Answered step by step

Verified Expert Solution

Question

1 Approved Answer

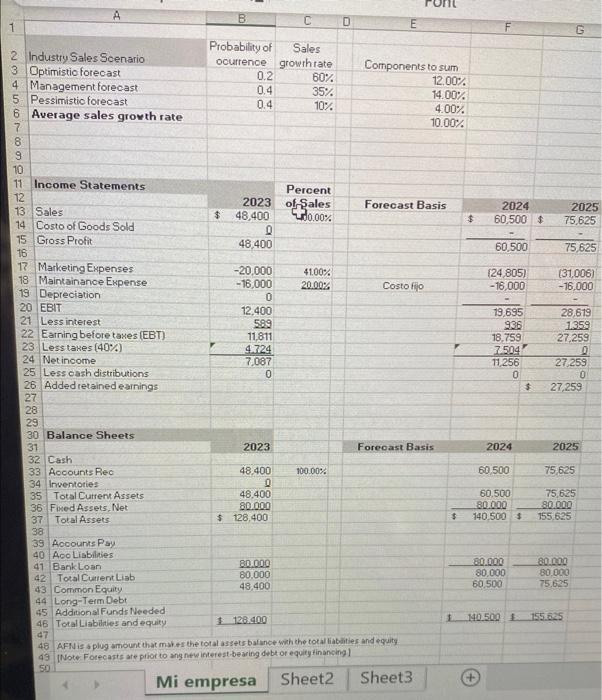

A 1 2 Industry Sales Scenario 3 Optimistic forecast 4 Management forecast 5 Pessimistic forecast 6 Average sales growth rate 7 8 9 10

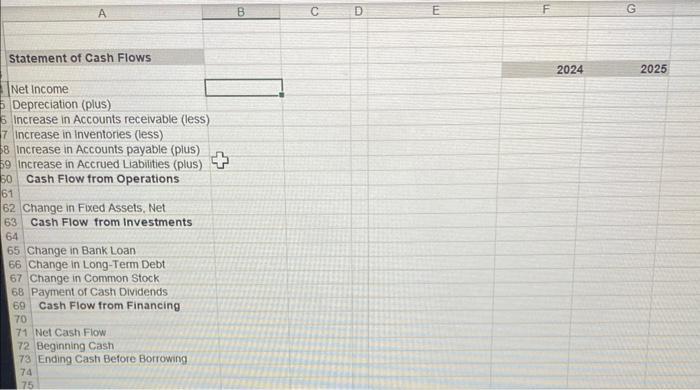

A 1 2 Industry Sales Scenario 3 Optimistic forecast 4 Management forecast 5 Pessimistic forecast 6 Average sales growth rate 7 8 9 10 11 Income Statements 12 13 Sales 14 Costo of Goods Sold 15 Gross Profit 16 17 Marketing Expenses 18 Maintainance Expense 19 Depreciation 20 EBIT 21 Less interest 22 Earning before taxes (EBT) 23 Less taxes (40%) 24 Net income 25 Less cash distributions 26 Added retained earnings 27 28 29 30 Balance Sheets 31 32 Cash 33 Accounts Rec 34 Inventories 35 Total Current Assets 36 Fixed Assets, Net 37 Total Assets 38 39 Accounts Pay 40 Aco Liabilities 41 Bank Loan 42 Total Current Liab 43 Common Equity 44 Long-Term Debt 45 Additional Funds Needed 46 Total Liabilities and equity 47 Probability of Sales ocurrence growth rate 60% 35% 10% 0.2 0.4 OO 44 0.4 Percent 2023 of Sales 0.00% $ 48,400 0 48,400 -20,000 -16,000 0 12,400 589 11,811 4.724 7,087 0 2023 C 48,400 0 48,400 80.000 $ 128,400 80.000 80,000 48,400 4100% 20.00% 100.00% D E Components to sum 12.00% Forecast Basis Costo fijo $128.400 48 AFN is a plug amount that makes the total assets balance with the total liabilities and equity 49 (Note Forecasts are prior to ang new interest-bearing debt or equity financing 1 50 Mi empresa Sheet2 14.00% 4.00% 10.00% Forecast Basis Sheet3 7 $ 1 2024 $ 60,500 $ 60,500 (24,805) -16,000 19,695 936 18,759 7.504 11,256 0 2024 60,500 60,500 80.000 80,000 60,500 $ 140.500 1 2025 75,625 75,625 (31,006) -16,000 28,619 1359 27,259 27,259 0 27,259 2025 80.000 80.000 140.500 $ 155.625 75,625 75,625 80.000 80.000 75.625 155.625 complete the cash statement A Statement of Cash Flows Net Income Depreciation (plus) Increase in Accounts receivable (less) 7 Increase in Inventories (less) 8 Increase in Accounts payable (plus) 59 Increase in Accrued Liabilities (plus) 50 Cash Flow from Operations 61 62 Change in Fixed Assets, Net 63 Cash Flow from Investments 64 65 Change in Bank Loan 66 Change in Long-Term Debt: 67 Change in Common Stock 68 Payment of Cash Dividends 69 Cash Flow from Financing 70 71 Net Cash Flow 72 Beginning Cash 73 Ending Cash Before Borrowing 74 75 B D E 2024 G 2025

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Financial Projections Assumptions Industry sales growth rate 4 Company sales growth rate 10 Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started