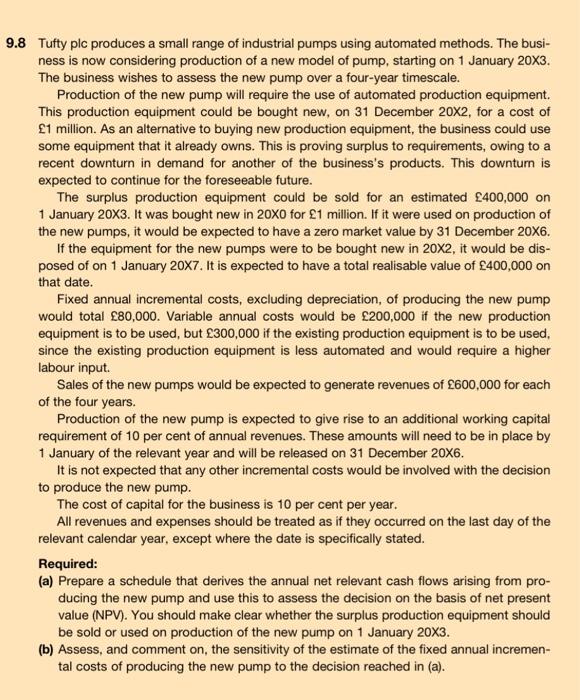

9.8 Tufty plc produces a small range of industrial pumps using automated methods. The busi- ness is now considering production of a new model of pump, starting on 1 January 20x3. The business wishes to assess the new pump over a four-year timescale. Production of the new pump will require the use of automated production equipment. This production equipment could be bought new, on 31 December 20X2, for a cost of 1 million. As an alternative to buying new production equipment, the business could use some equipment that it already owns. This is proving surplus to requirements, owing to a recent downturn in demand for another of the business's products. This downturn is expected to continue for the foreseeable future. The surplus production equipment could be sold for an estimated 400,000 on 1 January 20X3. It was bought new in 20x0 for 1 million. If it were used on production of the new pumps, it would be expected to have a zero market value by 31 December 20X6. If the equipment for the new pumps were to be bought new in 20X2, it would be dis- posed of on 1 January 20x7. It is expected to have a total realisable value of 400,000 on that date. Fixed annual incremental costs, excluding depreciation, of producing the new pump would total 80,000. Variable annual costs would be 200,000 if the new production equipment is to be used, but 300,000 if the existing production equipment is to be used, since the existing production equipment is less automated and would require a higher labour input. Sales of the new pumps would be expected to generate revenues of 600,000 for each of the four years. Production of the new pump is expected to give rise to an additional working capital requirement of 10 per cent of annual revenues. These amounts will need to be in place by 1 January of the relevant year and will be released on 31 December 20x6. It is not expected that any other incremental costs would be involved with the decision to produce the new pump. The cost of capital for the business is 10 per cent per year. All revenues and expenses should be treated as if they occurred on the last day of the relevant calendar year, except where the date is specifically stated. Required: (a) Prepare a schedule that derives the annual net relevant cash flows arising from pro- ducing the new pump and use this to assess the decision on the basis of net present value (NPV). You should make clear whether the surplus production equipment should be sold or used on production of the new pump on 1 January 20x3. (b) Assess, and comment on the sensitivity of the estimate of the fixed annual incremen- tal costs of producing the new pump to the decision reached in (a)