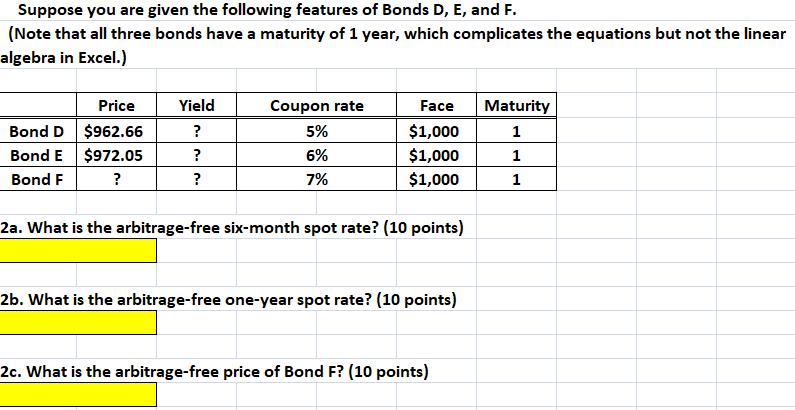

Suppose you are given the following features of Bonds D, E, and F. (Note that all three bonds have a maturity of 1 year,

Suppose you are given the following features of Bonds D, E, and F. (Note that all three bonds have a maturity of 1 year, which complicates the equations but not the linear algebra in Excel.) Bond D Bond E Bond F Price $962.66 $972.05 ? Yield ? ? ? Coupon rate 5% 6% 7% Face $1,000 $1,000 $1,000 2a. What is the arbitrage-free six-month spot rate? (10 points) 2b. What is the arbitrage-free one-year spot rate? (10 points) 2c. What is the arbitrage-free price of Bond F? (10 points) Maturity 1 1 1

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

2a 45 2b 9 2c 98165 2a2b Arbitrage free spot rate is ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started