Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A 1 Fair Value - VI 2 B D E F G H I J K On April 13, 2020, Bramble Ltd. purchased a

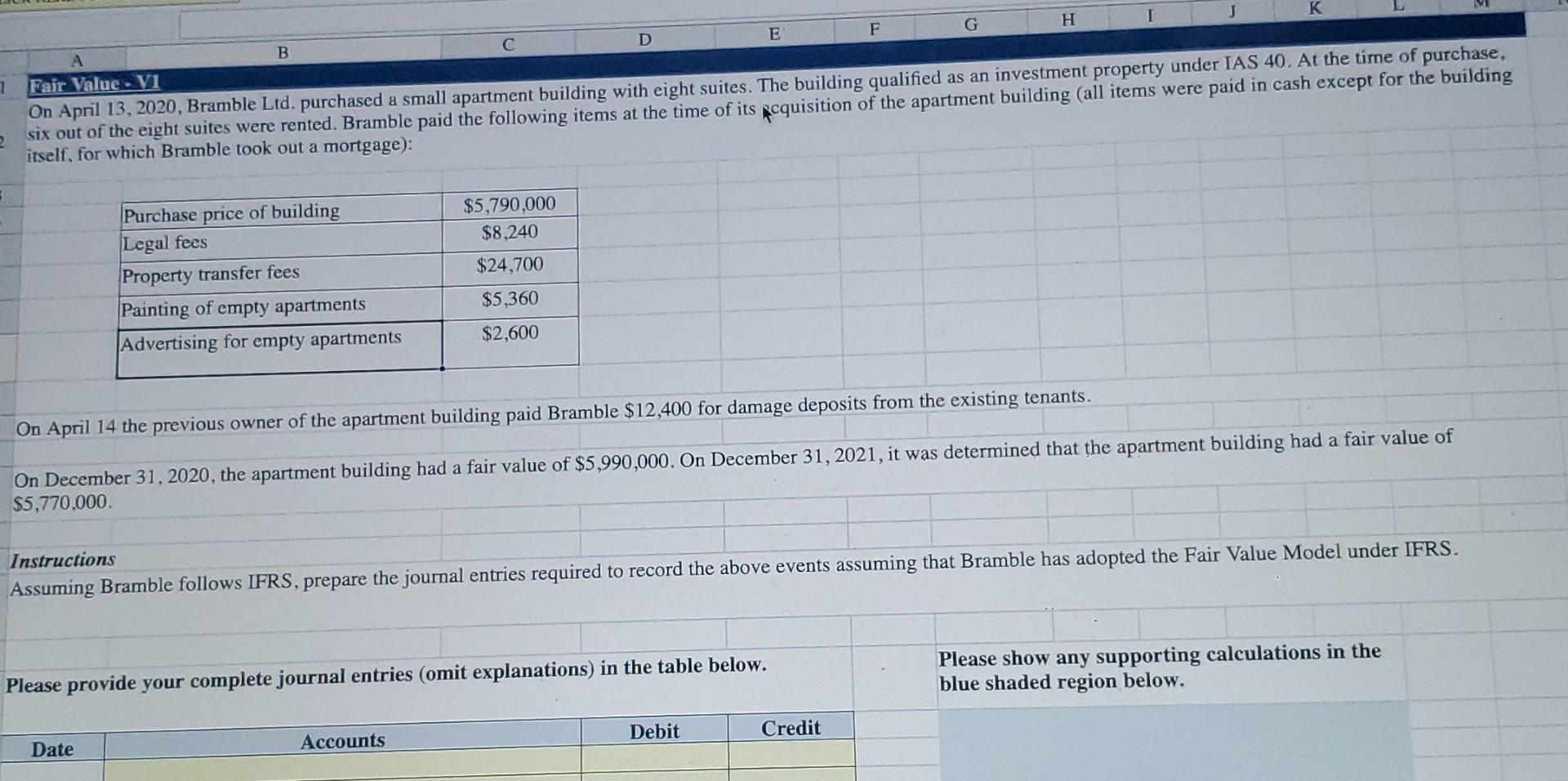

A 1 Fair Value - VI 2 B D E F G H I J K On April 13, 2020, Bramble Ltd. purchased a small apartment building with eight suites. The building qualified as an investment property under IAS 40. At the time of purchase, six out of the eight suites were rented. Bramble paid the following items at the time of its acquisition of the apartment building (all items were paid in cash except for the building itself, for which Bramble took out a mortgage): Purchase price of building Legal fees Property transfer fees Painting of empty apartments $5,790,000 $8,240 $24,700 Advertising for empty apartments $5,360 $2,600 On April 14 the previous owner of the apartment building paid Bramble $12,400 for damage deposits from the existing tenants. On December 31, 2020, the apartment building had a fair value of $5,990,000. On December 31, 2021, it was determined that the apartment building had a fair value of $5,770,000. Instructions Assuming Bramble follows IFRS, prepare the journal entries required to record the above events assuming that Bramble has adopted the Fair Value Model under IFRS. Please provide your complete journal entries (omit explanations) in the table below. Date Accounts Debit Credit Please show any supporting calculations in the blue shaded region below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started