Answered step by step

Verified Expert Solution

Question

1 Approved Answer

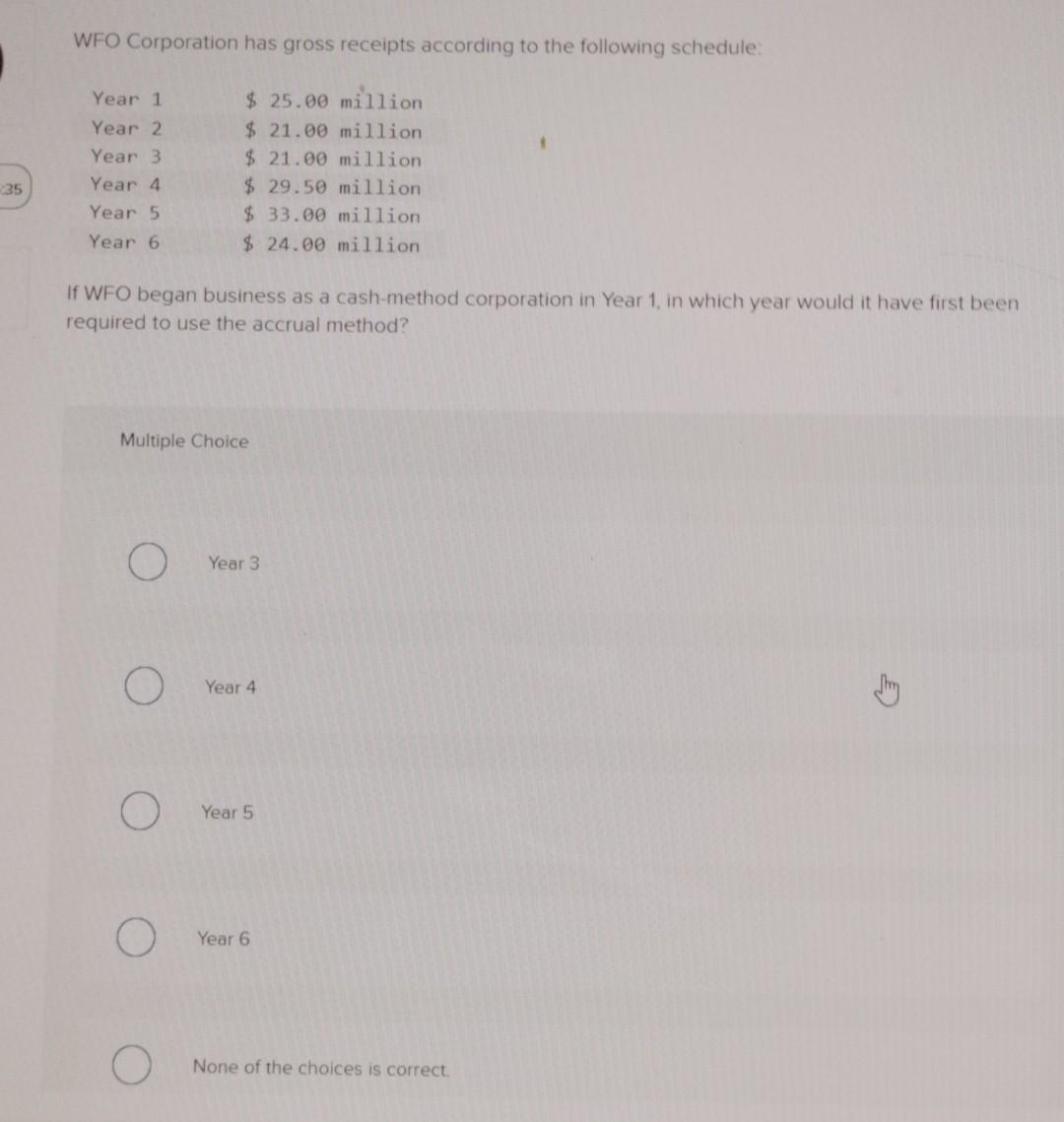

9 WFO Corporation has gross receipts according to the following schedule: If WFO began business as a cash-method corporation in Year 1 , in which

9

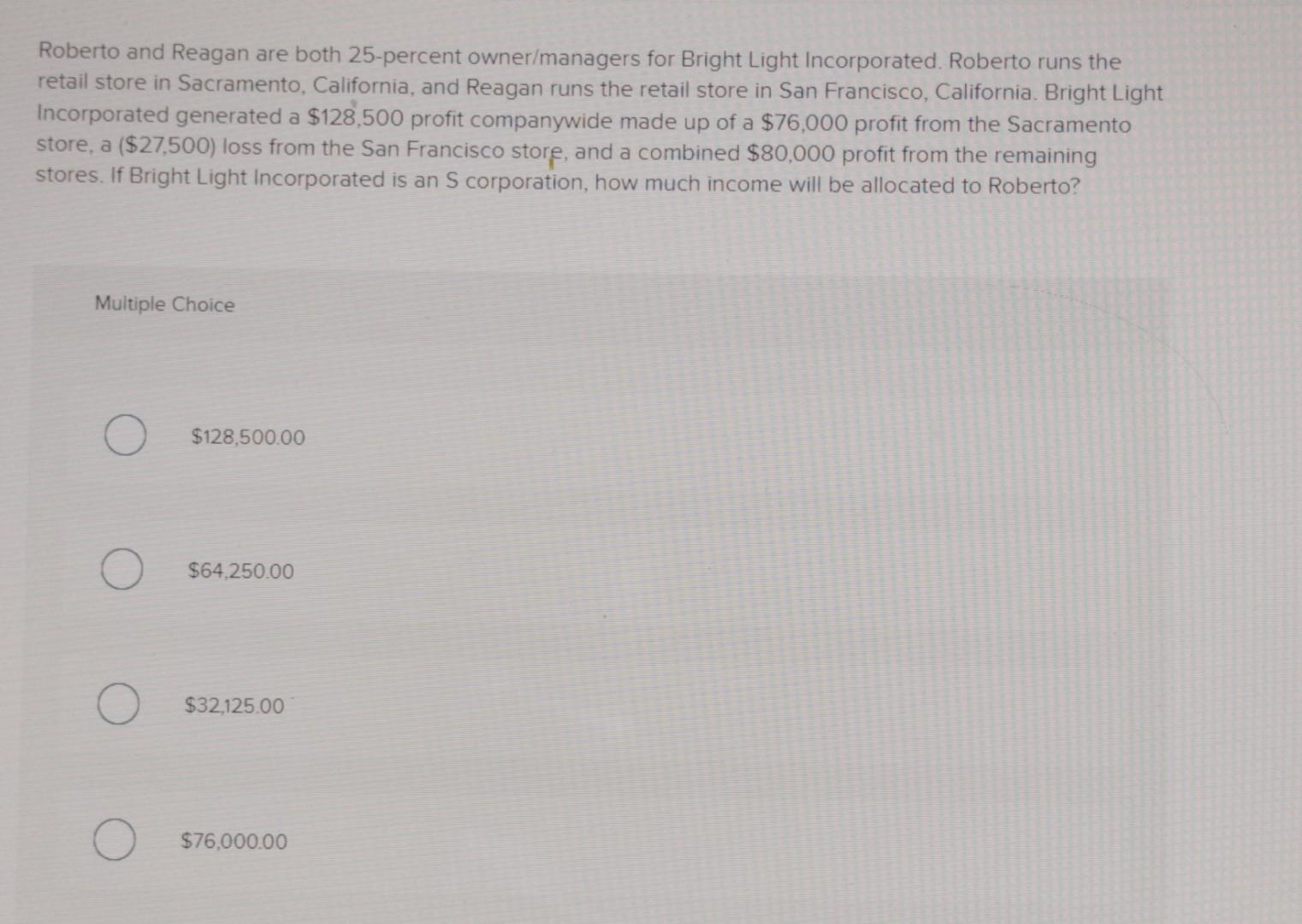

WFO Corporation has gross receipts according to the following schedule: If WFO began business as a cash-method corporation in Year 1 , in which year would it have first been required to use the accrual method? Multiple Choice Year 3 Year 4 Year 5 Year 6 None of the choices is correct. Roberto and Reagan are both 25-percent owner/managers for Bright Light Incorporated. Roberto runs the retail store in Sacramento, California, and Reagan runs the retail store in San Francisco, California. Bright Light Incorporated generated a $128,500 profit companywide made up of a $76,000 profit from the Sacramento store, a ($27,500) loss from the San Francisco store, and a combined $80,000 profit from the remaining stores. If Bright Light Incorporated is an S corporation, how much income will be allocated to Roberto? Multiple Choice $128,500.00 $64,250.00 $32,125.00 $76,000.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started