Answered step by step

Verified Expert Solution

Question

1 Approved Answer

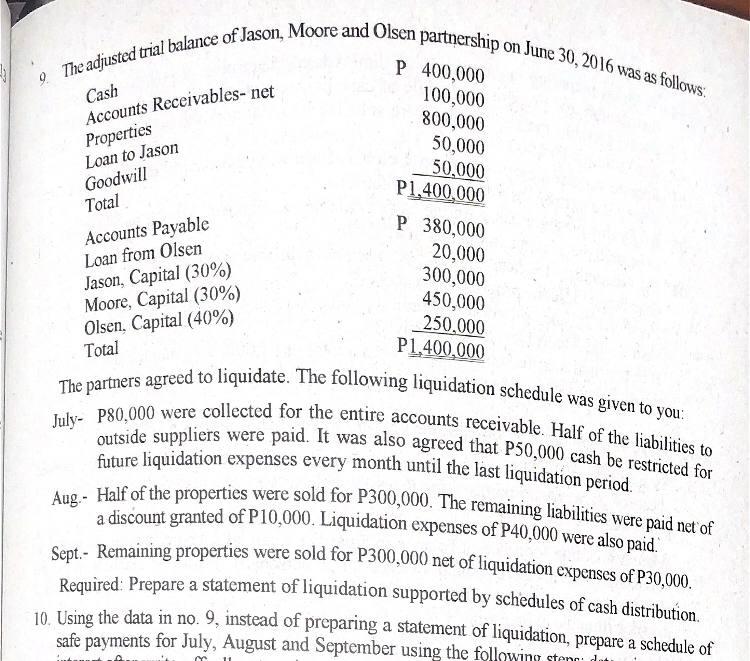

9 The adjusted trial balance of Jason, Moore and Olsen partnership on June 30, 2016 was as follows: outside suppliers were paid. It was

9 The adjusted trial balance of Jason, Moore and Olsen partnership on June 30, 2016 was as follows: outside suppliers were paid. It was also agreed that P50,000 cash be restricted for The partners agreed to liquidate. The following liquidation schedule was given to you: future liquidation expenses every month until the last liquidation period. July- P80,000 were collected for the entire accounts receivable. Half of the liabilities to P 400,000 Cash Accounts Receivables- net Properties Loan to Jason Goodwill Total 50,000 50,000 P1.400,000 Accounts Payable Loan from Olsen Jason, Capital (30%) Moore, Capital (30%) Olsen, Capital (40%) Total P 380,000 20,000 300,000 450,000 250.000 P1,400,000 Half of the properties were sold for P300,000. The remaining liabilities were paid net'of a discount granted of P10,000. Liquidation expenses of P40,000 were also paid. Sept. - Remaining properties were sold for P300,000 net of liquidation expenses of P30,000. Required: Prepare a statement of liquidation supported by schedules of cash distribution. 10. Using the data in no. 9, instead of preparing a statement of liquidation, prepare a schedule of safe payments for July, August and September using the following steno: dut

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answers Statement of Liquidation with schedules of cash distribution Particulars Cash Non Cash Asset...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started