Question

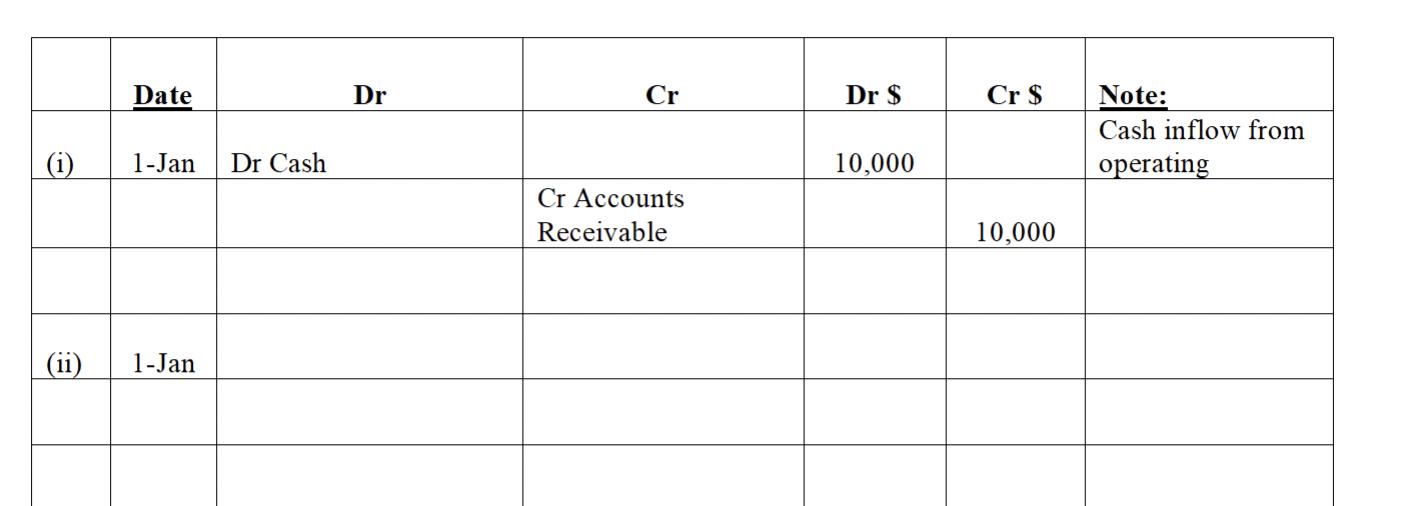

a) 1 January, collected $10,000 cash from accounts receivable b) January, prepaid rent $24,000 for the next 4 months. c) 1 January, paid $8,000 of

a) 1 January, collected $10,000 cash from accounts receivable

b) January, prepaid rent $24,000 for the next 4 months.

c) 1 January, paid $8,000 of accounts payable, which related to inventory purchased in 2022.

d) 2 January, the business took out additional $60,000 bank loan, which will be repaid on 31 December 2025. On the same day, the business purchased a piece of land for $100,000 cash.

e) 5 January, sold one piece of office equipment for $4,000 cash. The disposed equipment has a cost of $6,000 and accumulated depreciation of $500.

f) 7 January, purchased $50,000 of inventory on credit, which is payable in February 2023.

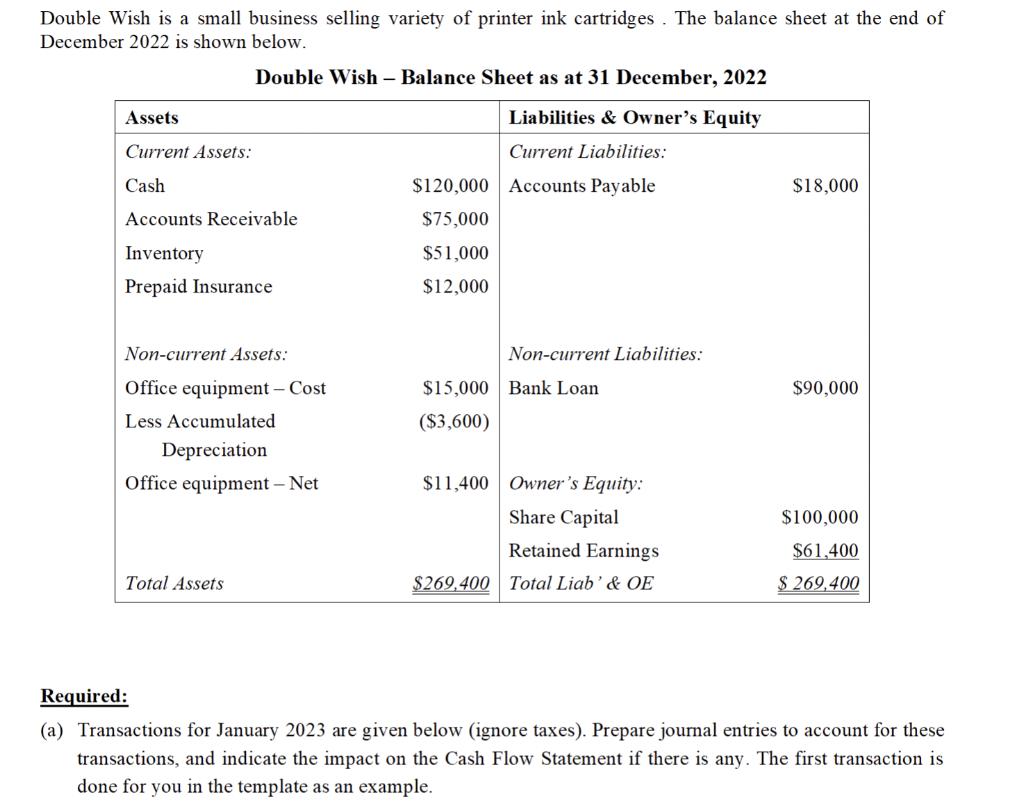

Double Wish is a small business selling variety of printer ink cartridges. The balance sheet at the end of December 2022 is shown below. Double Wish - Balance Sheet as at 31 December, 2022 Assets Current Assets: Cash Accounts Receivable Inventory Prepaid Insurance Non-current Assets: Office equipment - Cost Less Accumulated Depreciation Office equipment - Net Total Assets $120,000 $75,000 $51,000 $12,000 Liabilities & Owner's Equity Current Liabilities: Accounts Payable $11,400 Non-current Liabilities: $15,000 Bank Loan ($3,600) Owner's Equity: Share Capital Retained Earnings $269,400 Total Liab' & OE $18,000 $90,000 $100,000 $61,400 $ 269,400 Required: (a) Transactions for January 2023 are given below (ignore taxes). Prepare journal entries to account for these transactions, and indicate the impact on the Cash Flow Statement if there is any. The first transaction is done for you in the template as an example.

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer Heres the journal entry with the transactions Date Account Debi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started