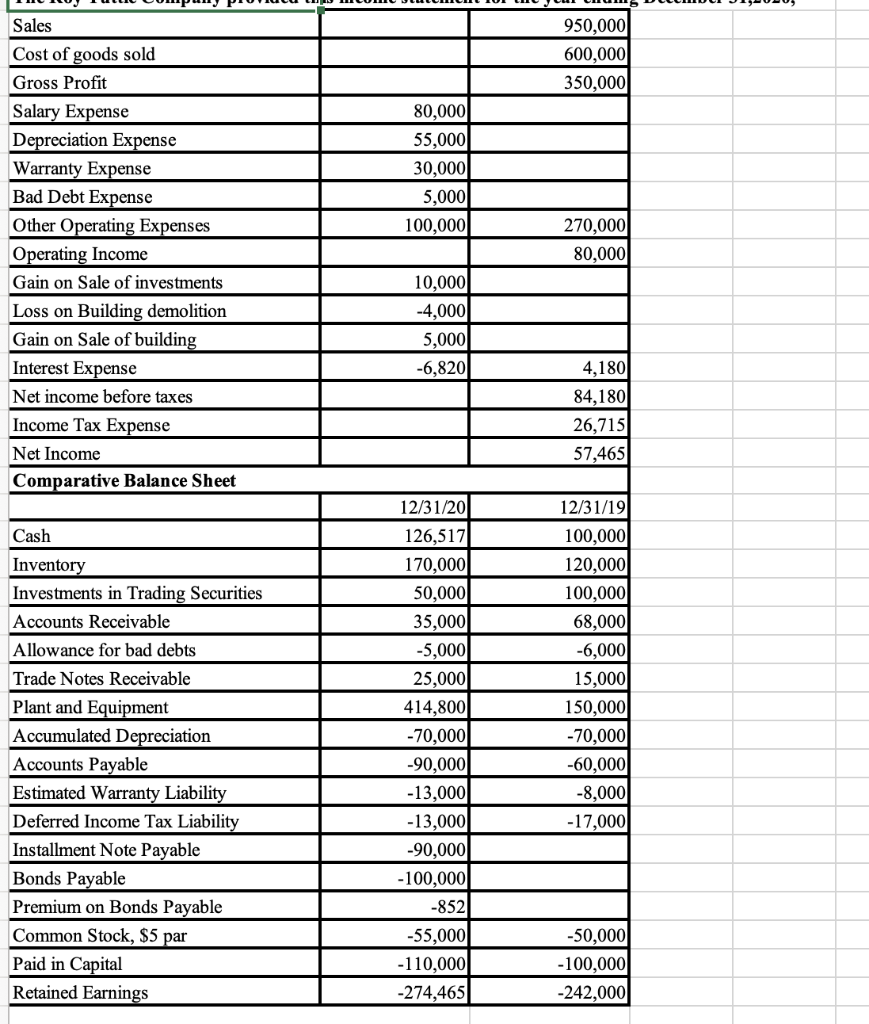

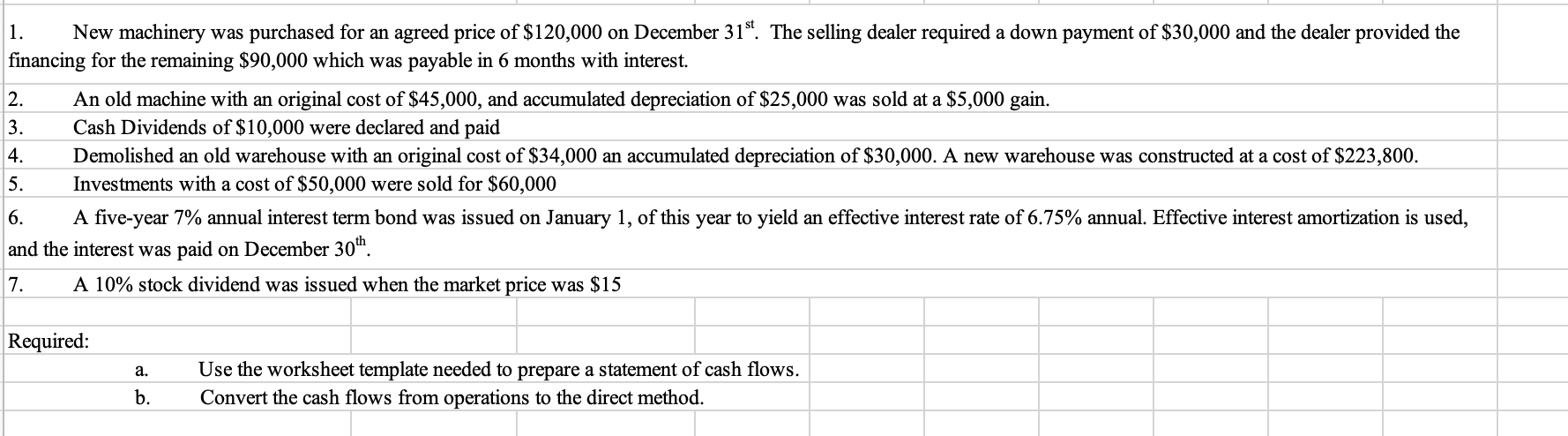

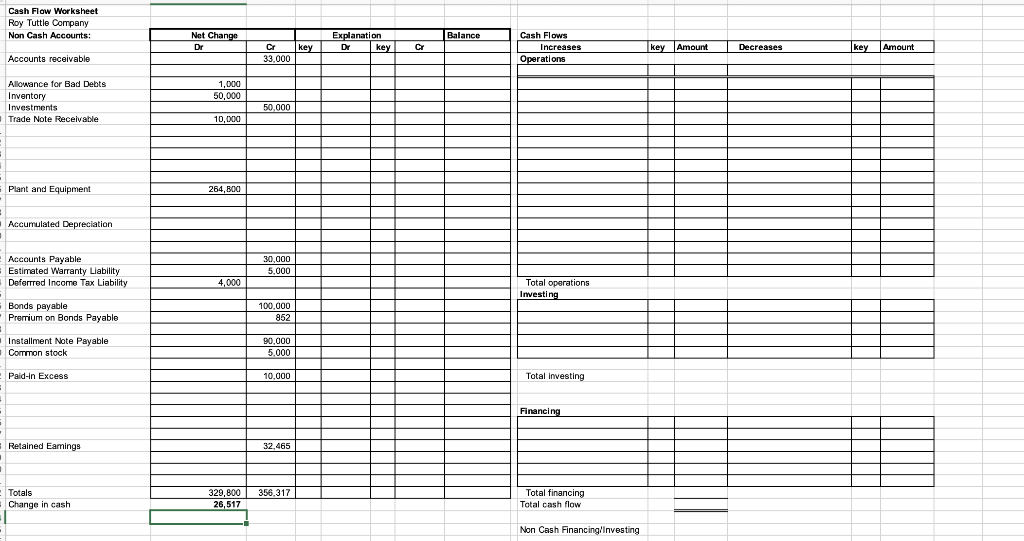

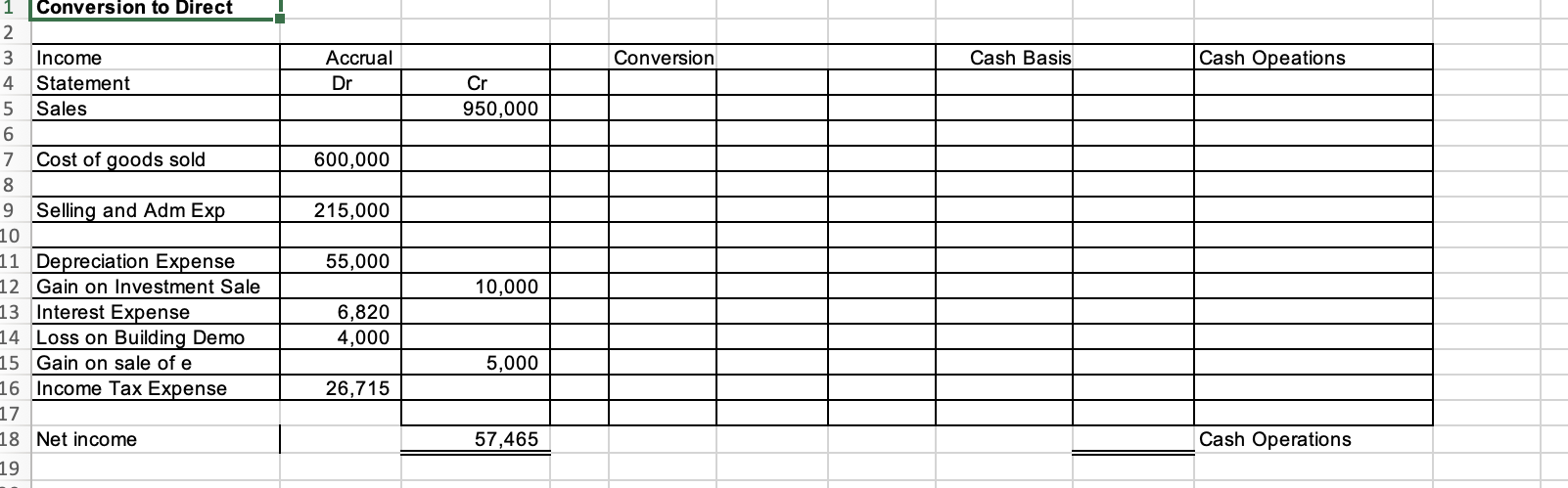

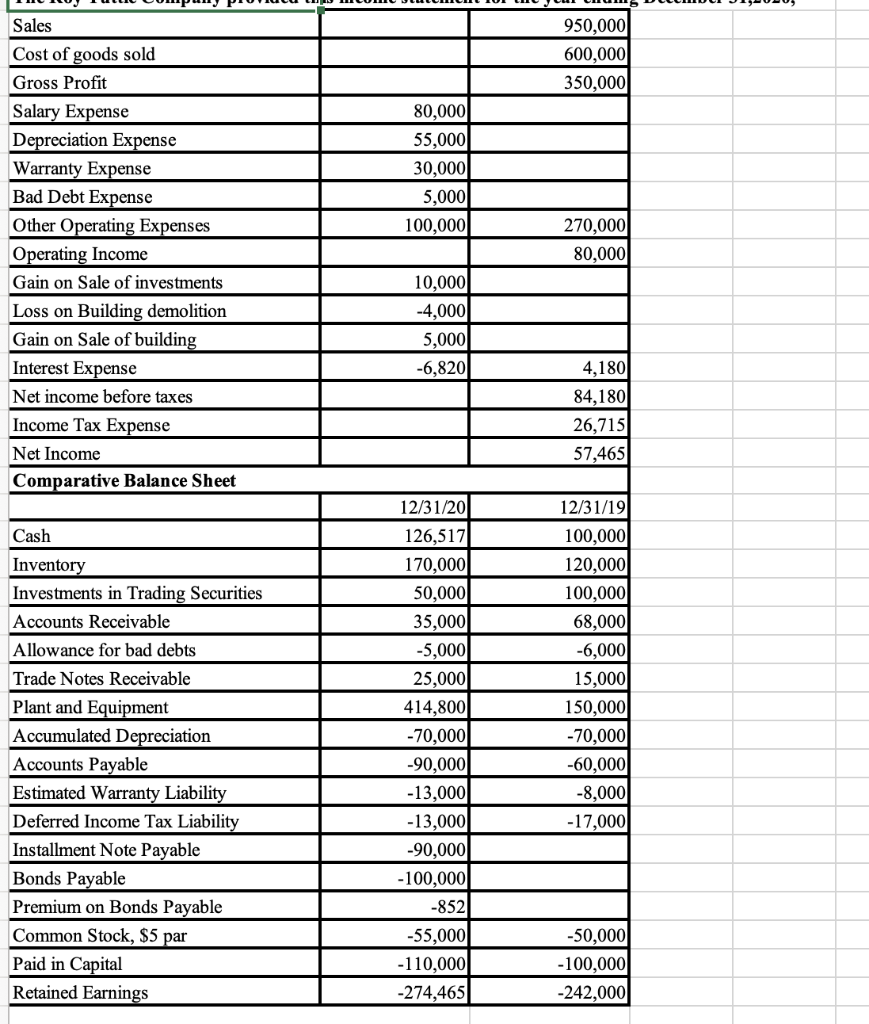

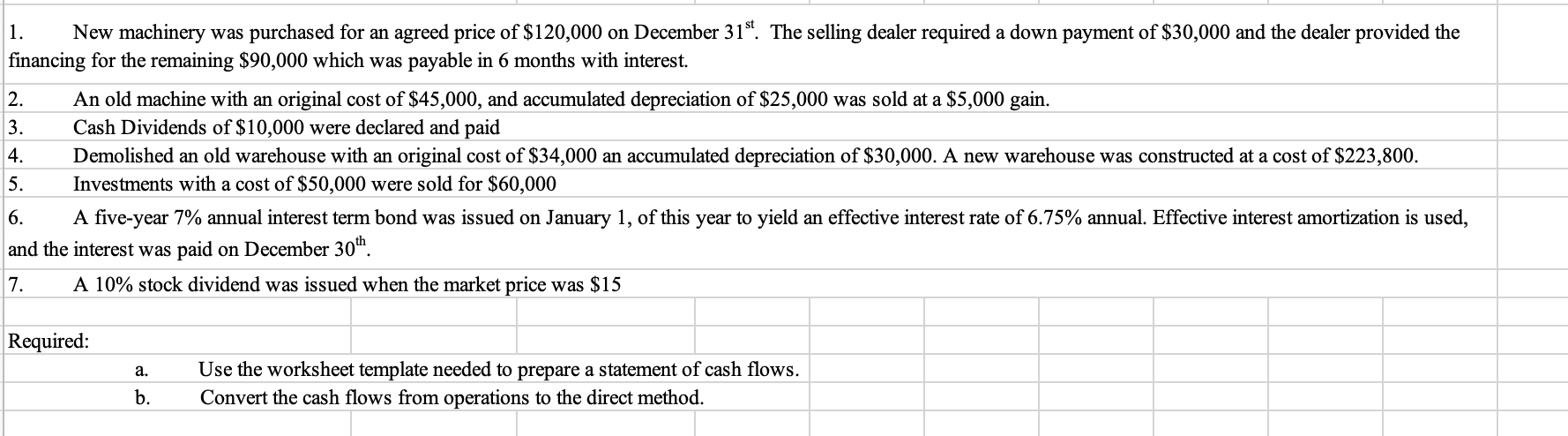

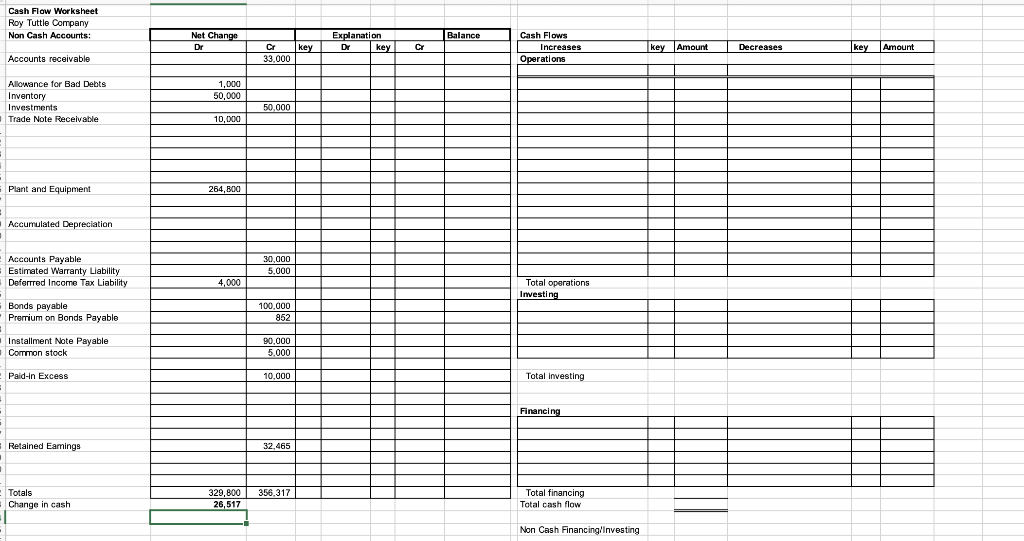

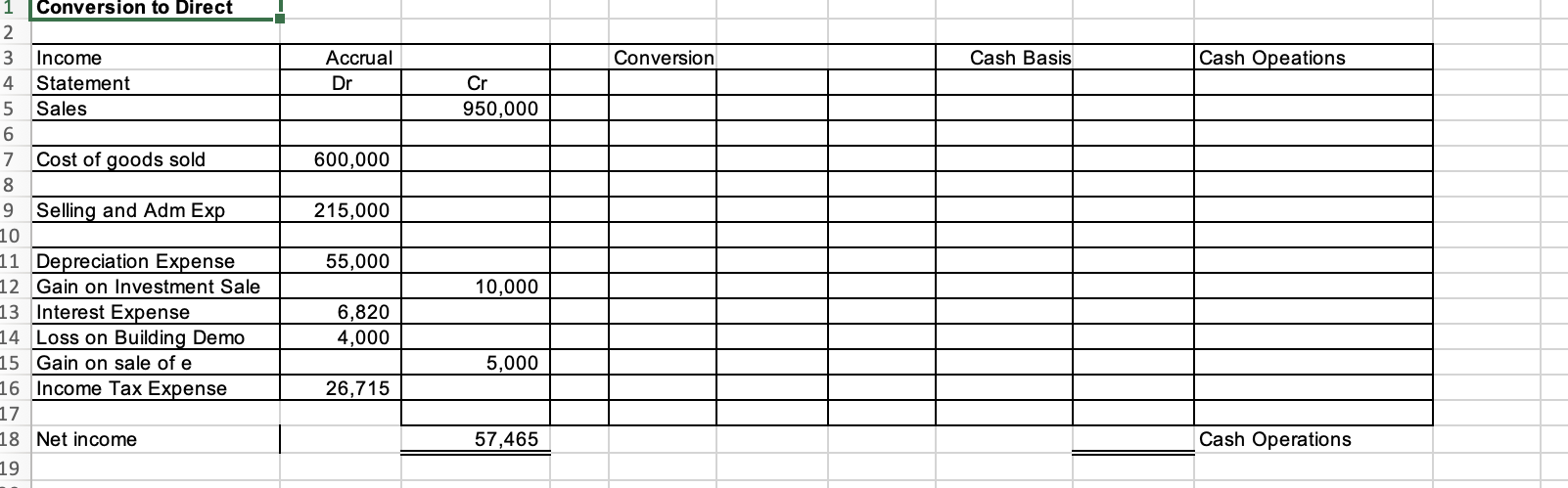

950,000 600,000 350,000 80,000 55,000 30,000 5,000 100,000 Sales Cost of goods sold Gross Profit Salary Expense Depreciation Expense Warranty Expense Bad Debt Expense Other Operating Expenses Operating Income Gain on Sale of investments Loss on Building demolition Gain on Sale of building Interest Expense Net income before taxes Income Tax Expense Net Income Comparative Balance Sheet 270,000 80,000 10,000 -4,000 5,000 -6,820 4,180 84,180 26,715 57,465 Cash Inventory Investments in Trading Securities Accounts Receivable Allowance for bad debts Trade Notes Receivable Plant and Equipment Accumulated Depreciation Accounts Payable Estimated Warranty Liability Deferred Income Tax Liability Installment Note Payable Bonds Payable Premium on Bonds Payable Common Stock, $5 par Paid in Capital Retained Earnings 12/31/20 126,517 170,000 50,000 35,000 -5,000 25,000 414,800 -70,000 -90,000 -13,000 -13,000 -90,000 -100,000 -852 -55,000 -110,000 -274,465 12/31/19 100,000 120,000 100,000 68,000 -6,000 15,000 150,000 -70,000 -60,000 -8,000 -17,000 -50,000 -100,000 -242,000 1. New machinery was purchased for an agreed price of $120,000 on December 315. The selling dealer required a down payment of $30,000 and the dealer provided the financing for the remaining $90,000 which was payable in 6 months with interest. 2. An old machine with an original cost of $45,000, and accumulated depreciation of $25,000 was sold at a $5,000 gain. 3. Cash Dividends of $10,000 were declared and paid 4. Demolished an old warehouse with an original cost of $34,000 an accumulated depreciation of $30,000. A new warehouse was constructed at a cost of $223,800. 5. Investments with a cost of $50,000 were sold for $60,000 6. A five-year 7% annual interest term bond was issued on January 1, of this year to yield an effective interest rate of 6.75% annual. Effective interest amortization is used, and the interest was paid on December 30th. 7. A 10% stock dividend was issued when the market price was $15 Required: a. Use the worksheet template needed to prepare a statement of cash flows. Convert the cash flows from operations to the direct method. b. Cash Flow Worksheet Roy Tuttle Company Non Cash Accounts: Net Change Dr Balance Explanation Dr key CY Cash Flows Increases Operations key Amount Cr key 33.000 Decreases key Amount Accounts receivable 1,000 50,000 Allowance for Bad Debts Inventory Investments Trade Note Receivable 50,000 10,000 Plant and Equipment 264,800 Accumulated Depreciation Accounts Payable Estimated Warranty Liability Deferred Income Tax Liability 30,000 5.000 4,000 Total operations Investing Bonds payable Premium on Bonds Payable 100,000 852 Installment Note Payable Common stock 90.000 5.000 Paid-in Excess 10,000 Total Investing Financing Retained Eamings 32,465 356,317 Totals Change in cash 329,800 26,517 Total financing Total cash flow Non Cash Financing/Investing Conversion Cash Basis Cash Opeations Accrual Dr Cr 950,000 600,000 215,000 Conversion to Direct 2 3 Income 4 Statement 5 Sales 6 7 Cost of goods sold 8 9 Selling and Adm Exp 10 11 Depreciation Expense 12 Gain on Investment Sale 13 Interest Expense 14 Loss on Building Demo 15 Gain on sale of e 16 Income Tax Expense 17 18 Net income 19 55,000 10,000 6,820 4,000 5,000 26,715 57,465 Cash Operations