Answered step by step

Verified Expert Solution

Question

1 Approved Answer

99-105, please show work On January 1, 2018, Dodd, Inc., declared a 10% stock dividend when the fair value of the common stock was $30

99-105, please show work

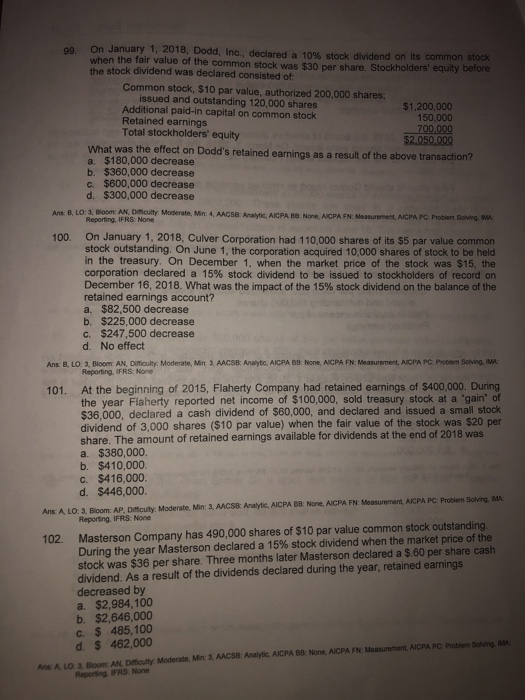

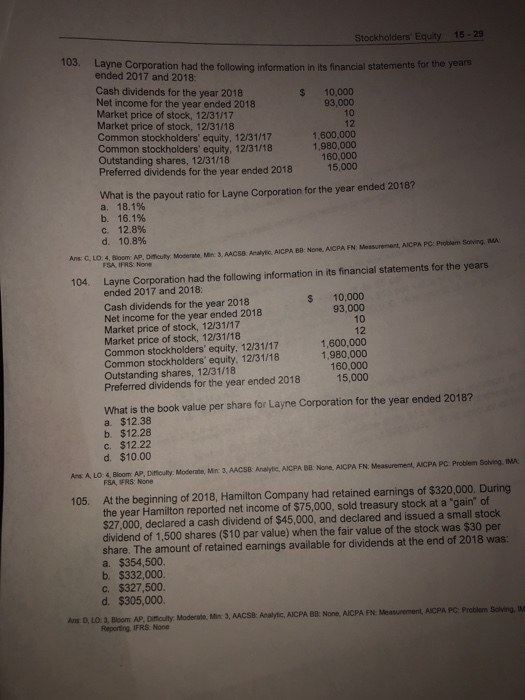

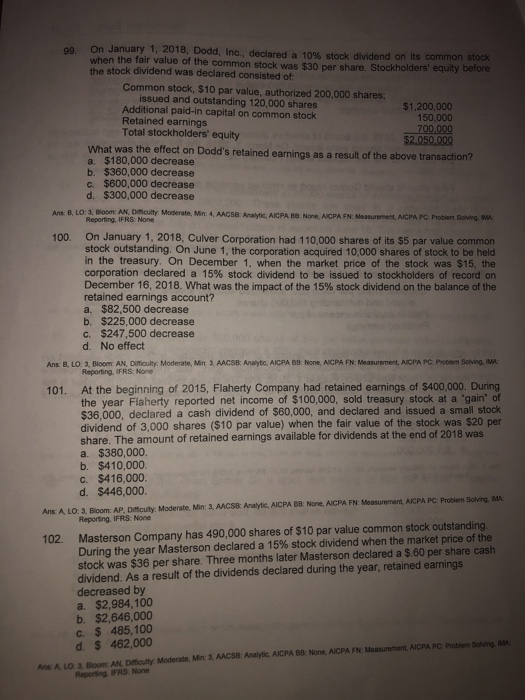

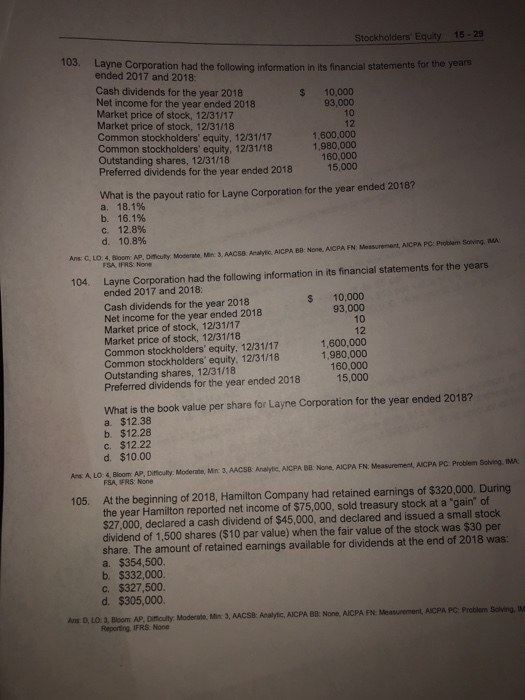

On January 1, 2018, Dodd, Inc., declared a 10% stock dividend when the fair value of the common stock was $30 per share. Stockholders' equity before the stock dividend was declared consisted of on its common stock Common stock, $10 par value, authorized 200,000 shares issued and outstanding 120,000 shares Additional paid-in capital on common stock Retained earnings Total stockholders equity $1,200,000 150,000 What was the effect on Dodd's retained earnings as a result of the above transaction? a. $180,000 decrease b. $360,000 decrease c. $600,000 decrease d. $300,000 decrease Ans: B, LO: 3, Bloom: AN, Dificulty Moderate, Min: 4, AACSB Analytic, AICPA B8 None, AICPA FN: Measurement, AICPA PC: Problen Soving, MA Reporting, IFRS None On January 1, 2018, Culver Corporation had 110,000 shares of its $5 par value common stock outstanding. On June 1, the corporation acquired 10,000 shares of stock to be held in the treasury. On December 1, when the market price of the stock was $15, the corporation declared a 15% stock dividend to be issued to stockholders of record on December 16, 2018. What was the impact of the 15% stock dividend on the balance of the retained earnings account? a. $82,500 decrease b. $225,000 decrease C. $247,500 decrease d. No effect 100. Ans B, LO 3, 8loom A Ditiauly: Moderate, Min S.AACSB Anaytc AICPA BB: one, AICPt, AlCPA PC. PiobieSoig, MAL 101. At the beginning of 2015, Flaherty Company had retained earnings of $400,000. During Reporting IFRS: None the year Flaherty reported net income of $100,000, sold treasury stock at a "gain of $36,000, declared a cash dividend of $60,000, and declared and issued a small stock dividend of 3,000 shares ($10 par value) when the fair value of the stock was $20 per share. The amount of retained earnings available for dividends at the end of 2018 was a. $380,000. b. $410,000. c. $416,000. d. $446,000 Ans A LO 3 Bloom AP Dilouty Moderate, Min 3.AACSB Anayte, AICPA 88 Nore, AlCPA FN: MeasuremPom Sakng, Reporing. IFRS. None During the year Masterson declared a 15% stock dividend when the market price of the stock was $36 per share. Three months later Masterson declared a $.60 per share cash 102. Masterson Company has 490,000 shares of $10 par value common stock outstanding dividend. As a result of the dividends declared during the year, retained earnings decreased by a. $2,984,100 b. $2,646,000 c. $ 485,100 d. 462,000 Ans A LO: 3, Bloom: AN, Difficulity. Moderate, Min: 3, AACSB: Analytic, AICPA 68 None, AICPA FN. Measurement AICPA PC Probiem Soving IMA Reporting, IFRS None Stockholders' Equity 15-29 103. Layne Corporation had the following information in its financial statements for the years ended 2017 and 2018 Cash dividends for the year 2018 Net income for the year ended 2018 Market price of stock, 12/31/17 Market price of stock, 12/31/18 Common stockholders' equity, 12/31/17 Common stockholders' equity, 12/31/18 Outstanding shares, 12/31/18 Preferred dividends for the year ended 2018 $ 10,000 93,000 10 1,600,000 1,980,000 160,000 15,000 What is the payout ratio for Layne Corporation for the year ended 2018? 18.1% a. b. 16.1% 12.8% d. C. 10.8% Ans: C, LO: 4, Biloom AP, Ditficulty. Moderate, Min 3 AACSB Analytic AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving. MMA FSA IFRS: None Layne Corporation had the following information in its financial statements for the years ended 2017 and 2018: 104. Cash dividends for the year 2018 Net income for the year ended 2018 Market price of stock, 12/31/17 Market price of stock, 12/31/18 Common stockholders' equity, 12/31/17 Common stockholders' equity, 12/31/18 Outstanding shares, 12/31/18 Preferred dividends for the year ended 2018 $ 10,000 93,000 10 12 1,600,000 1,980,000 160,000 15,000 What is the book value per share for Layne Corporation for the year ended 2018? a. $12.38 b. $12.28 c. $12.22 d. $10.00 Ans. A LO 4, Bloom AP, Difsculty. Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Sohing, IMA FSA, IFRS: None 105. At the beginning of 2018, Hamilton Company had retained earnings of $320,000. During the year Hamilton reported net income of $75,000, sold treasury stock at a "gain of $27,000, declared a cash dividend of $45,000, and declared and issued a small stock dividend of 1,500 shares ($10 par value) when the fair value of the stock was $30 per share. The amount of retained earnings available for dividends at the end of 2018 was: a. $354,500. b. $332,000. c. $327,500. d. $305,000. Ana D. LO 3, Bloom AP. Diffioulity Moderate, Min: 3, AACSB: Analyic, AICPA BB: None, AICPA FN: Measurement, AICPA PC Reporsing, IFRS None

On January 1, 2018, Dodd, Inc., declared a 10% stock dividend when the fair value of the common stock was $30 per share. Stockholders' equity before the stock dividend was declared consisted of on its common stock Common stock, $10 par value, authorized 200,000 shares issued and outstanding 120,000 shares Additional paid-in capital on common stock Retained earnings Total stockholders equity $1,200,000 150,000 What was the effect on Dodd's retained earnings as a result of the above transaction? a. $180,000 decrease b. $360,000 decrease c. $600,000 decrease d. $300,000 decrease Ans: B, LO: 3, Bloom: AN, Dificulty Moderate, Min: 4, AACSB Analytic, AICPA B8 None, AICPA FN: Measurement, AICPA PC: Problen Soving, MA Reporting, IFRS None On January 1, 2018, Culver Corporation had 110,000 shares of its $5 par value common stock outstanding. On June 1, the corporation acquired 10,000 shares of stock to be held in the treasury. On December 1, when the market price of the stock was $15, the corporation declared a 15% stock dividend to be issued to stockholders of record on December 16, 2018. What was the impact of the 15% stock dividend on the balance of the retained earnings account? a. $82,500 decrease b. $225,000 decrease C. $247,500 decrease d. No effect 100. Ans B, LO 3, 8loom A Ditiauly: Moderate, Min S.AACSB Anaytc AICPA BB: one, AICPt, AlCPA PC. PiobieSoig, MAL 101. At the beginning of 2015, Flaherty Company had retained earnings of $400,000. During Reporting IFRS: None the year Flaherty reported net income of $100,000, sold treasury stock at a "gain of $36,000, declared a cash dividend of $60,000, and declared and issued a small stock dividend of 3,000 shares ($10 par value) when the fair value of the stock was $20 per share. The amount of retained earnings available for dividends at the end of 2018 was a. $380,000. b. $410,000. c. $416,000. d. $446,000 Ans A LO 3 Bloom AP Dilouty Moderate, Min 3.AACSB Anayte, AICPA 88 Nore, AlCPA FN: MeasuremPom Sakng, Reporing. IFRS. None During the year Masterson declared a 15% stock dividend when the market price of the stock was $36 per share. Three months later Masterson declared a $.60 per share cash 102. Masterson Company has 490,000 shares of $10 par value common stock outstanding dividend. As a result of the dividends declared during the year, retained earnings decreased by a. $2,984,100 b. $2,646,000 c. $ 485,100 d. 462,000 Ans A LO: 3, Bloom: AN, Difficulity. Moderate, Min: 3, AACSB: Analytic, AICPA 68 None, AICPA FN. Measurement AICPA PC Probiem Soving IMA Reporting, IFRS None Stockholders' Equity 15-29 103. Layne Corporation had the following information in its financial statements for the years ended 2017 and 2018 Cash dividends for the year 2018 Net income for the year ended 2018 Market price of stock, 12/31/17 Market price of stock, 12/31/18 Common stockholders' equity, 12/31/17 Common stockholders' equity, 12/31/18 Outstanding shares, 12/31/18 Preferred dividends for the year ended 2018 $ 10,000 93,000 10 1,600,000 1,980,000 160,000 15,000 What is the payout ratio for Layne Corporation for the year ended 2018? 18.1% a. b. 16.1% 12.8% d. C. 10.8% Ans: C, LO: 4, Biloom AP, Ditficulty. Moderate, Min 3 AACSB Analytic AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving. MMA FSA IFRS: None Layne Corporation had the following information in its financial statements for the years ended 2017 and 2018: 104. Cash dividends for the year 2018 Net income for the year ended 2018 Market price of stock, 12/31/17 Market price of stock, 12/31/18 Common stockholders' equity, 12/31/17 Common stockholders' equity, 12/31/18 Outstanding shares, 12/31/18 Preferred dividends for the year ended 2018 $ 10,000 93,000 10 12 1,600,000 1,980,000 160,000 15,000 What is the book value per share for Layne Corporation for the year ended 2018? a. $12.38 b. $12.28 c. $12.22 d. $10.00 Ans. A LO 4, Bloom AP, Difsculty. Moderate, Min: 3, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Sohing, IMA FSA, IFRS: None 105. At the beginning of 2018, Hamilton Company had retained earnings of $320,000. During the year Hamilton reported net income of $75,000, sold treasury stock at a "gain of $27,000, declared a cash dividend of $45,000, and declared and issued a small stock dividend of 1,500 shares ($10 par value) when the fair value of the stock was $30 per share. The amount of retained earnings available for dividends at the end of 2018 was: a. $354,500. b. $332,000. c. $327,500. d. $305,000. Ana D. LO 3, Bloom AP. Diffioulity Moderate, Min: 3, AACSB: Analyic, AICPA BB: None, AICPA FN: Measurement, AICPA PC Reporsing, IFRS None

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started