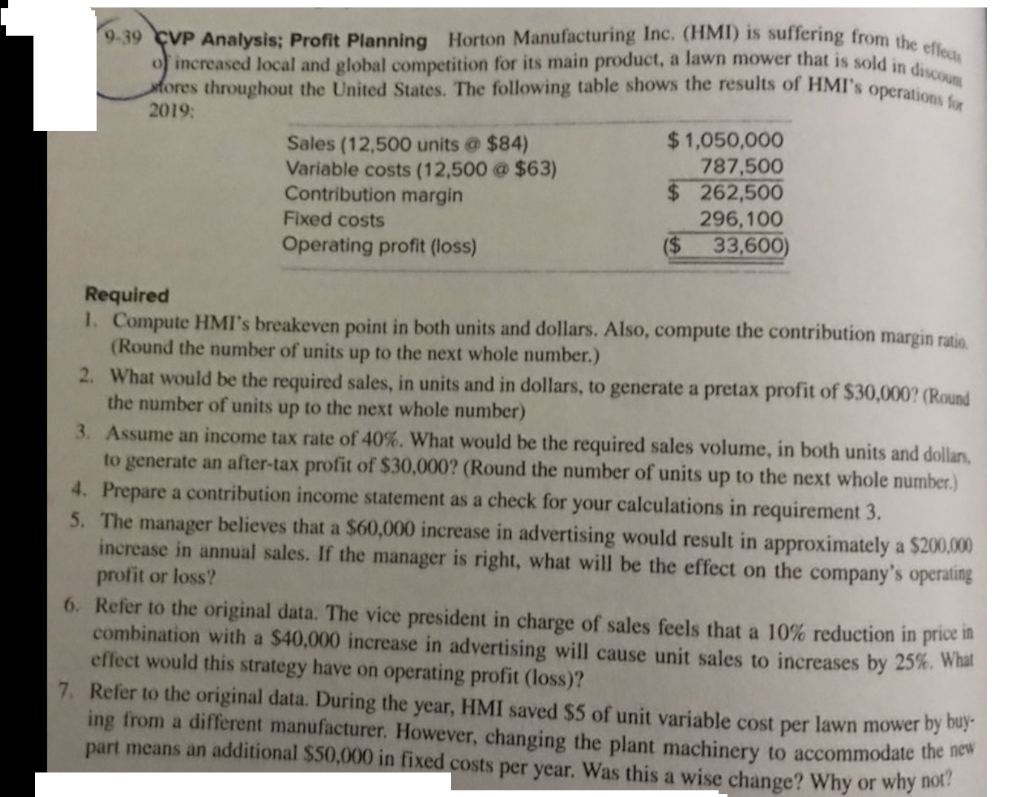

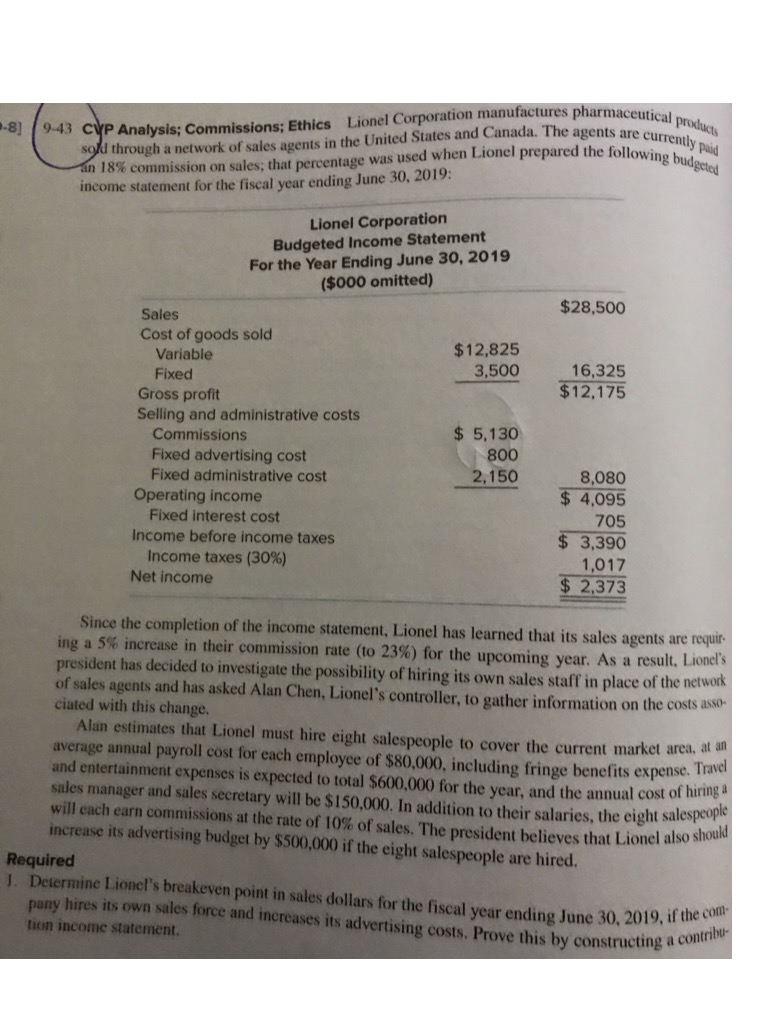

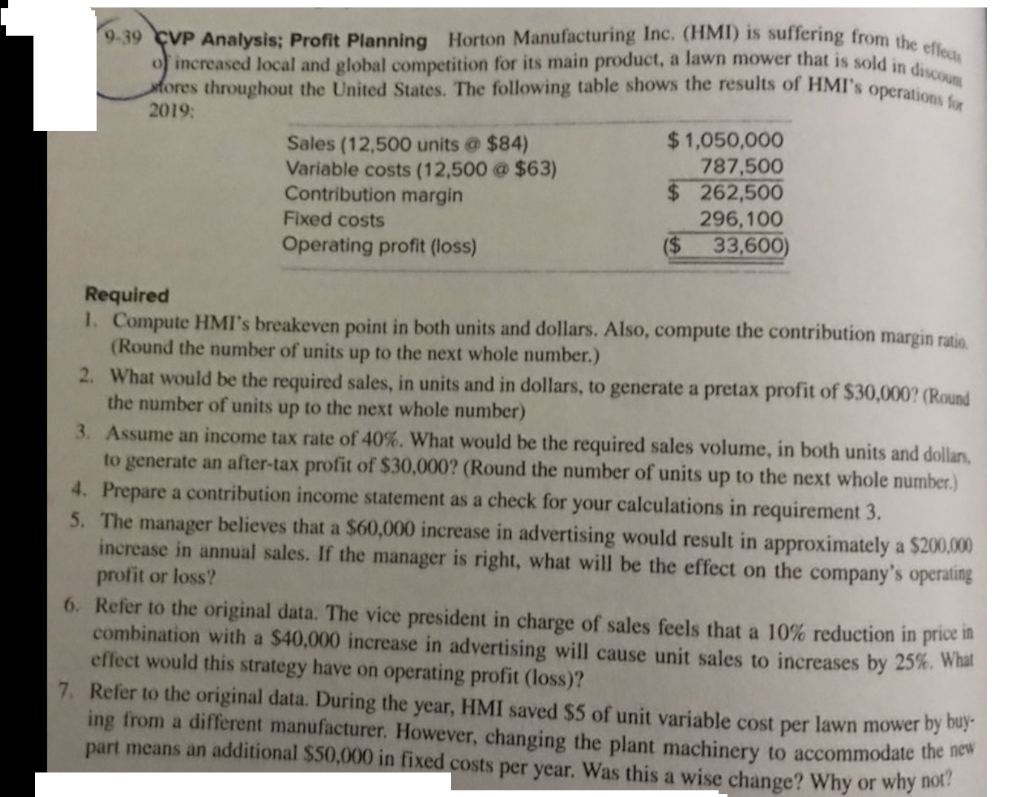

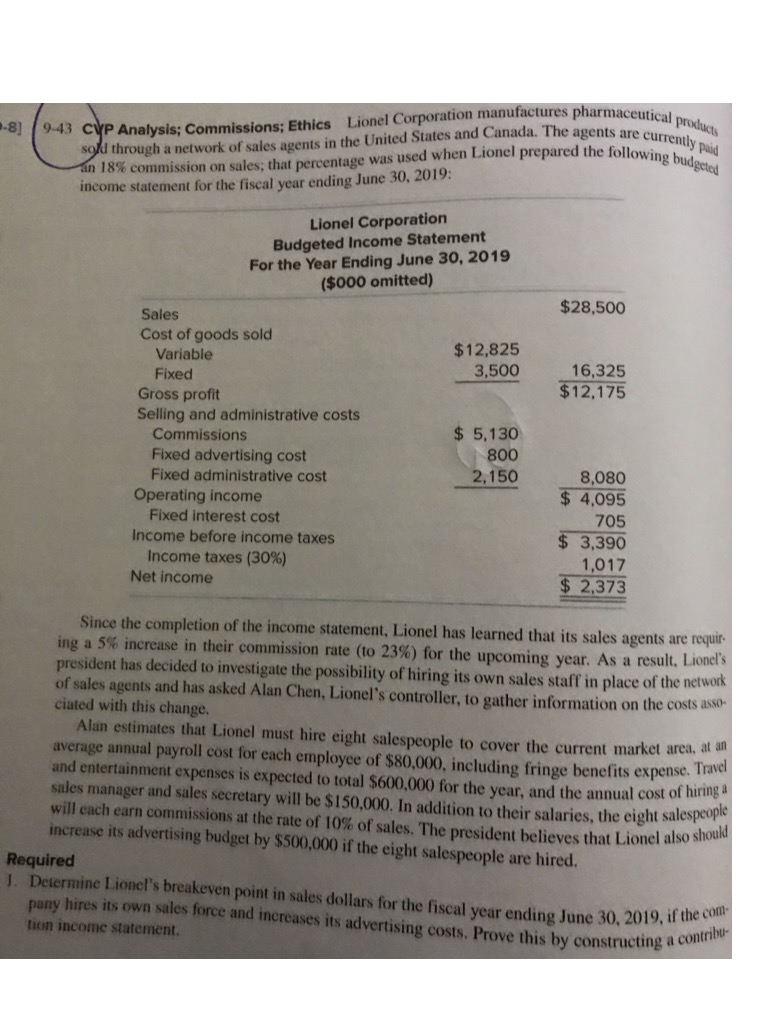

9-39 CVP Analysis; Profit Planning Horton Manufacturing Inc. (HMI) is suffering from the effects o increased local and global competition for its main product, a lawn mower that is sold in discount oros throughout the United States. The following table shows the results of HMI's operations 2019; Sales (12,500 units @ $84) $ 1,050,000 Variable costs (12,500 a $63) 787,500 Contribution margin $ 262,500 Fixed costs 296,100 Operating profit (loss) ($ 33,600 Required 1. Compute HMI's breakeven point in both units and dollars. Also, compute the contribution margin ratio. (Round the number of units up to the next whole number.) 2. What would be the required sales, in units and in dollars, to generate a pretax profit of $30,000? (Round the number of units up to the next whole number) 3. Assume an income tax rate of 40%. What would be the required sales volume, in both units and dollar to generate an after-tax profit of $30,000? (Round the number of units up to the next whole number.) 4. Prepare a contribution income statement as a check for your calculations in requirement 3. 5. The manager believes that a $60,000 increase in advertising would result in approximately a $200,000 increase in annual sales. If the manager is right, what will be the effect on the company's operating profit or loss? 6. Refer to the original data. The vice president in charge of sales feels that a 10% reduction in price in combination with a $40,000 increase in advertising will cause unit sales to increases by 25%. What effect would this strategy have on operating profit (loss)? 7. Refer to the original data. During the year, HMI saved $5 of unit variable cost per lawn mower by buy ing from a different manufacturer. However, changing the plant machinery to accommodate the new part means an additional $50,000 in fixed costs per year. Was this a wise change? Why or why not? pany hires its own sales force and increases its advertising costs. Prove this by constructing a contribu -8] 9-43 CVP Analysis; Commissions; Ethics Lionel Corporation manufactures pharmaceutical products sold through a network of sales agents in the United States and Canada. The agents are currently paid an 18% commission on sales, that percentage was used when Lionel prepared the following budgeted income statement for the fiscal year ending June 30, 2019: Lionel Corporation Budgeted Income Statement For the Year Ending June 30, 2019 ($000 omitted) $28,500 $12,825 3,500 16,325 $12,175 Sales Cost of goods sold Variable Fixed Gross profit Selling and administrative costs Commissions Fixed advertising cost Fixed administrative cost Operating income Fixed interest cost Income before income taxes Income taxes (30%) Net income $ 5,130 800 2,150 8,080 $ 4,095 705 $ 3,390 1,017 $ 2,373 Since the completion of the income statement, Lionel has learned that its sales agents are requir- ing a 5% increase in their commission rate (to 23%) for the upcoming year. As a result, Lionel's president has decided to investigate the possibility of hiring its own sales staff in place of the network of sales agents and has asked Alan Chen, Lionel's controller, to gather information on the costs asso- ciated with this change. Alan estimates that Lionel must hire eight salespeople to cover the current market area, at an average annual payroll cost for each employee of $80,000, including fringe benefits expense. Travel and entertainment expenses is expected to total $600,000 for the year, and the annual cost of hiring a sales manager and sales secretary will be $150,000. In addition to their salaries, the eight salespeople will each earn commissions at the rate of 10% of sales. The president believes that Lionel also should increase its advertising budget by $500,000 if the eight salespeople are hired. Required 1. Determine Lionel's breakeven point in sales dollars for the fiscal year ending June 30, 2019, if the conte tion income statement. 2. If Lionel continues to sell through its network of sales agents and pays the higher commission rate, determine the estimated volume in sales dollars that would be required to generate the operating profit as projected in the budgeted income statement. 3. Describe the general assumptions underlying breakeven analysis that may limit its usefulness. 4. What is the indifference point in sales for the firm to either accept the agents' demand or adopt the pr posed change? Which plan is better for the firm? Why? 5. What are the ethical issues, if any, that Alan should consider? (CMA Adapted)