9-1 please help! thanks! thumbs up!

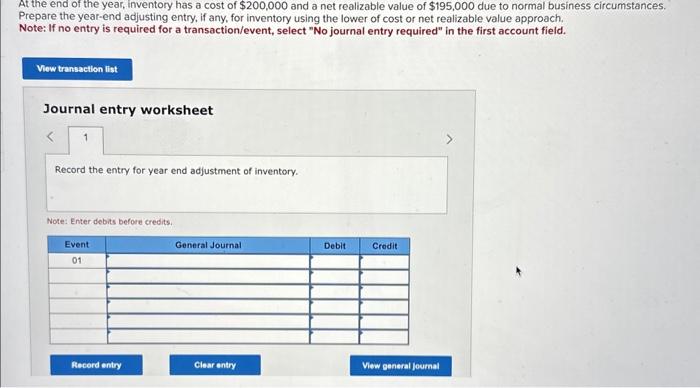

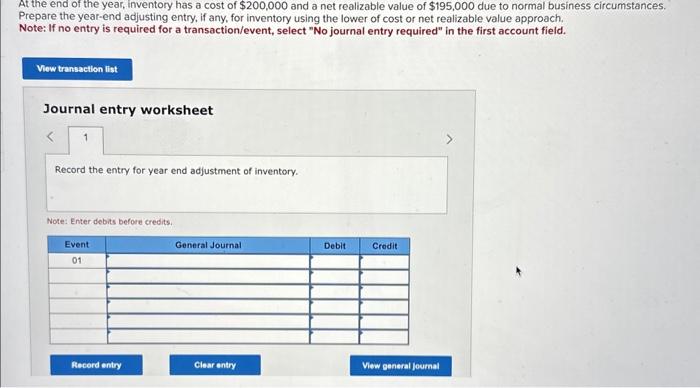

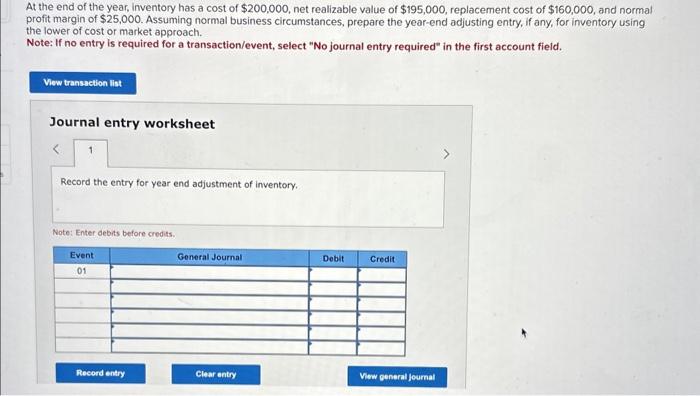

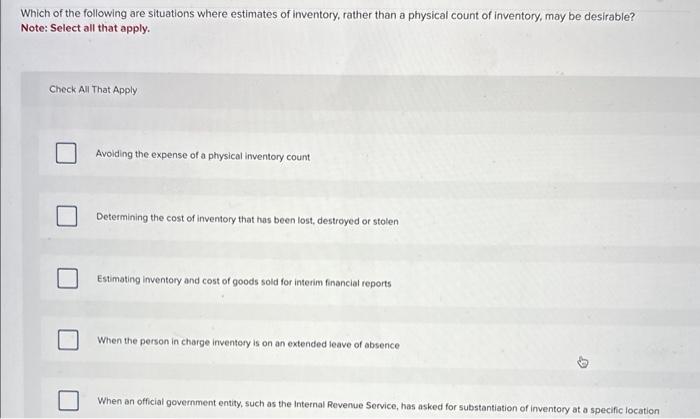

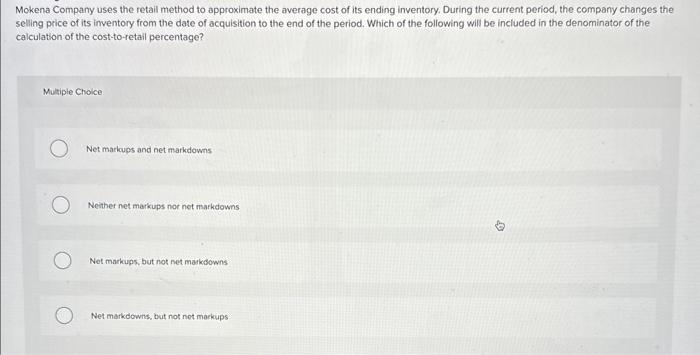

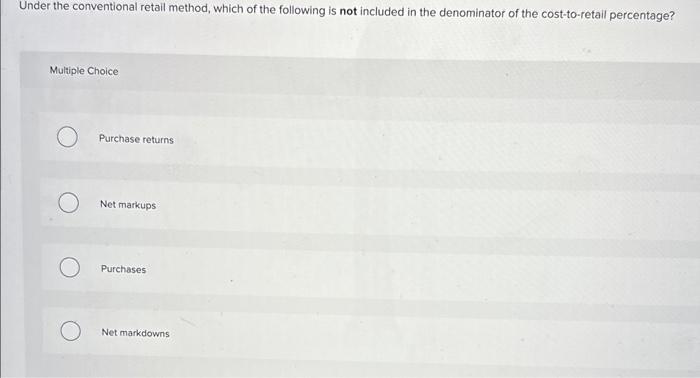

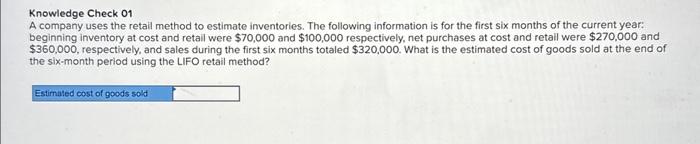

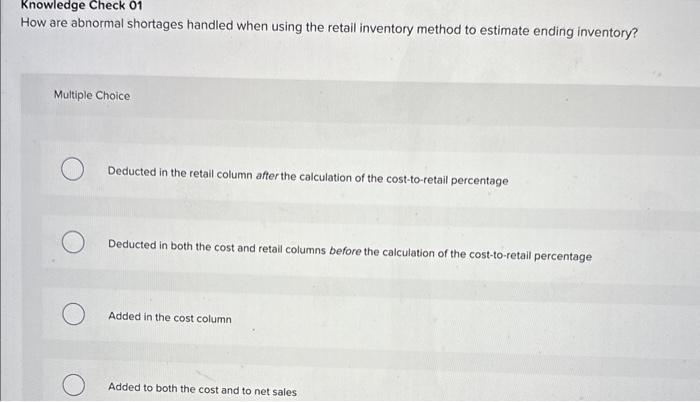

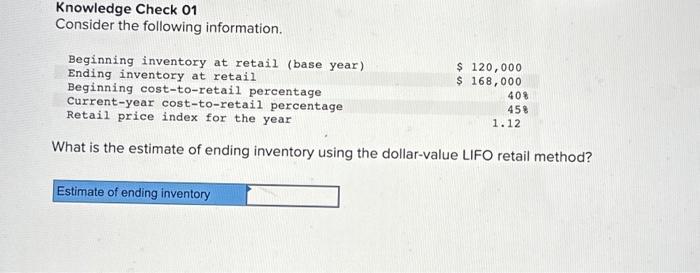

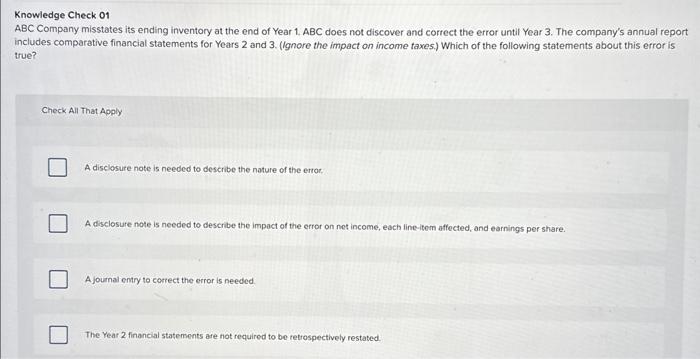

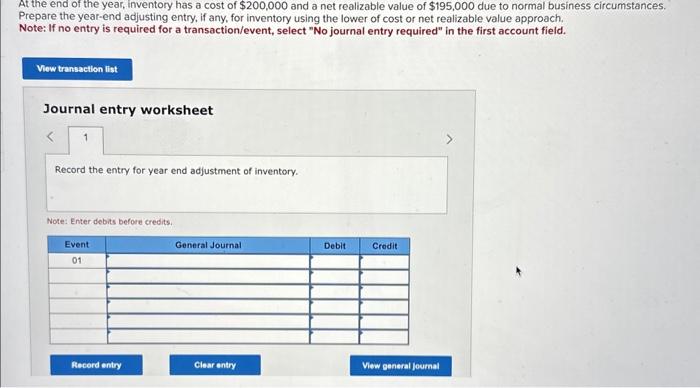

At the end of the year, inventory has a cost of $200,000 and a net realizable value of $195,000 due to normal business circumstances. Prepare the year-end adjusting entry, if any, for inventory using the lower of cost or net realizable value approach. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the entry for year end adjustment of inventory. Note: Enter debits before credits. At the end of the year, inventory has a cost of $200,000, net realizable value of $195,000, replacement cost of $160,000, and normal profit margin of $25,000. Assuming normal business circumstances, prepare the year-end adjusting entry, if any, for inventory using the lower of cost or market approach. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the entry for year end adjustment of inventory. Note: Enter debits before credits. Which of the following are situations where estimates of inventory, rather than a physical count of inventory, may be desirable? Note: Select all that apply. Check All That Apply Avoiding the expense of a physical inventory count Determining the cost of inventory that has been lost, destroyed or stolen Estimating inventory and cost of goods sold for interim financial reports When the person in charge inventery is on an extended leave of absence When an official government entity, such as the Internal Revenue Service, has asked for substantiation of inventory at a specific location Mokena Company uses the retail method to approximate the average cost of its ending inventory. During the current period, the company changes the selling price of its inventory from the date of acquisition to the end of the period. Which of the following will be included in the denominator of the calculation of the cost-toretail percentage? Mustiple Choice Net markups and net markdowns Neither net markups nor net markdowns Net markups, but not net markdowns Net markdowns, but not not markups Under the conventional retail method, which of the following is not included in the denominator of the cost-to-retail percentage? Multiple Choice Purchase returns Net markups Purchases Net markdowns Knowledge Check 01 A company uses the retail method to estimate inventories. The following information is for the first six months of the current year: beginning inventory at cost and retail were $70,000 and $100,000 respectively, net purchases at cost and retall were $270,000 and $360,000, respectively, and sales during the first six months totaled $320,000. What is the estimated cost of goods sold at the end of the six-month period using the LIFO retail method? How are abnormal shortages handled when using the retail inventory method to estimate ending inventory? Multiple Choice Deducted in the retall column after the calculation of the cost-to-retail percentage Deducted in both the cost and retail columns before the calculation of the cost-to-retail percentage Added in the cost column Added to both the cost and to net sales What is the estimate of ending inventory using the dollar-value LIFO retail method? Knowledge Check 01 ABC Company misstates its ending inventory at the end of Year 1. ABC does not discover and correct the error until Year 3. The company's annual report includes comparative financial statements for Years 2 and 3. (Ignore the impact on income taxes.) Which of the following statements about this error is true? Check All That Apply A disclosure note is needed to describe the noture of the error. A disclosure note is needed to describe the impact of the efror on net income, each line-item affected, and earnings per share. A journal entry to correct the error is needed. The Year 2 financial statements are not required to be retrespectively restated