Answered step by step

Verified Expert Solution

Question

1 Approved Answer

96 Done Crunch Chip Company Income Sta... Crunch Chip Company Income Statement Your name: Click or tap here to enter text. Directions: Using the information

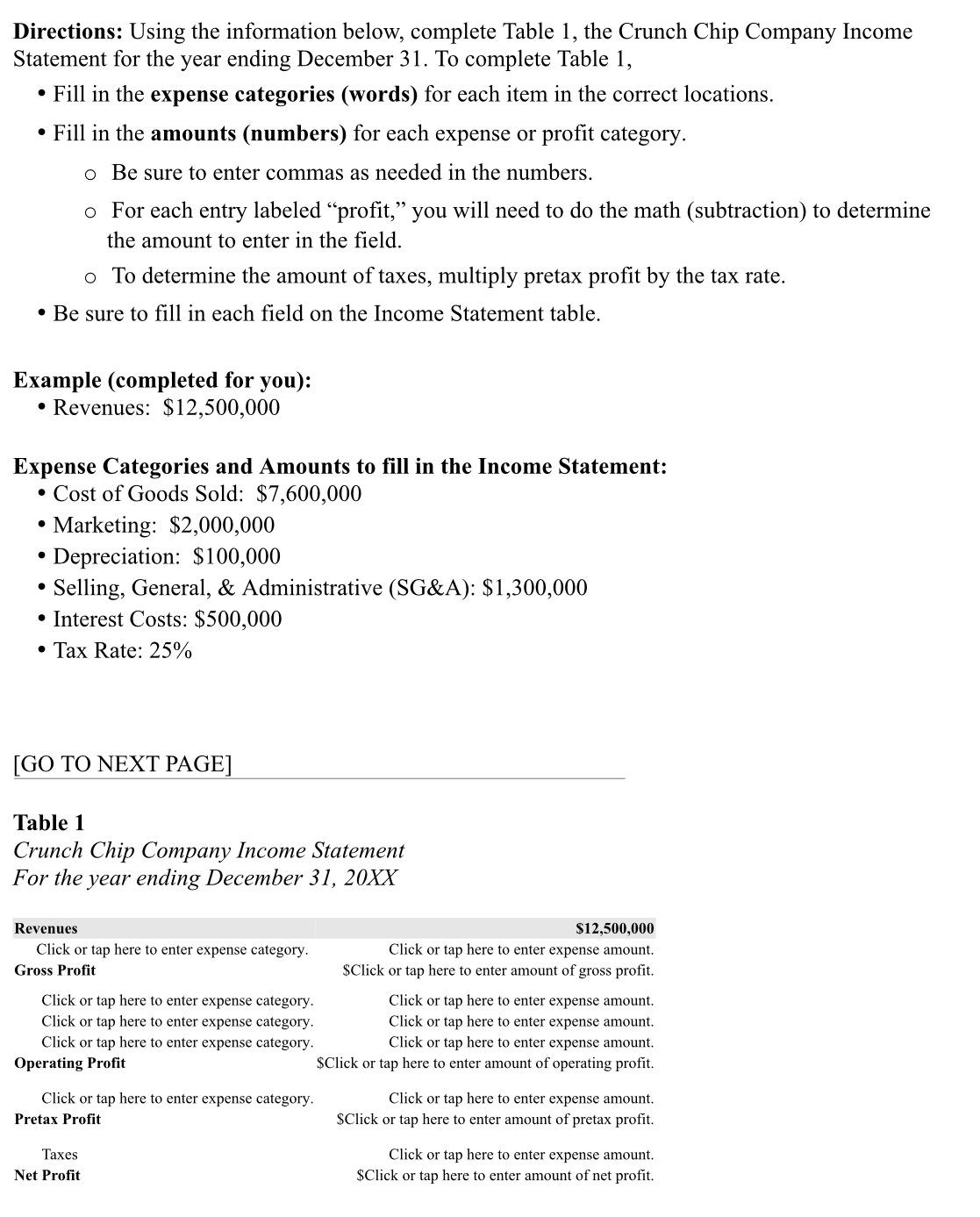

96 Done Crunch Chip Company Income Sta... Crunch Chip Company Income Statement Your name: Click or tap here to enter text. Directions: Using the information below, complete Table 1, the Crunch Chip Company Income Statement for the year ending December 31. To complete Table 1, . Fill in the expense categories (words) for each item in the correct locations. . Fill in the amounts (numbers) for each expense or profit category. o Be sure to enter commas as needed in the numbers. o For each entry labeled "profit," you will need to do the math (subtraction) to determine the amount to enter in the field. o To determine the amount of taxes, multiply pretax profit by the tax rate. . Be sure to fill in each field on the Income Statement table. Example (completed for you): . Revenues: $12,500,000 Expense Categories and Amounts to fill in the Income Statement: . Cost of Goods Sold: $7,600,000 . Marketing: $2,000,000 . Depreciation: $100,000 . Selling, General, & Administrative (SG&A): $1,300,000 . Interest Costs: $500,000 . Tax Rate: 25% [GO TO NEXT PAGE] Table 1 Crunch Chip Company Income Statement For the year ending December 31, 20XX Revenues $12,500,000 Click or tap here to enter expense category. Click or tap here to enter expense amount. Gross Profit $Click or tap here to enter amount of gross profit. Click or tap here to enter expense category. Click or tap here to enter expense amount. Click or tap here to enter expense category. Click or tap here to enter expense amount. Click or tap here to enter expense category. Click or tap here to enter expense amount. Operating Profit $Click or tap here to enter amount of operating profit. Click or tap here to enter expense category Click or tap here to enter expense amount. Pretax Profit $Click or tap here to enter amount of pretax profit. Taxes Click or tap here to enter expense amount. Net Profit $Click or tap here to enter amount of net profit

96 Done Crunch Chip Company Income Sta... Crunch Chip Company Income Statement Your name: Click or tap here to enter text. Directions: Using the information below, complete Table 1, the Crunch Chip Company Income Statement for the year ending December 31. To complete Table 1, . Fill in the expense categories (words) for each item in the correct locations. . Fill in the amounts (numbers) for each expense or profit category. o Be sure to enter commas as needed in the numbers. o For each entry labeled "profit," you will need to do the math (subtraction) to determine the amount to enter in the field. o To determine the amount of taxes, multiply pretax profit by the tax rate. . Be sure to fill in each field on the Income Statement table. Example (completed for you): . Revenues: $12,500,000 Expense Categories and Amounts to fill in the Income Statement: . Cost of Goods Sold: $7,600,000 . Marketing: $2,000,000 . Depreciation: $100,000 . Selling, General, & Administrative (SG&A): $1,300,000 . Interest Costs: $500,000 . Tax Rate: 25% [GO TO NEXT PAGE] Table 1 Crunch Chip Company Income Statement For the year ending December 31, 20XX Revenues $12,500,000 Click or tap here to enter expense category. Click or tap here to enter expense amount. Gross Profit $Click or tap here to enter amount of gross profit. Click or tap here to enter expense category. Click or tap here to enter expense amount. Click or tap here to enter expense category. Click or tap here to enter expense amount. Click or tap here to enter expense category. Click or tap here to enter expense amount. Operating Profit $Click or tap here to enter amount of operating profit. Click or tap here to enter expense category Click or tap here to enter expense amount. Pretax Profit $Click or tap here to enter amount of pretax profit. Taxes Click or tap here to enter expense amount. Net Profit $Click or tap here to enter amount of net profitDirections: Using the information below, complete Table 1, the Crunch Chip Company Income Statement for the year ending December 31. To complete Table 1, Fill in the expense categories (words) for each item in the correct locations. Fill in the amounts (numbers) for each expense or profit category. o Be sure to enter commas as needed in the numbers. For each entry labeled "profit," you will need to do the math (subtraction) to determine the amount to enter in the field. To determine the amount of taxes, multiply pretax profit by the tax rate. Be sure to fill in each field on the Income Statement table. Example (completed for you): Revenues: $12,500,000 Expense Categories and Amounts to fill in the Income Statement: Cost of Goods Sold: $7,600,000 Marketing: $2,000,000 Depreciation: $100,000 Selling, General, & Administrative (SG&A): $1,300,000 Interest Costs: $500,000 Tax Rate: 25% [GO TO NEXT PAGE] Table 1 Crunch Chip Company Income Statement For the year ending December 31, 20XX Revenues Click or tap here to enter expense category. Gross Profit Click or tap here to enter expense category. Click or tap here to enter expense category. Click or tap here to enter expense category. Operating Profit Click or tap here to enter expense category. Pretax Profit Taxes Net Profit $12,500,000 Click or tap here to enter expense amount. $Click or tap here to enter amount of gross profit. Click or tap here to enter expense amount. Click or tap here to enter expense amount. Click or tap here to enter expense amount. $Click or tap here to enter amount of operating profit. Click or tap here to enter expense amount. $Click or tap here to enter amount of pretax profit. Click or tap here to enter expense amount. $Click or tap here to enter amount of net profit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started