Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9 The Commonwealth of Virginia filed suit in October 2016, against Northern Timber Corporation seeking civil penalties and injunctive relief for violations of environmental laws

9

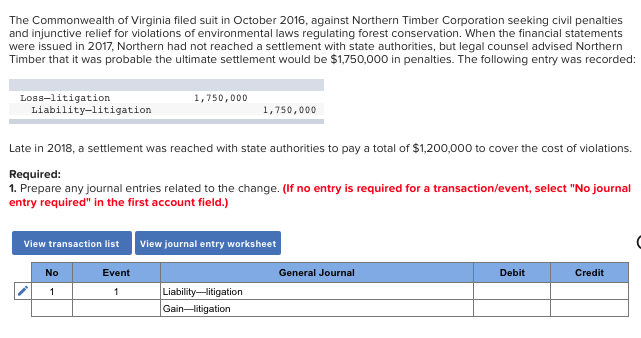

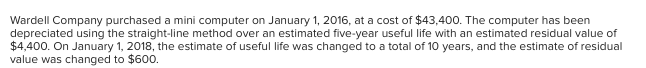

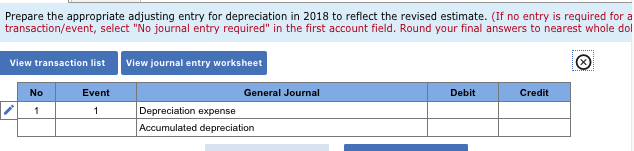

The Commonwealth of Virginia filed suit in October 2016, against Northern Timber Corporation seeking civil penalties and injunctive relief for violations of environmental laws regulating forest conservation. When the financial statements were issued in 2017, Northern had not reached a settlement with state authorities, but legal counsel advised Northern Timber that it was probable the ultimate settlement would be $1,750,000 in penalties. The following entry was recorded: Loss-litigation Liability-litigation 1,750,000 1,750,000 Late in 2018, a settlement was reached with state authorities to pay a total of $1,200,000 to cover the cost of violations. Required: 1. Prepare any journal entries related to the change. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Event General Journal Debit Credit Liability-litigation Gain-litigation 1 Wardell Company purchased a mini computer on January 1, 2016, at a cost of $43,400. The computer has been depreciated using the straight-line method over an estimated five-year useful life with an estimated residual value of $4,400. On January 1, 2018, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $600. Prepare the appropriate adjusting entry for depreciation in 2018 to reflect the revised estimate. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to nearest whole dol View transaction list View journal entry worksheet General Journal No Event Debit Credit 1 Depreciation expense 1 Accumulated depreciation Prepare the appropriate adjusting entry for depreciation in 2018 to reflect the revised estimate. Assuming that the company sum-of-the-years-digits method instead of the straight-line method. (If no entry is required for a transaction/event, select" journal entry required" in the first account field. Do not round intermediate calculations and round your final answers to nea whole dollar.) Shov r.. View transaction list View journal entry worksheet No Event General Journal Debit Credit Depreciation expense Accumulated depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started