Answered step by step

Verified Expert Solution

Question

1 Approved Answer

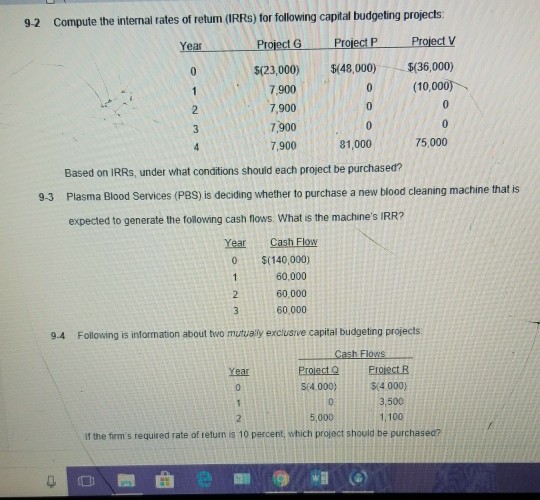

92 Compute the internal rates of retum (IRRS) for following capital budgeting projects: Project G Project PProject V Year (23,000)$(48,000)$(36,000) (10,000) 7,900 7,900 7,900 7,900

92 Compute the internal rates of retum (IRRS) for following capital budgeting projects: Project G Project PProject V Year (23,000)$(48,000)$(36,000) (10,000) 7,900 7,900 7,900 7,900 0 81,000 75,000 Based on IRRs, under what conditions should each project be purchased? Plasma Blood Services (PBS) is deciding whether to purchase a new blood cleaning machine that is expected to generate the following cash flows. What is the machine's IRR? 9.3 Year Cash Flow 0 (140,000) 160,000 60,000 60,000 2 94 Follovwing is information about two mutuaily excusve capitai budgeting projects Cash Flows ProjectR $(4 000) 3,500 1,100 Project Q 5 4.000) Year 5,000 if the trm's required rate of return is 10 percent, which project should be purchasec? 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started