Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. You are a private wealth advisor. A client (Lewis) comes to you for advice on a matter. financial The University has offered me

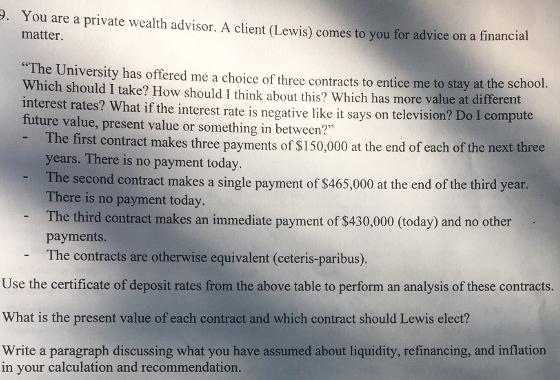

9. You are a private wealth advisor. A client (Lewis) comes to you for advice on a matter. financial "The University has offered me a choice of three contracts to entice me to stay at the school. Which should I take? How should I think about this? Which has more value at different interest rates? What if the interest rate is negative like it says on television? Do I compute future value, present value or something in between?" The first contract makes three payments of $150,000 at the end of each of the next three years. There is no payment today. The second contract makes a single payment of $465,000 at the end of the third year. There is no payment today. The third contract makes an immediate payment of $430,000 (today) and no other payments. The contracts are otherwise equivalent (ceteris-paribus). Use the certificate of deposit rates from the above table to perform an analysis of these contracts. What is the present value of each contract and which contract should Lewis elect? Write a paragraph discussing what you have assumed about liquidity, refinancing, and inflation in your calculation and recommendation.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Use the certificate of deposit rates from the above table to perform an analysis of these contracts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started