Answered step by step

Verified Expert Solution

Question

1 Approved Answer

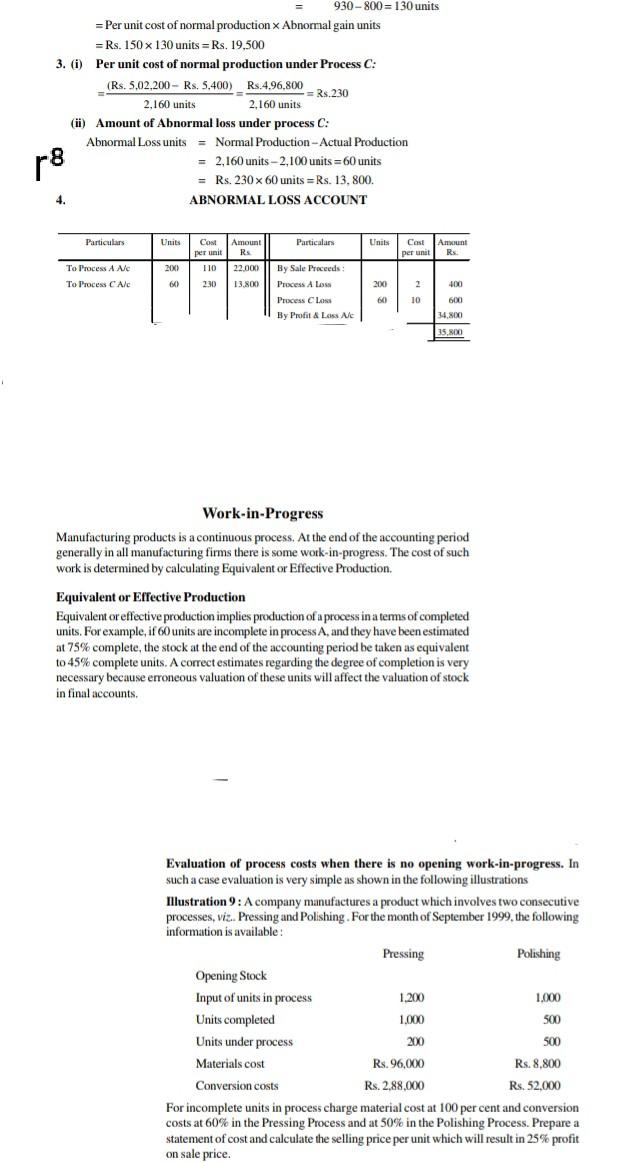

930-800= 130 units = Per unit cost of normal production x Abnormal gain units = Rs. 150 x 130 units =Rs. 19,500 3. (i) Per

930-800= 130 units = Per unit cost of normal production x Abnormal gain units = Rs. 150 x 130 units =Rs. 19,500 3. (i) Per unit cost of normal production under Process C: (Rs. 5,02.200 - Rs. 5.400)_Rs.4.96,800 = Rs. 230 2,160 units 2.160 units (ii) Amount of Abnormal loss under process C: Abnormal Loss units = Normal Production - Actual Production = 2,160 units -2,100 units = 60 units = Rs. 230 x 60 units =Rs. 13.800 ABNORMAL LOSS ACCOUNT r8 4. Particulars Units Particalans Units Cost per unit 110 Amount RS Cos! per unit Amount Rs 2000 To Process A AC To Process C Alc 22.000 13.800 6) 2:30 200 2 400 By Sale Proceeds Process A Los Process Class By Profit & Las AX 60 10 600 34,00 35,800 Work-in-Progress Manufacturing products is a continuous process. At the end of the accounting period generally in all manufacturing firms there is some work-in-progress. The cost of such work is determined by calculating Equivalent or Effective Production. Equivalent or Effective Production Equivalent or effective production implies production of a process in a terms of completed units. For example, if 60 units are incomplete in process A, and they have been estimated at 75% complete, the stock at the end of the accounting period be taken as equivalent to 45% complete units. A correct estimates regarding the degree of completion is very necessary because erroneous valuation of these units will affect the valuation of stock in final accounts. 1.000 Evaluation of process costs when there is no opening work-in-progress. In such a case evaluation is very simple as shown in the following illustrations Illustration 9: A company manufactures a product which involves two consecutive processes, viz. Pressing and Polishing. For the month of September 1999, the following information is available: Pressing Polishing Opening Stock Input of units in process 1.200 Units completed 1.000 Units under process 200 500 Materials cost Rs 96.000 Rs. 8,800 Conversion costs Rs. 2.88,000 Rs. 52,000 For incomplete units in process charge material cost at 100 per cent and conversion costs at 60% in the Pressing Process and at 50% in the Polishing Process. Prepare a statement of cost and calculate the selling price per unit which will result in 25% profit on sale price. 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started