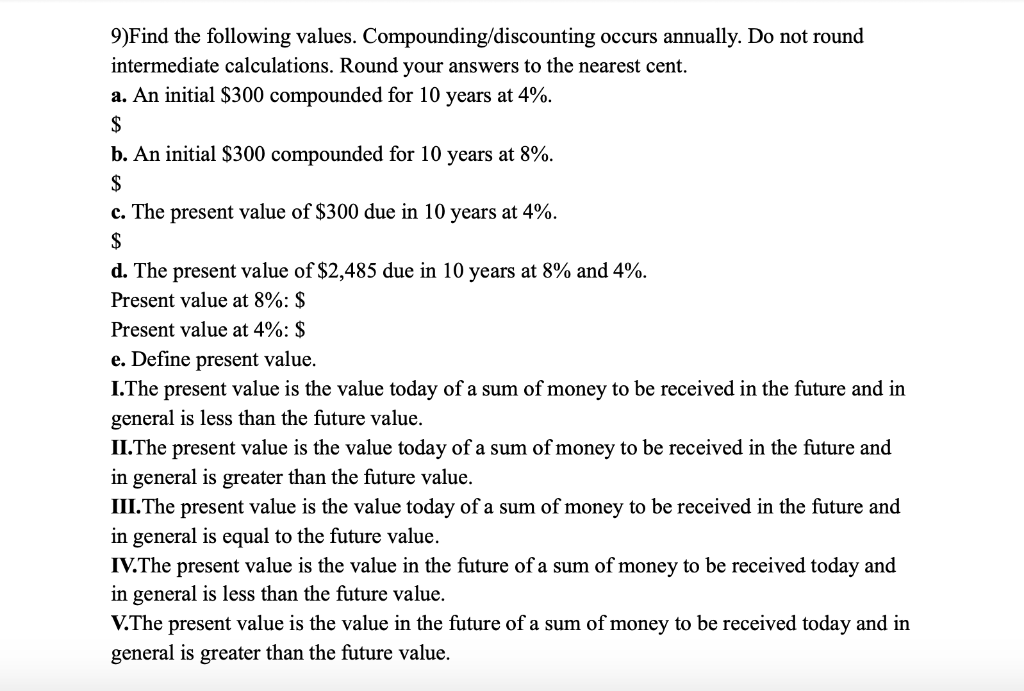

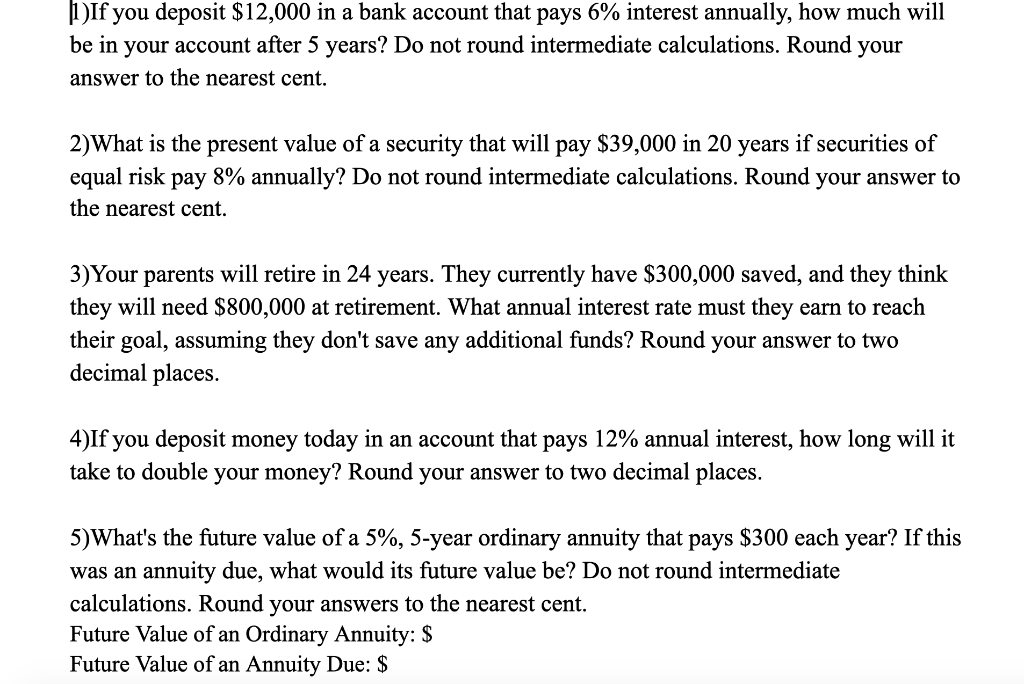

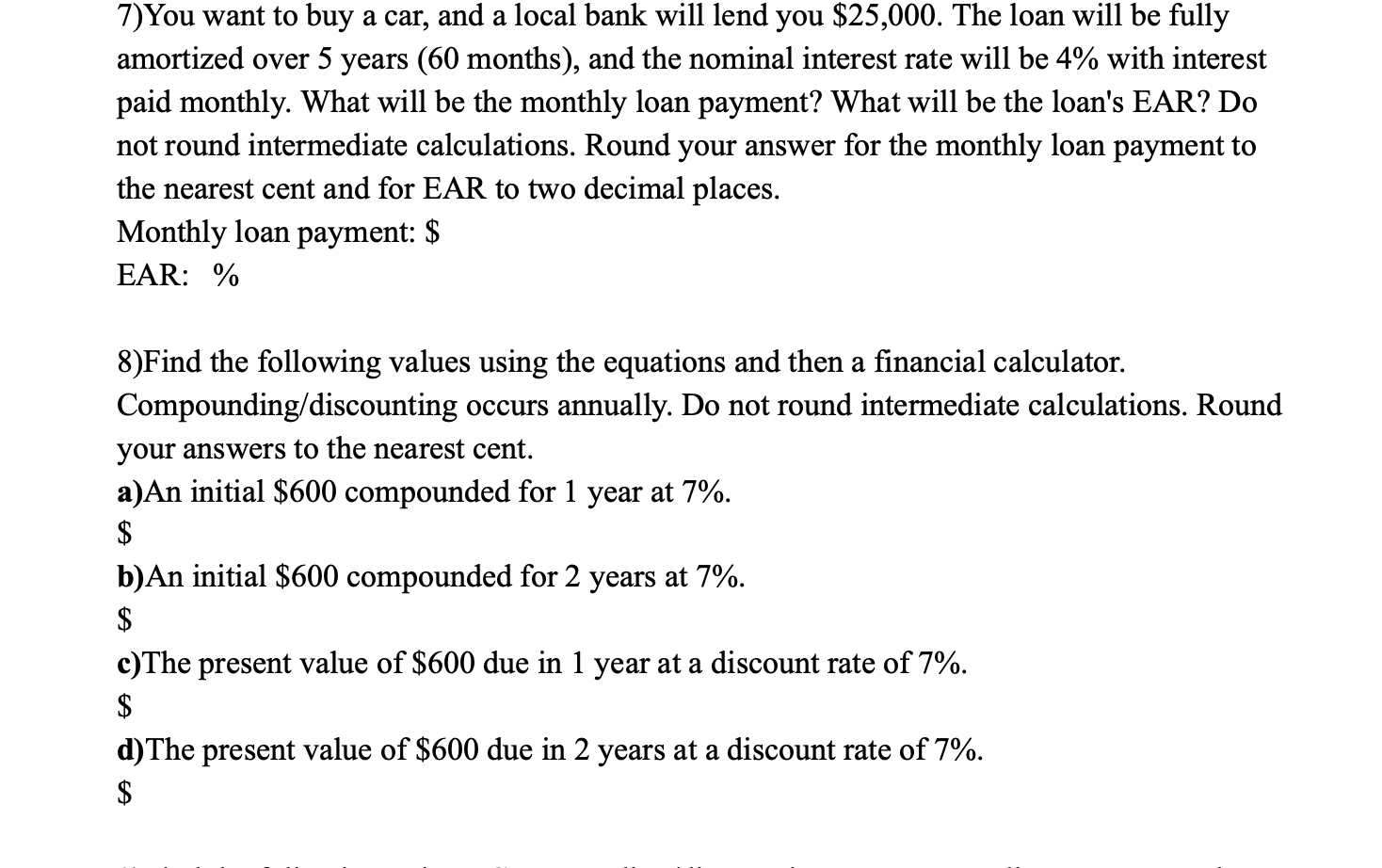

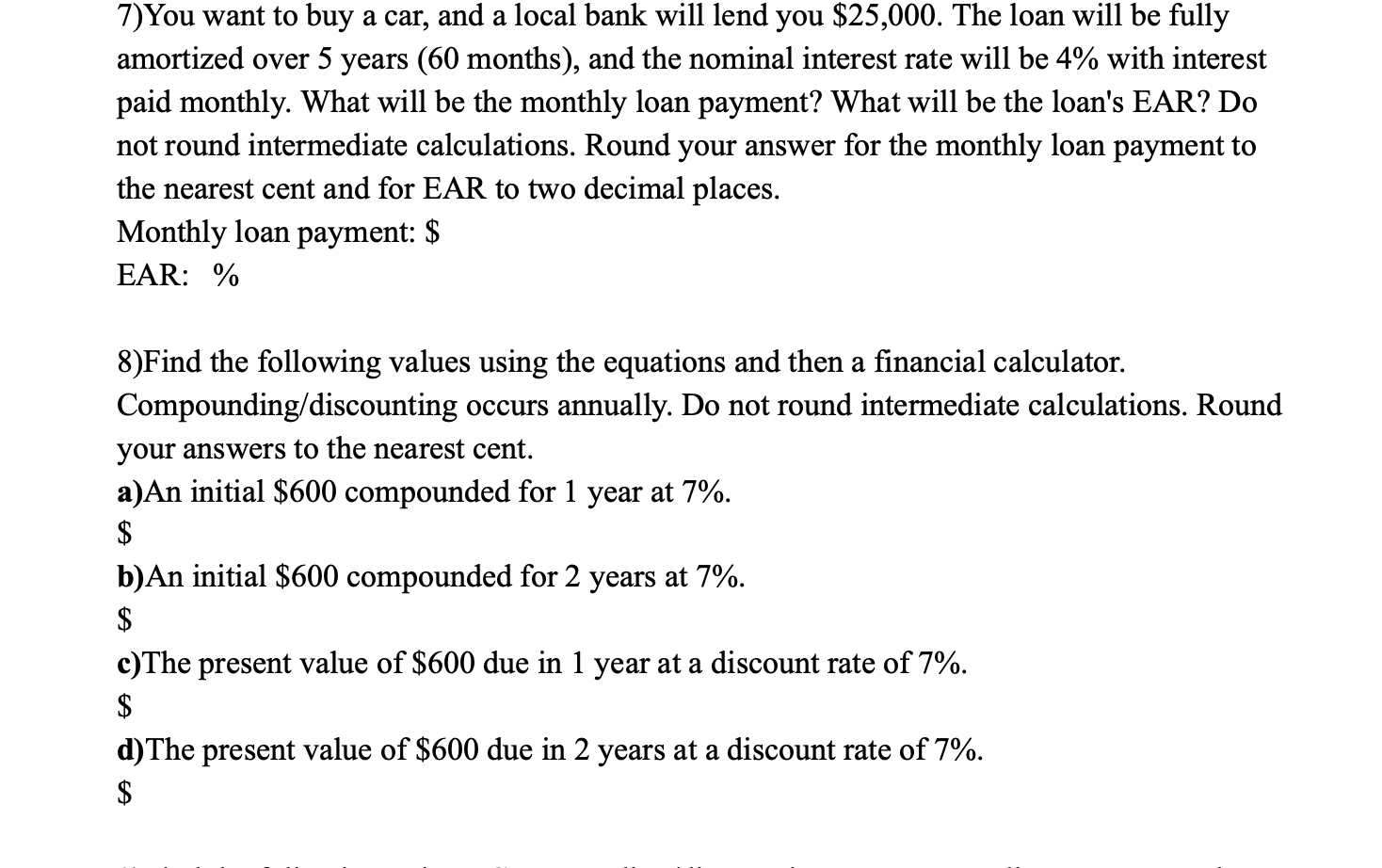

9)Find the following values. Compounding/discounting occurs annually. Do not round intermediate calculations. Round your answers to the nearest cent. a. An initial $300 compounded for 10 years at 4%. $ b. An initial $300 compounded for 10 years at 8%. $ c. The present value of $300 due in 10 years at 4%. $ d. The present value of $2,485 due in 10 years at 8% and 4%. Present value at 8%:$ Present value at 4%:$ e. Define present value. I.The present value is the value today of a sum of money to be received in the future and in general is less than the future value. II.The present value is the value today of a sum of money to be received in the future and in general is greater than the future value. III. The present value is the value today of a sum of money to be received in the future and in general is equal to the future value. IV.The present value is the value in the future of a sum of money to be received today and in general is less than the future value. V.The present value is the value in the future of a sum of money to be received today and in general is greater than the future value. 10)Sawyer Corporation's 2017 sales were $13 million. Its 2012 sales were $6.5 million. At what rate have sales been growing? Round your answer to two decimal places. b)If you deposit $12,000 in a bank account that pays 6% interest annually, how much will be in your account after 5 years? Do not round intermediate calculations. Round your answer to the nearest cent. 2)What is the present value of a security that will pay $39,000 in 20 years if securities of equal risk pay 8% annually? Do not round intermediate calculations. Round your answer to the nearest cent. 3) Your parents will retire in 24 years. They currently have $300,000 saved, and they think they will need $800,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places. 4)If you deposit money today in an account that pays 12% annual interest, how long will it take to double your money? Round your answer to two decimal places. 5)What's the future value of a 5%, 5-year ordinary annuity that pays $300 each year? If this was an annuity due, what would its future value be? Do not round intermediate calculations. Round your answers to the nearest cent. Future Value of an Ordinary Annuity: $ Future Value of an Annuity Due: $ 7) You want to buy a car, and a local bank will lend you $25,000. The loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 4% with interest paid monthly. What will be the monthly loan payment? What will be the loan's EAR? Do not round intermediate calculations. Round your answer for the monthly loan payment to the nearest cent and for EAR to two decimal places. Monthly loan payment: $ EAR: % 8)Find the following values using the equations and then a financial calculator. Compounding/discounting occurs annually. Do not round intermediate calculations. Round your answers to the nearest cent. a)An initial $600 compounded for 1 year at 7%. $ b)An initial $600 compounded for 2 years at 7%. $ c)The present value of $600 due in 1 year at a discount rate of 7%. $ d)The present value of $600 due in 2 years at a discount rate of 7%. $