Answered step by step

Verified Expert Solution

Question

1 Approved Answer

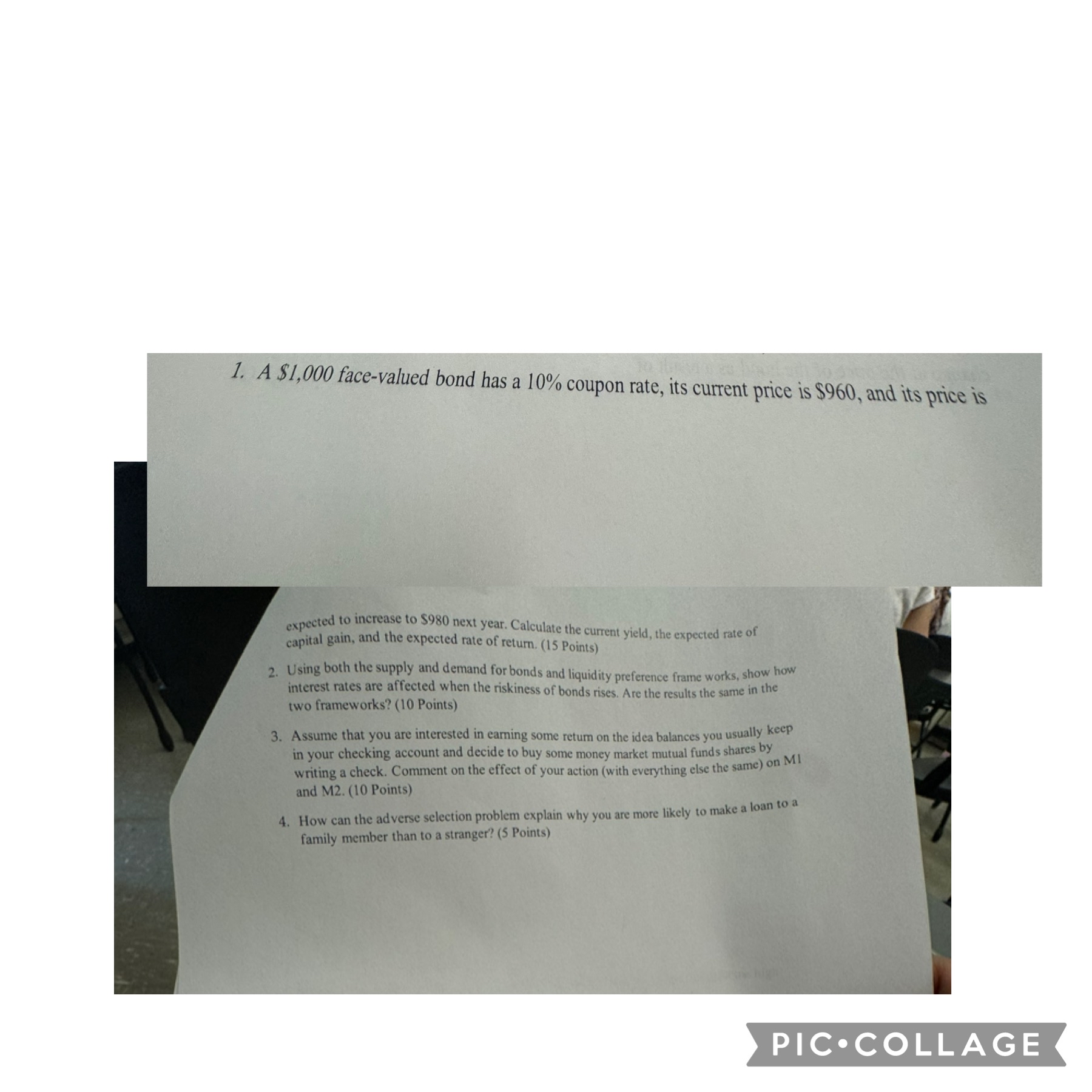

A $ 1 , 0 0 0 face - valued bond has a 1 0 % coupon rate, its current price is $ 9 6

A $ facevalued bond has a coupon rate, its current price is $ and its price is expected to increase to $ next year. Calculate the current yield, the expected rate of capital gain, and the expected rate of return. Points

Using both the supply and demand for bonds and liquidity preference frame works, show how interest rates are affected when the riskiness of bonds rises. Are the results the same in the two frameworks? Points

Assume that you are interested in earning some retum on the idea balances you usually keep in your checking account and decide to buy some money market mutual funds shares by writing a check. Comment on the effect of your action with everything else the same on M and M Points

How can the adverse selection problem explain why you are more likely to make a loan to a family member than to a stranger? Points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started