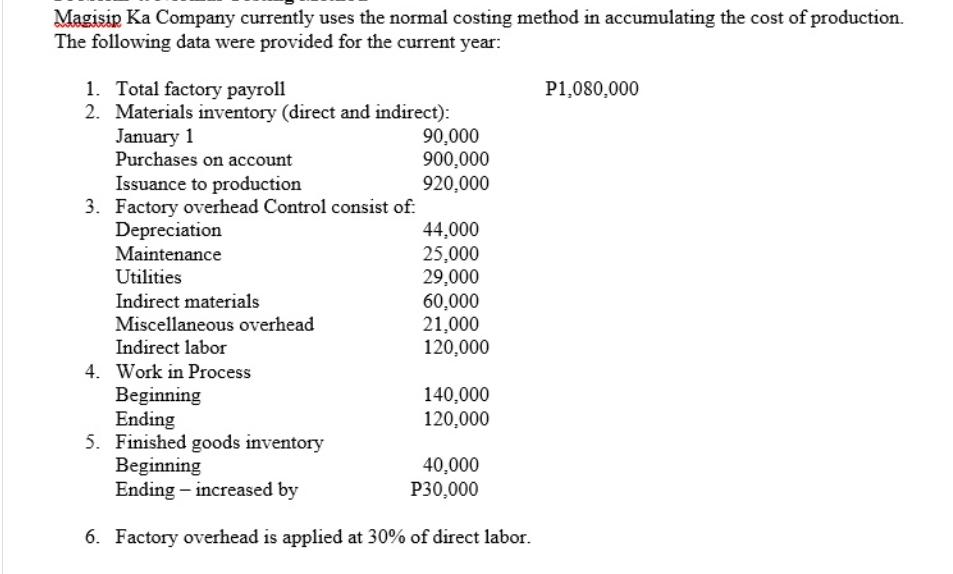

90,000 Magisip Ka Company currently uses the normal costing method in accumulating the cost of production. The following data were provided for the current

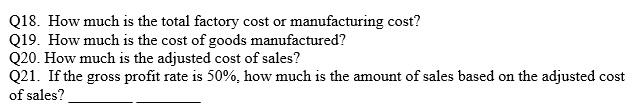

90,000 Magisip Ka Company currently uses the normal costing method in accumulating the cost of production. The following data were provided for the current year: 1. Total factory payroll 2. Materials inventory (direct and indirect): January 1 P1,080,000 Purchases on account 900,000 Issuance to production 920,000 3. Factory overhead Control consist of: Depreciation 44,000 Maintenance 25,000 Utilities 29,000 Indirect materials 60,000 Miscellaneous overhead 21,000 Indirect labor 120,000 4. Work in Process Beginning 140,000 Ending 120,000 5. Finished goods inventory Beginning Ending increased by 40,000 P30,000 6. Factory overhead is applied at 30% of direct labor. Q18. How much is the total factory cost or manufacturing cost? Q19. How much is the cost of goods manufactured? Q20. How much is the adjusted cost of sales? Q21. If the gross profit rate is 50%, how much is the amount of sales based on the adjusted cost of sales?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the answers to your questions lets go through each step and pull the necessary informat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started