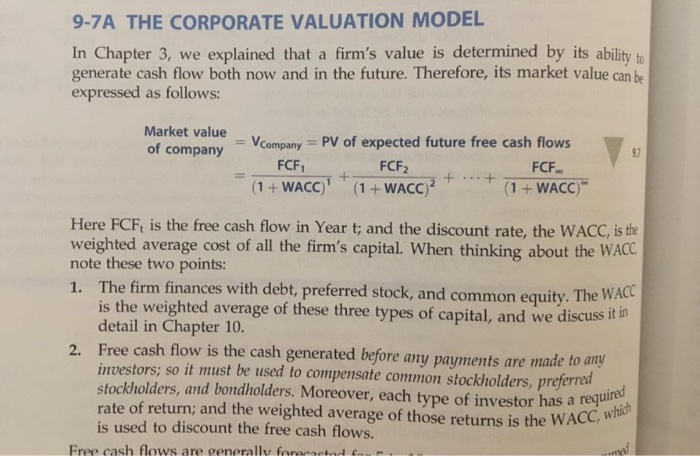

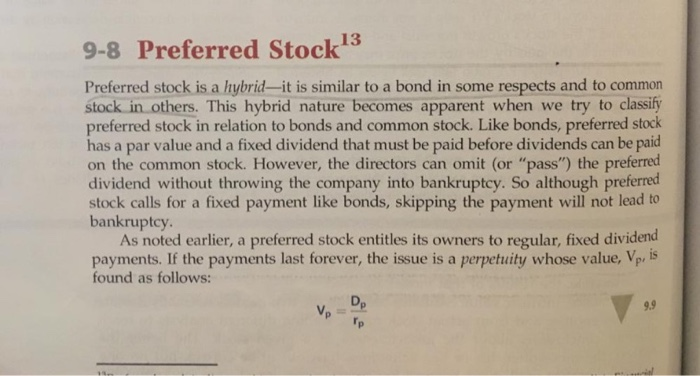

97 rate of return; and the weighted average of those returns is the WACC, which 9-7A THE CORPORATE VALUATION MODEL In Chapter 3, we explained that a firm's value is determined by its ability to generate cash flow both now and in the future. Therefore, its market value can be expressed as follows: Market value of company V company = PV of expected future free cash flows FCF FCF2 FCF. + + ... + (1 + WACC)' *(1 + WACC)? (1 + WACC) Here FCF, is the free cash flow in Year t; and the discount rate, the WACC, is the weighted average cost of all the firm's capital. When thinking about the WACC note these two points: 1. The firm finances with debt, preferred stock, and common equity. The WACC is the weighted average of these three types of capital, and we discuss it in detail in Chapter 10. 2. Free cash flow is the cash generated before any payments are made to any investors; so it must be used to compensate common stockholders, preferred stockholders, and bondholders. Moreover, each type of investor has a is used to discount the free cash flows. Free cash flows are generally foreactor required Look at the Corporate Valuation Models (Formulas 9-7 and 9-8) presented in Chapter 9, and consider what these models are communicating about the key value drivers for a business. What do you think is the most powerful value driver in the formulas? Over which value drivers does management have the most control? The least control? 13 9-8 Preferred Stock Preferred stock is a hybridit is similar to a bond in some respects and to common stock in others. This hybrid nature becomes apparent when we try to classify preferred stock in relation to bonds and common stock. Like bonds, preferred stock has a par value and a fixed dividend that must be paid before dividends can be paid on the common stock. However, the directors can omit (or "pass") the preferred dividend without throwing the company into bankruptcy. So although preferred stock calls for a fixed payment like bonds, skipping the payment will not lead to bankruptcy. As noted earlier, a preferred stock entitles its owners to regular, fixed dividend payments. If the payments last forever, the issue is a perpetuity whose value, Vp, is found as follows: D 9.9 ve