Answered step by step

Verified Expert Solution

Question

1 Approved Answer

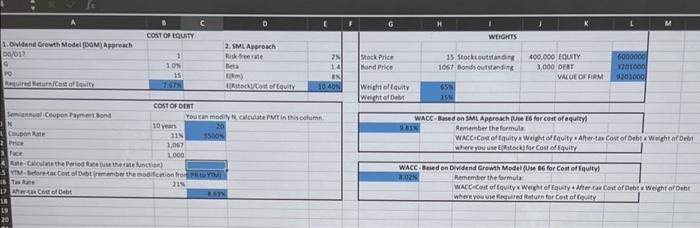

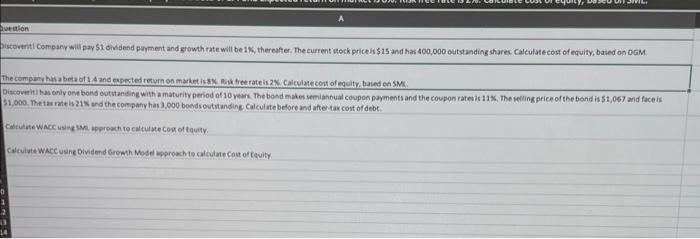

A 1. Dividend Growth Model (DGM) Approach DO/D1? G PO Required Return/Cost of Equity Semiannual-Coupon Payment Bond ON 1 Coupon Rate 2 Price B COST

A 1. Dividend Growth Model (DGM) Approach DO/D1? G PO Required Return/Cost of Equity Semiannual-Coupon Payment Bond ON 1 Coupon Rate 2 Price B COST OF EQUITY 1 1.0% 15 7.67% COST OF DEBT 10 years 11% 1,067 1,000 C 3 Face 4 Rate-Calculate the Period Rate (use the rate function) SYTM-Before-tax Cost of Debt (remember the modification from PR to YTM) 16 Tax Rate 21% 17 After-tax Cost of Debt 18 19 20 D 2. SML Approach Risk-free rate 8.69% Beta E(Rm) E(Rstock)/Cost of Equity E You can modify N, calculate PMT in this column. 20 5500% 2% 1.4 8% 10.40% F G Stock Price Bond Price Weight of Equity Weight of Debt H 9.81% I 65% 35% WEIGHTS 15 Stocks outstanding 1067 Bonds outstanding J 400,000 EQUITY 3,000 DEBT K VALUE OF FIRM WACC-Based on SML Approach (Use E6 for cost of equity) Remember the formula: L WACC-Based on Dividend Growth Model (Use B6 for Cost of Equity) 8.02% Remember the formula: 6000000 3201000 9201000 M WACC=Cost of Equity x Weight of Equity + After-tax Cost of Debt x Weight of Debt where you use E(Rstock) for Cost of Equity WACC=Cost of Equity x Weight of Equity + After-tax Cost of Debt x Weight of Debt where you use Required Return for Cost of Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started