Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is given concerning a pure yield pick-up swap: You currently hold a 10 year, 7 percent coupon bond priced to yield

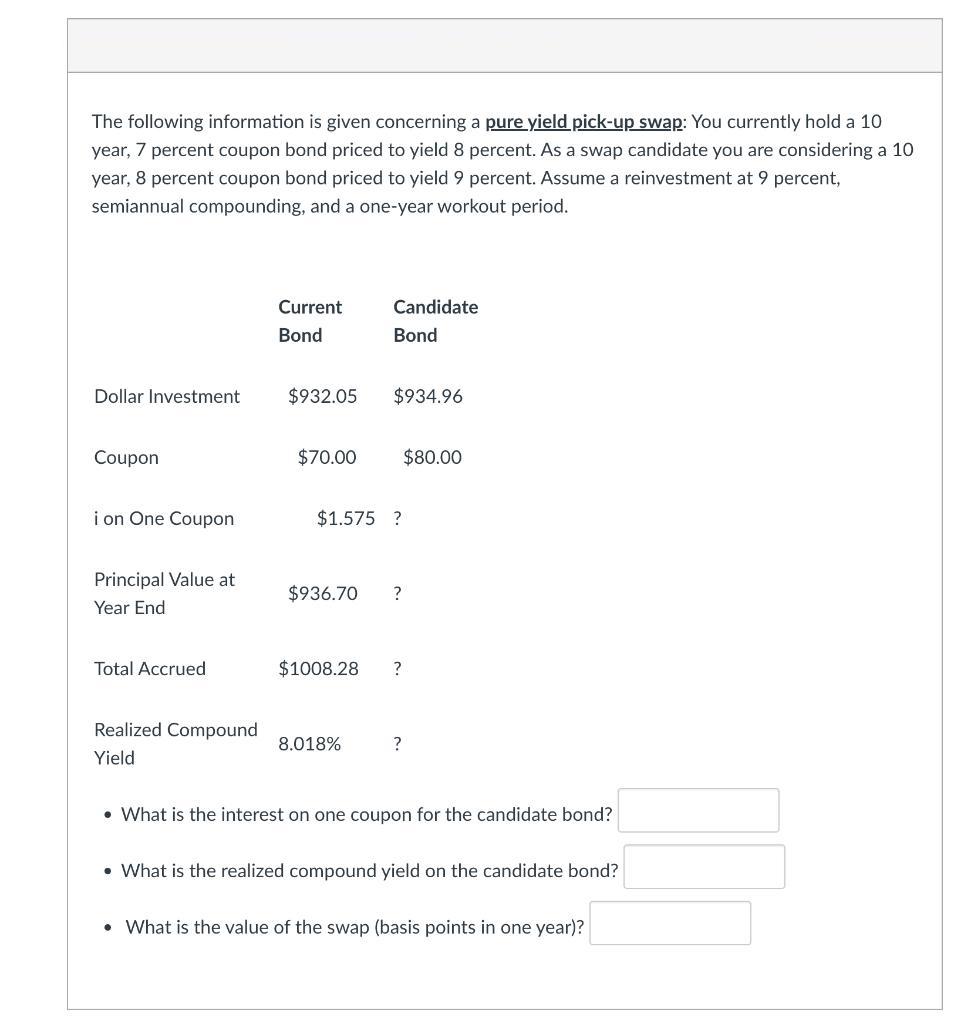

The following information is given concerning a pure yield pick-up swap: You currently hold a 10 year, 7 percent coupon bond priced to yield 8 percent. As a swap candidate you are considering a 10 year, 8 percent coupon bond priced to yield 9 percent. Assume a reinvestment at 9 percent, semiannual compounding, and a one-year workout period. Dollar Investment Coupon i on One Coupon Principal Value at Year End Total Accrued Realized Compound Yield Current Bond $932.05 $70.00 Candidate Bond $934.96 $1.575 ? $936.70 ? 8.018% $1008.28 ? ? $80.00 What is the interest on one coupon for the candidate bond? What is the realized compound yield on the candidate bond? What is the value of the swap (basis points in one year)?

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the interest earned on one coupon of the candidate bond you can use the following for...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started