Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9:49 X Bank Reconciliation Assignment 1 PDF 150 KB Assignment #1 - Bank Reconciliation This assignment has 33 total marks. This assignment is worth

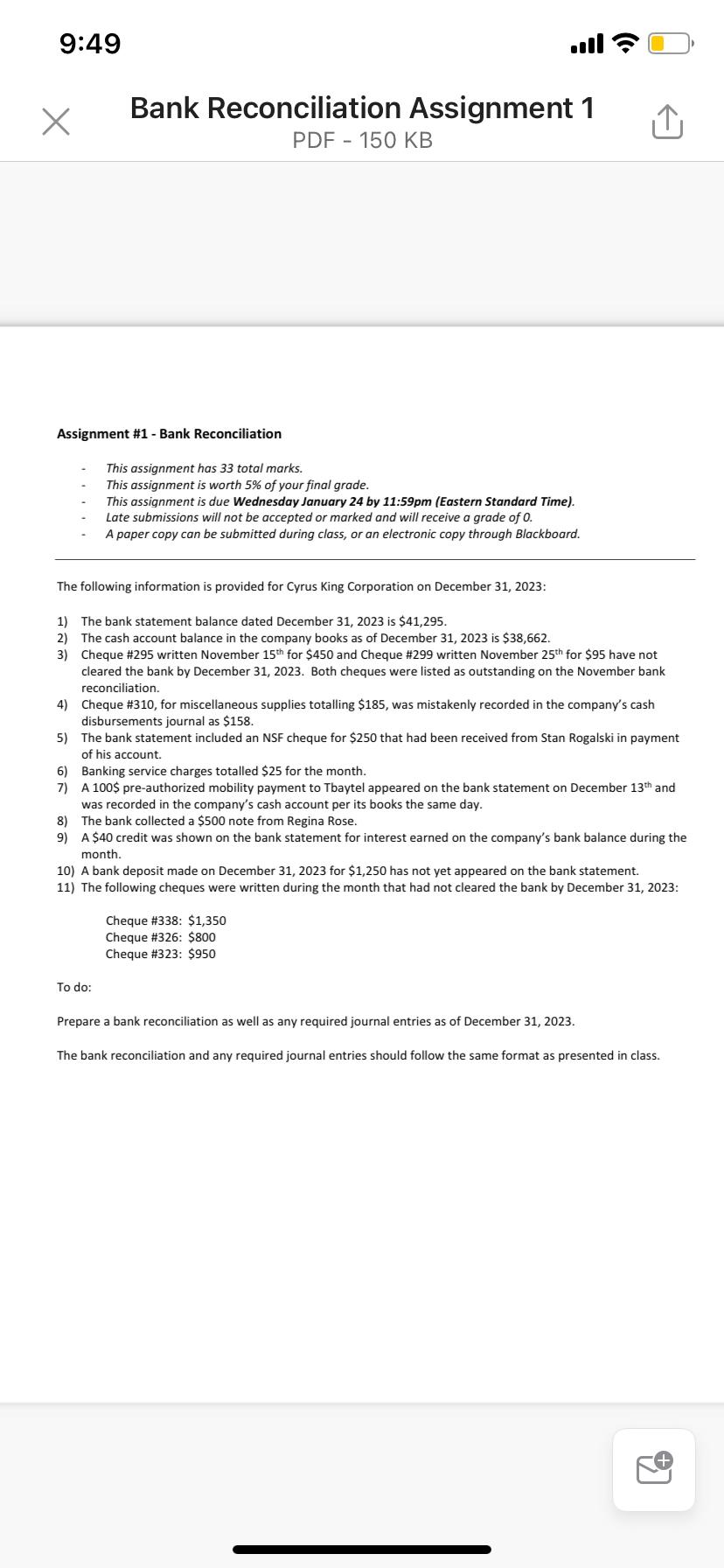

9:49 X Bank Reconciliation Assignment 1 PDF 150 KB Assignment #1 - Bank Reconciliation This assignment has 33 total marks. This assignment is worth 5% of your final grade. This assignment is due Wednesday January 24 by 11:59pm (Eastern Standard Time). Late submissions will not be accepted or marked and will receive a grade of 0. A paper copy can be submitted during class, or an electronic copy through Blackboard. The following information is provided for Cyrus King Corporation on December 31, 2023: 1) The bank statement balance dated December 31, 2023 is $41,295. 2) The cash account balance in the company books as of December 31, 2023 is $38,662. 3) Cheque # 295 written November 15th for $450 and Cheque # 299 written November 25th for $95 have not cleared the bank by December 31, 2023. Both cheques were listed as outstanding on the November bank reconciliation. 4) Cheque # 310, for miscellaneous supplies totalling $185, was mistakenly recorded in the company's cash disbursements journal as $158. 5) The bank statement included an NSF cheque for $250 that had been received from Stan Rogalski in payment of his account. 6) Banking service charges totalled $25 for the month. 7) A 100$ pre-authorized mobility payment to Tbaytel appeared on the bank statement on December 13th and was recorded in the company's cash account per its books the same day. 8) The bank collected a $500 note from Regina Rose. 9) A $40 credit was shown on the bank statement for interest earned on the company's bank balance during the month. To do: 10) A bank deposit made on December 31, 2023 for $1,250 has not yet appeared on the bank statement. 11) The following cheques were written during the month that had not cleared the bank by December 31, 2023: Cheque # 338: $1,350 Cheque #326: $800 Cheque #323: $950 Prepare a bank reconciliation as well as any required journal entries as of December 31, 2023. The bank reconciliation and any required journal entries should follow the same format as presented in class. 97

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To perform a bank reconciliation for Cyrus King Corporation as of December 31 2023 we need to reconcile the differences between the banks records and the companys book records to arrive at the true ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started