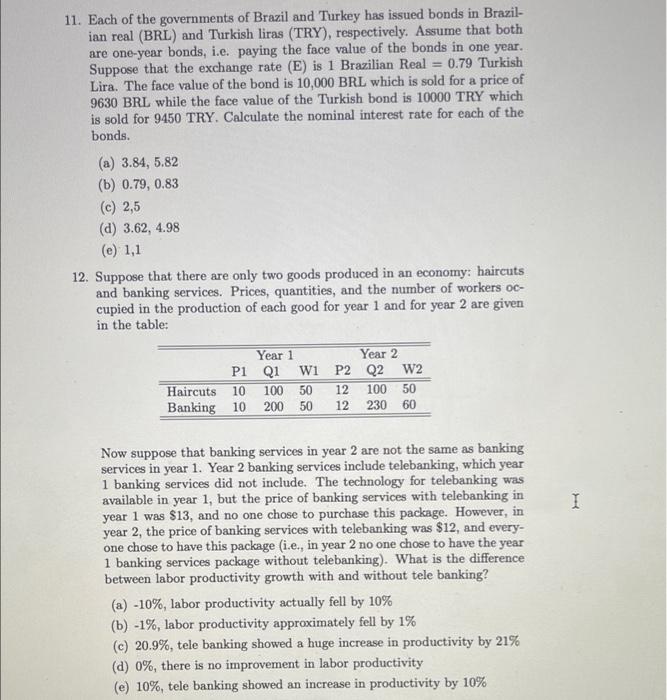

9. Suppose that a one-year bond with a face value of $1,000 and a two-year bond with a face value of $1,060 are exchanged in the market. Suppose that the two bonds have the exact same risk characteristics. Suppose further that the current interest rate is 5%, and that market participants expect the interest rate to be 6% next year. If investors want to hold the two bonds for one year only, would arbitrage work? (a) It wont cause the investors are indifferent between the two bonds (b) It would work because the bonds have different value. (c) It wont because for two years, the bond PDVs are identical (d) It wont because the investor is interested in only keeping the bonds for a year 10. Uncovered interest parity implies that interest rates must be the same across countries. (a) False, UIP implies that interest rates will always be unequal unless covered by the parity condition. (b) False, the equality of interest rates across countries implies UIP and not the other way (c) False, UIP implies that interest rates may not be equal if the FX market of the two countries are not linked (a) False, UIP implies that unequal interest rates cause activity in FX market and cause eventual equality 11. Each of the governments of Brazil and Turkey has issued bonds in Brazil- ian real (BRL) and Turkish liras (TRY), respectively. Assume that both are one-year bonds, i.e. paying the face value of the bonds in one year. Suppose that the exchange rate (E) is 1 Brazilian Real 0.79 Turkish Lira. The face value of the bond is 10,000 BRL which is sold for a price of 9630 BRL while the face value of the Turkish bond is 10000 TRY which is sold for 9450 TRY. Calculate the nominal interest rate for each of the bonds. (a) 3.84, 5.82 (b) 0.79, 0.83 (c) 2,5 (d) 3.62, 4.98 (e) 1,1 12. Suppose that there are only two goods produced in an economy: haircuts and banking services. Prices, quantities, and the number of workers oc- cupied in the production of each good for year 1 and for year 2 are given in the table: Year 1 Year 2 P1 Q1 W1 P2 Q2 W2 Haircuts 10 100 50 12 100 50 Banking 10 200 50 12 230 60 1 Now suppose that banking services in year 2 are not the same as banking services in year 1. Year 2 banking services include telebanking, which year 1 banking services did not include. The technology for telebanking was available in year 1, but the price of banking services with telebanking in year 1 was $13, and no one chose to purchase this package. However, in year 2, the price of banking services with telebanking was $12, and every- one chose to have this package (i.e., in year 2 no one chose to have the year 1 banking services package without telebanking). What is the difference between labor productivity growth with and without tele banking? (a) -10%, labor productivity actually fell by 10% (b) -1%, labor productivity approximately fell by 1% (C) 20.9%, tele banking showed a huge increase in productivity by 21% (d) 0%, there is no improvement in labor productivity (e) 10%, tele banking showed an increase in productivity by 10%