Answered step by step

Verified Expert Solution

Question

1 Approved Answer

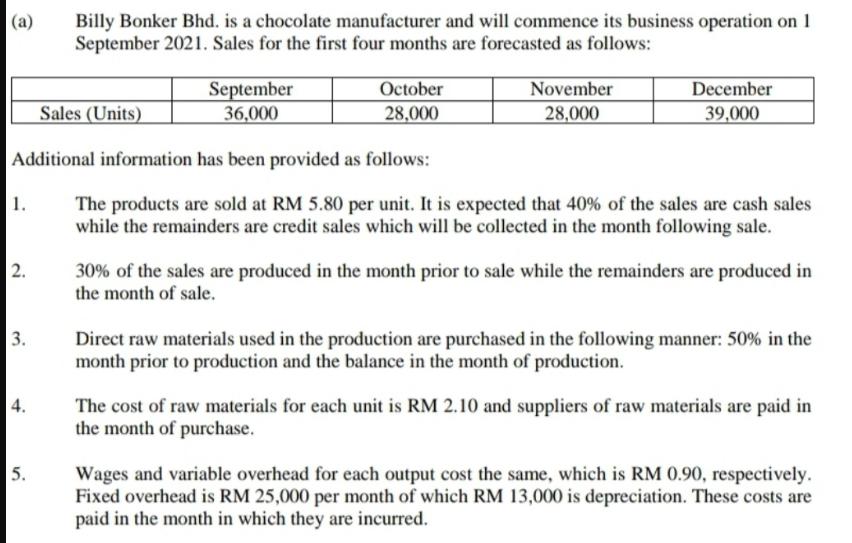

(a) Billy Bonker Bhd. is a chocolate manufacturer and will commence its business operation on 1 September 2021. Sales for the first four months

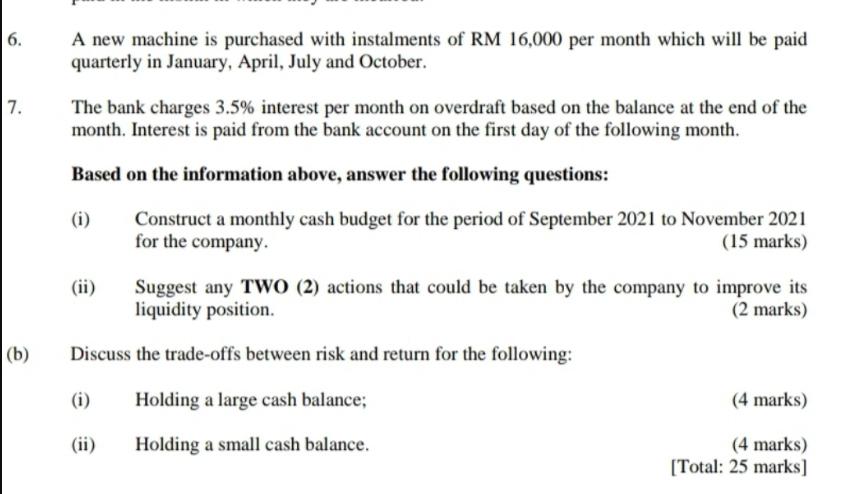

(a) Billy Bonker Bhd. is a chocolate manufacturer and will commence its business operation on 1 September 2021. Sales for the first four months are forecasted as follows: Sales (Units) September 36,000 October 28,000 November 28,000 December 39,000 Additional information has been provided as follows: 1. 2. 3. 4. 5. The products are sold at RM 5.80 per unit. It is expected that 40% of the sales are cash sales while the remainders are credit sales which will be collected in the month following sale. 30% of the sales are produced in the month prior to sale while the remainders are produced in the month of sale. Direct raw materials used in the production are purchased in the following manner: 50% in the month prior to production and the balance in the month of production. The cost of raw materials for each unit is RM 2.10 and suppliers of raw materials are paid in the month of purchase. Wages and variable overhead for each output cost the same, which is RM 0.90, respectively. Fixed overhead is RM 25,000 per month of which RM 13,000 is depreciation. These costs are paid in the month in which they are incurred. 6. 7. A new machine is purchased with instalments of RM 16,000 per month which will be paid quarterly in January, April, July and October. The bank charges 3.5% interest per month on overdraft based on the balance at the end of the month. Interest is paid from the bank account on the first day of the following month. Based on the information above, answer the following questions: (i) (ii) Construct a monthly cash budget for the period of September 2021 to November 2021 for the company. (15 marks) Suggest any TWO (2) actions that could be taken by the company to improve its liquidity position. (2 marks) (b) Discuss the trade-offs between risk and return for the following: (i) Holding a large cash balance; (ii) Holding a small cash balance. (4 marks) (4 marks) [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer iTo calculate the cash budget for Billy Bonker Bhd for the first four months we need to consider the cash inflows from sales and the cash outflows for raw materials direct labor variable overhe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started