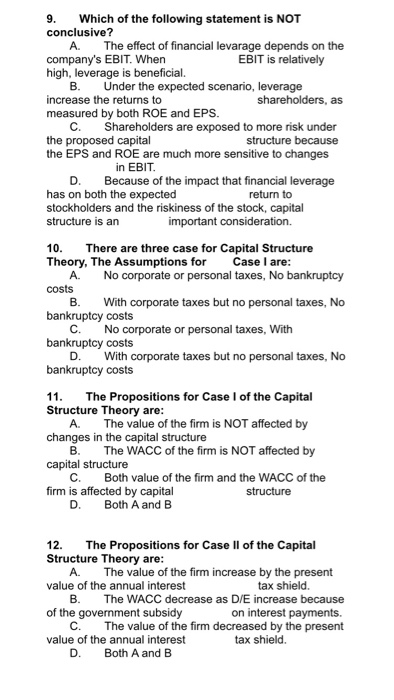

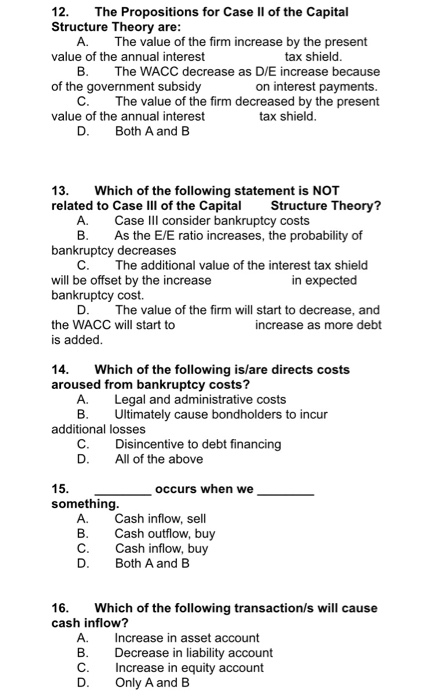

9. Which of the following statement is NOT conclusive? . The effect of financial levarage depends on the EBIT is relatively company's EBIT. When high, leverage is beneficial B. Under the expected scenario, leverage increase the returns to measured by both ROE and EPS . shareholders, as Shareholders are exposed to more risk under the proposed capital the EPS and ROE are much more sensitive to changes structure because in EBIT. D. Because of the impact that financial leverage has on both the expected return to stockholders and the riskiness of the stock, capital important consideration structure is an 10. There are three case for Capital Structure Case I are: No corporate or personal taxes, No bankruptcy Theory, The Assumptions for A. costs With corporate taxes but no personal taxes, No . bankruptcy costs No corporate or personal taxes, With C. bankruptcy costs D. With corporate taxes but no personal taxes, No bankruptcy costs 11 The Propositions for Case I of the Capital Structure Theory are . The value of the firm is NOT affected by changes in the capital structure . The WACC of the firm is NOT affected by capital structure . Both value of the firm and the WACC of the firm is affected by capital D. structure Both A and B The Propositions for Case Il of the Capital Structure Theory are: 12. The value of the firm increase by the present tax shield. A. value of the annual interest . of the government subsidy . value of the annual interest D. The WACC decrease as D/E increase because on interest payments. The value of the firm decreased by the present tax shield. Both A and B 12. The Propositions for Case Il of the Capital Structure Theory are The value of the firm increase by the present tax shield. . value of the annual interest . of the government subsidy . value of the annual interest D. The WACC decrease as D/E increase because on interest payments. The value of the firm decreased by the present tax shield. Both A and B 13. related to Case Ill of the Capital . Which of the following statement is NOT Structure Theory? Case Ill consider bankruptcy costs . As the E/E ratio increases, the probability of bankruptcy decreases . The additional value of the interest tax shield in expected will be offset by the increase bankruptcy cost. D. The value of the firm will start to decrease, and increase as more debt the WACC will start to is added. Which of the following is/are directs costs 14. aroused from bankruptcy costs? Legal and administrative costs Ultimately cause bond holders to incur A. . additional losses . Disincentive to debt financing All of the above D. 15. occurs when we something. Cash inflow, sell . Cash outflow, buy C. Cash inflow, buy D. Both A and B . 16. cash inflow? Which of the following transaction/s will cause A. Increase in asset account Decrease in liability account Increase in equity account Only A and B . C. D