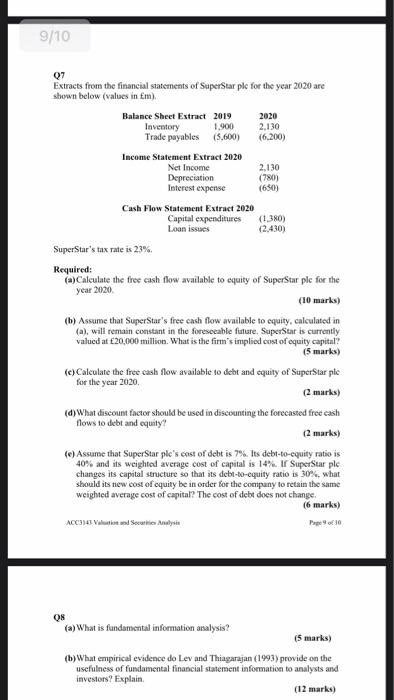

9/10 07 Extracts from the financial statements of SuperStar plc for the year 2020 are shown below (values in Em) Balance Sheet Extract 2019 2020 Inventory 1,900 2.130 Trade payables (5,600) (6.200) Income Statement Extract 2020 Net Income 2.130 Depreciation (780) Interest expense (650) Cash Flow Statement Extract 2020 Capital expenditures (1.380) Loon issues (2.430) SuperStar's tax rate is 23% Required: Calculate the free cash flow available to equity of SuperStar ple for the year 2020 (10 marks) (b) Assume that Super Star's free cash flow available to cquity, calculated in (a), will remain constant in the foreseeable future. SuperStar is currently valued at 20,000 million. What is the firm's implied cost of equity capital? (5 marks) (c) Calculate the free cash flow available to debt and equity of SuperStar ple for the year 2020 2 marks) (d) What discount factor should be used in discounting the forecasted free cash flows to debt and equity? (2 marks) (c) Assume that SuperStar ple's cost of debt is 7%. Its debt-to-equity ratio is 40% and its weighted average cost of capital is 14%. If SuperStar ple changes its capital structure so that its debt-to-equity ratio is 30%, what should its new cost of equity be in order for the company to retain the same weighted average cost of capital? The cost of debt does not change (6 marks) ACC3143 od Sir Analysis 08 (a) What is fundamental information analysis? (5 marks) (b) What empirical evidence do Lev and Thiagarajan (1993) provide on the usefulness of fundamental financial statement information to analysts and investors? Explain (12 marks) 9/10 07 Extracts from the financial statements of SuperStar plc for the year 2020 are shown below (values in Em) Balance Sheet Extract 2019 2020 Inventory 1,900 2.130 Trade payables (5,600) (6.200) Income Statement Extract 2020 Net Income 2.130 Depreciation (780) Interest expense (650) Cash Flow Statement Extract 2020 Capital expenditures (1.380) Loon issues (2.430) SuperStar's tax rate is 23% Required: Calculate the free cash flow available to equity of SuperStar ple for the year 2020 (10 marks) (b) Assume that Super Star's free cash flow available to cquity, calculated in (a), will remain constant in the foreseeable future. SuperStar is currently valued at 20,000 million. What is the firm's implied cost of equity capital? (5 marks) (c) Calculate the free cash flow available to debt and equity of SuperStar ple for the year 2020 2 marks) (d) What discount factor should be used in discounting the forecasted free cash flows to debt and equity? (2 marks) (c) Assume that SuperStar ple's cost of debt is 7%. Its debt-to-equity ratio is 40% and its weighted average cost of capital is 14%. If SuperStar ple changes its capital structure so that its debt-to-equity ratio is 30%, what should its new cost of equity be in order for the company to retain the same weighted average cost of capital? The cost of debt does not change (6 marks) ACC3143 od Sir Analysis 08 (a) What is fundamental information analysis? (5 marks) (b) What empirical evidence do Lev and Thiagarajan (1993) provide on the usefulness of fundamental financial statement information to analysts and investors? Explain (12 marks)